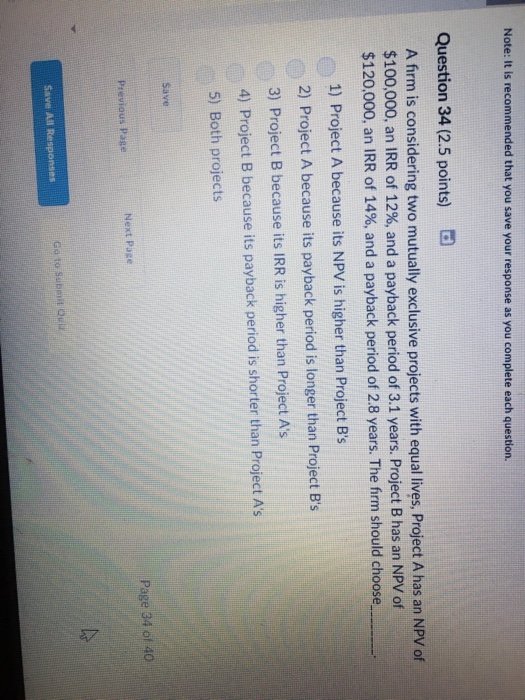

Question: I need help with these questions ASAP 34&35 Note: It is recommended that you save your response as you complete each question. Question 35 (2.5

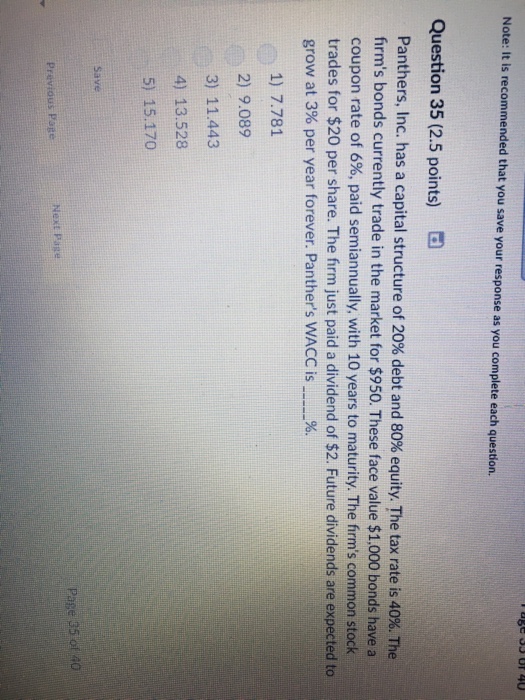

Note: It is recommended that you save your response as you complete each question. Question 35 (2.5 points) Panthers, Inc. has a capital structure of 20% debt and 80% equity. The tax rate is 40%. The firm's bonds currently trade in the market for $950. These face value $1,000 bonds have a coupon rate of 6%, paid semiannually, with 10 years to maturity. The firm's common stock trades for $20 per share. The firm just paid a dividend of $2. Future dividends are expected to grow at 3% per year forever. Panther's WACC is 96. 1) 7.781 2) 9.089 3) 11.443 4) 13.528 5) 15.170 Save Page 50 Pr

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts