Question: I need help with these question 1 Currently, the prime rate and federal funds rates are (12) 7.5% and 4.5% b. 4.5% and .2% c.

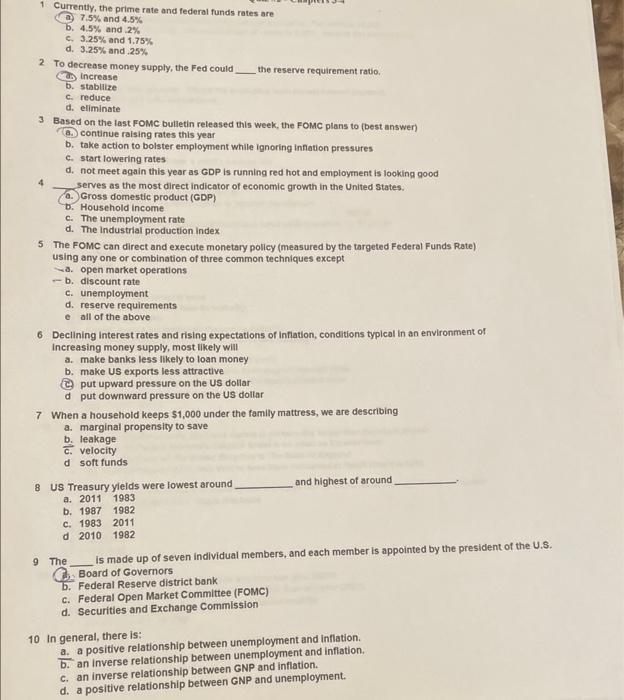

1 Currently, the prime rate and federal funds rates are (12) 7.5% and 4.5% b. 4.5% and .2% c. 3.25% and 1.75% d. 3.25% and .25% 2. To decrease money supply, the Fed could ab increase b. stablize c. reduce d. eliminate 3 Based on the last FOMC bulletin released this week, the FOMC plans to (best answer) (a.) continue raising rates this year b. take action to bolster employment while ignoring inflation pressures c. start lowering rates d. not meet again this year as GDP is running red hot and employment is looking good 4 serves as the most direct indicator of economic growth in the United states. a. Gross domestic product (GDP) b. Household income c. The unemployment rate d. The Industrial production index 5 The FOMC can direct and execute monetary policy (measured by the targeted Federal Funds Rate) using any one or combination of three common techniques except -a. open market operations. b. discount rate c. unemployment d. reserve requirements e all of the above 6 Decilning interest rates and rising expectations of infiation, conditions typical in an environment of Increasing money supply, most likely will a. make banks less likely to loan money b. make US exports less attractive (C) put upward pressure on the US dollar d put downward pressure on the Us dollar 7 When a household keeps $1,000 under the family mattress, we are describing a. marginal propensity to save b. leakage c. velocity d soft funds 8 US Treasury yleids were fowest around and highest of around a. 20111983 b. 19871982 c. 19832011 d 20101982 9 The is made up of seven individual members, and each member is appointed by the president of the U.S. b. Board of Governors b. Federal Reserve district bank c. Federal Open Market Committee (FOMC) d. Securities and Exchange Commission 10 In general, there is: a. a positive relationship between unemployment and inflation. D. an inverse relationship between unemployment and inflation. c. an inverse relationship between GNP and inflation. d. a positive relationship between GNP and unemployment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts