Question: I need help with these questions. Can you all answer these questions with explanations? QUESTION 12 David files his tax ruum 45 days after the

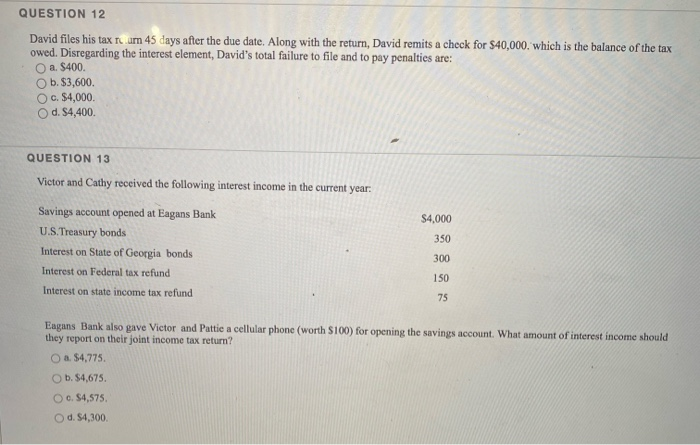

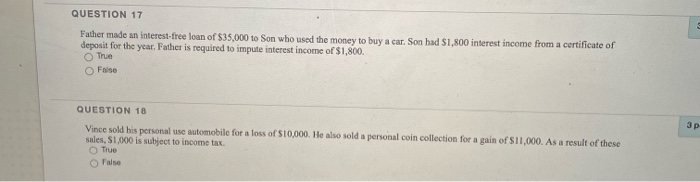

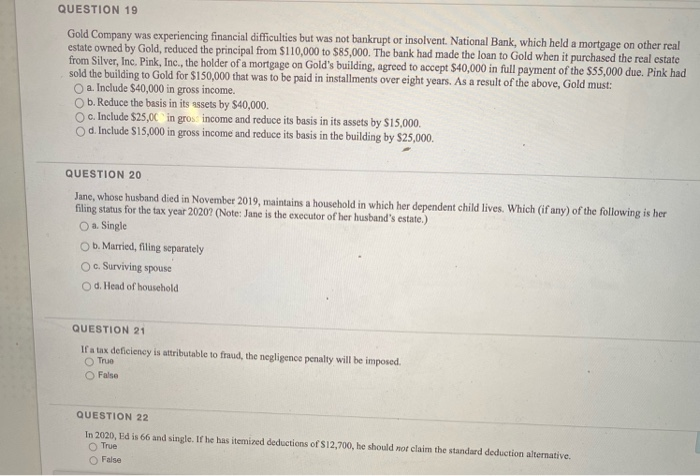

QUESTION 12 David files his tax ruum 45 days after the due date. Along with the return, David remits a check for $40,000, which is the balance of the tax owed. Disregarding the interest element, David's total failure to file and to pay penalties are: a $400. b. $3,600 Oc. $4,000. O d. $4,400 QUESTION 13 Victor and Cathy received the following interest income in the current year. $4,000 350 Savings account opened at Eagans Bank U.S. Treasury bonds Interest on State of Georgia bonds Interest on Federal tax refund Interest on state income tax refund 300 150 75 Eugans Bank also gave Victor and Pattie a cellular phone (worth $100) for opening the savings account. What amount of interest income should they report on their joint income tax return? O a $4,775. Ob. $4,675. O 0 S4,575 O d. 54,300 QUESTION 17 Father made an interest-free loan of $35,000 to Son who used the money to buy a car. Son had $1,800 interest income from a certificate of deposit for the year, Father is required to impute interest income of $1,800. O True Faise QUESTION 18 3 p Vince sold his personal use automobile for a loss of $10,000. He also sold a personal coin collection for a gain of $11,000. As a result of these sales, $1,000 is subject to income tax. True False QUESTION 19 Gold Company was experiencing financial difficulties but was not bankrupt or insolvent. National Bank, which held a mortgage on other real estate owned by Gold, reduced the principal from $110,000 to $85,000. The bank had made the loan to Gold when it purchased the real estate from Silver, Inc. Pink, Inc., the holder of a mortgage on Gold's building, agreed to accept $40,000 in full payment of the $55,000 due. Pink had sold the building to Gold for $150,000 that was to be paid in installments over eight years. As a result of the above, Gold must: a. Include $40,000 in gross income. b. Reduce the basis in its assets by $40,000 c. Include $25,0C in gros income and reduce its basis in its assets by S15,000 d. Include $15,000 in gross income and reduce its basis in the building by $25,000 QUESTION 20 Jane, whose husband died in November 2019, maintains a household in which her dependent child lives. Which (if any) of the following is her filing status for the tax year 2020? (Note: Jane is the executor of her husband's estate.) a. Single b. Married, filing separately O c. Surviving spouse Od. Head of household QUESTION 21 If a tax deficiency is attributable to fraud, the negligence penalty will be imposed True False QUESTION 22 In 2020, Ed is 66 and single. If he has itemized deductions of $12,700, he should not claim the standard deduction alternative. True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts