Question: I need help with these question as soon as possible. Thank you very much Hudson Company manufactures worments shoes. It uses a job costing system

I need help with these question as soon as possible. Thank you very much

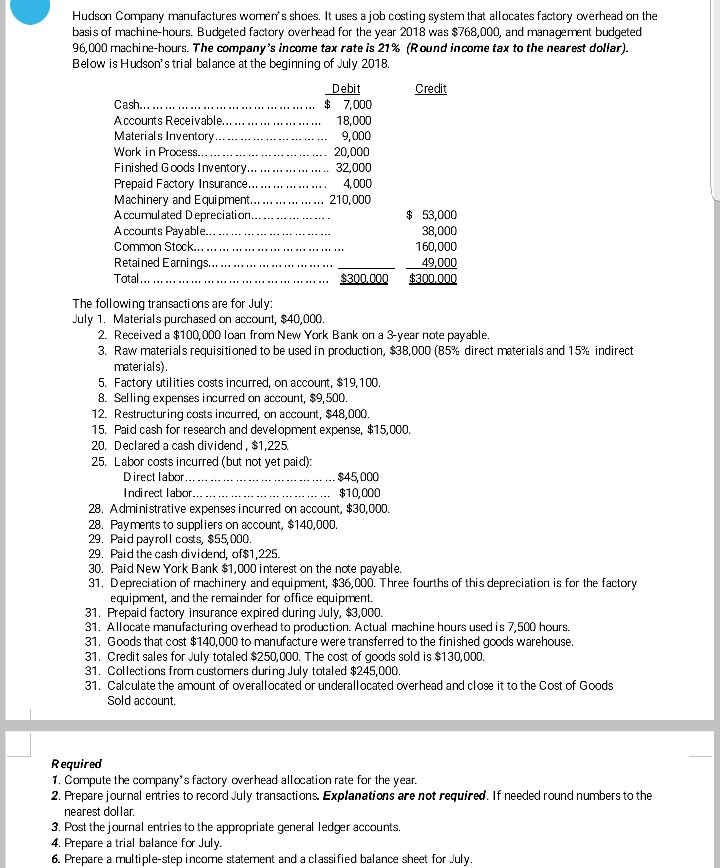

Hudson Company manufactures worments shoes. It uses a job costing system that allocates factory overhead on the basis of machine hours. Budgeted factory overhead for the year 2018 was $768,000, and management budgeted 96,000 machine-hours. The company's income tax rate is 21% (Round income tax to the nearest dollar). Below is Hudson's trial balance at the beginning of July 2018. Debit Credit Accounts Receivable... Materials Inventory.. 18,000 9,000 20,000 Prepaid Factory Insurance.... Machinery and Equipment... 210,000 53,000 A ccounts Payable... 160,000 The following transacti ons are for July: July 1. Materials purchased on account, $40,000 2. Received a $100,000 loan from New York Bank on a 3-year note payable. 3. Raw materials requisitioned to be used in production, $38,000 (85% direct materials and 15% indirect materials) 5. Factory utilities costs incurred, on account, $19,100 8. Selling expenses incurred on account, $9,500. 12. Restructuring costs incurred, on accournt, $48,000. 15. Paid cash for research and development expense, $15,000 20. Declared a cash dividend, $1,225. 25. Labor costs incurred (but not yet paid) Direct labor.. .. $45,000 28. Administrative expenses incurred on account, $30,000 28. Payments to suppliers on account, $140,000. 29. Paid payroll costs, $55,000. 29. Paid the cash dividend, of$1,225. 30. Paid New York Bank $1,000 interest on the note payable 31. Depreciation of machinery and equipment, $36,000. Three fourths of this depreciation is for the factory equipment, and the remainder for office equipment. 31. Prepaid factory insurance expired during July, $3,000 31. Allocate manufacturing overhead to production. Actual machine hours used is 7,500 hours. 31. Goods that cost $140,000 to manufacture were transferred to the finished goods warehouse 31. Credit sales for July totaled $250,000. The cost of goods sold is $130,000 31. Collections from custormers during July totaled $245,000. 31. Calculate the amount of overallocated or underallocated overhead and close it to the Cost of Goods Sold account. Required 1. Compute the company's factory overhead allocation rate for the year 2. Prepare journal entries to record July transactions. Explanations are not required. If needed round numbers to the nearest dollar 3. Post the journal entries to the appropriate general ledger accounts. 4. Prepare a trial balance for July 6. Prepare a multiple-step income staterment and a classified balance sheet for July

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts