Question: I need help with these problems (Related to Checkpoint 7.1) (Calculating rates of return) On December 5, 2007, the common stock of Google Inc. (GOOG)

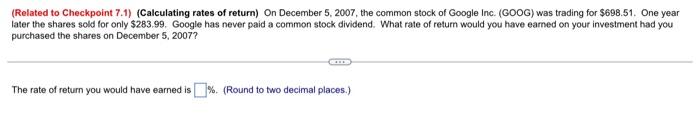

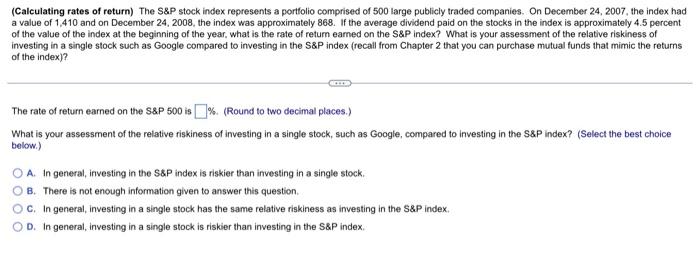

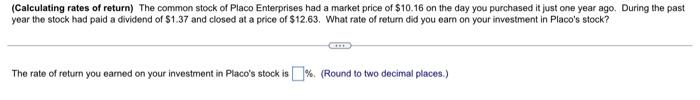

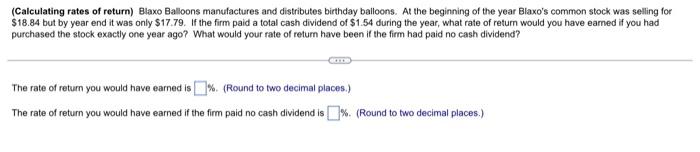

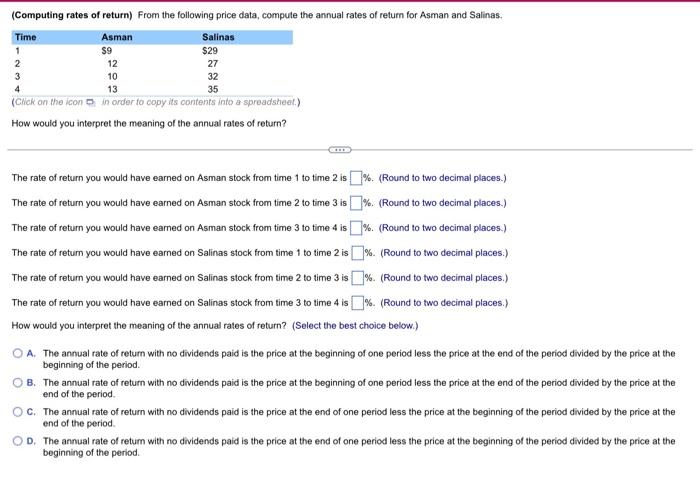

(Related to Checkpoint 7.1) (Calculating rates of return) On December 5, 2007, the common stock of Google Inc. (GOOG) was trading for $698.51. One year later the shares sold for only $283.99. Google has never paid a common stock dividend. What rate of return would you have eamed on your investment had you purchased the shares on December 5, 2007? The rate of return you would have earned is % (Round to two decimal places.) (Calculating rates of return) The S&P stock index represents a portfolio comprised of 500 large publicly traded companies. On December 24, 2007, the index had a value of 1.410 and on December 24, 2008, the index was approximately 868. If the average dividend paid on the stocks in the index is approximately 4.5 percent of the value of the index at the beginning of the year, what is the rate of return earned on the S&P index? What is your assessment of the relative riskiness of investing in a single stock such as Google compared to investing in the S&P index (recall from Chapter 2 that you can purchase mutual funds that mimic the returns of the index)? The rate of return earned on the S&P 500 is % (Round to two decimal places.) What is your assessment of the relative riskiness of investing in a single stock, such as Google, compared to investing in the S&P index? (Select the best choice below.) O A In general, investing in the S&P index is riskier than investing in a single stock B. There is not enough information given to answer this question C. In general, investing in a single stock has the same relative riskiness as investing in the S&P index. D. In general, investing in a single stock is riskier than investing in the S&P index (Calculating rates of return) The common stock of Placo Enterprises had a market price of $10.16 on the day you purchased it just one year ago. During the past year the stock had paid a dividend of $1.37 and closed at a price of $12.63. What rate of return did you eam on your investment in Placo's stock? The rate of return you earned on your investment in Placo's stock is % (Round to two decimal places.) (Calculating rates of return) Blaxo Balloons manufactures and distributes birthday balloons. At the beginning of the year Blaxo's common stock was selling for $18.84 but by year end it was only $17.79. If the firm paid a total cash dividend of $1.54 during the year, what rate of return would you have eamed if you had purchased the stock exactly one year ago? What would your rate of return have been if the firm had paid no cash dividend? The rate of return you would have earned is % (Round to two decimal places.) The rate of return you would have earned if the firm paid no cash dividend is %. (Round to two decimal places.) (Computing rates of return) From the following price data, compute the annual rates of return for Asman and Salinas. Time Asman Salinas 1 $9 $29 2 12 27 3 10 32 4 13 35 (Click on the icon in order to copy its contents into a spreadsheet.) How would you interpret the meaning of the annual rates of return? The rate of return you would have earned on Asman stock from time 1 to time 2 is %. (Round to two decimal places.) The rate of return you would have earned on Asman stock from time 2 to time 3 is % (Round to two decimal places.) The rate of return you would have earned on Asman stock from time 3 to time 4 is % (Round to two decimal places.) The rate of return you would have earned on Salinas stock from time 1 to time 2 is % (Round to two decimal places.) The rate of return you would have earned on Salinas stock from time 2 to time 3 is % (Round to two decimal places.) The rate of return you would have earned on Salinas stock from time 3 to time 4 is %. (Round to two decimal places.) How would you interpret the meaning of the annual rates of return? (Select the best choice below.) O A. The annual rate of return with no dividends paid is the price at the beginning of one period less the price at the end of the period divided by the price at the beginning of the period. B. The annual rate of return with no dividends paid is the price at the beginning of one period less the price at the end of the period divided by the price at the end of the period. OC. The annual rate of return with no dividends paid is the price at the end of one period less the price at the beginning of the period divided by the price at the end of the period OD. The annual rate of return with no dividends paid is the price at the end of one period less the price at the beginning of the period divided by the price at the beginning of the period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts