Question: I need help with these questions please Prior Year Current Year Category Accounts payable 3.146.00 5,927.00 Accounts receivable 6.868.00 9,082.00 Accruals 5,683.00 6, 108.00 Additional

I need help with these questions please

I need help with these questions please

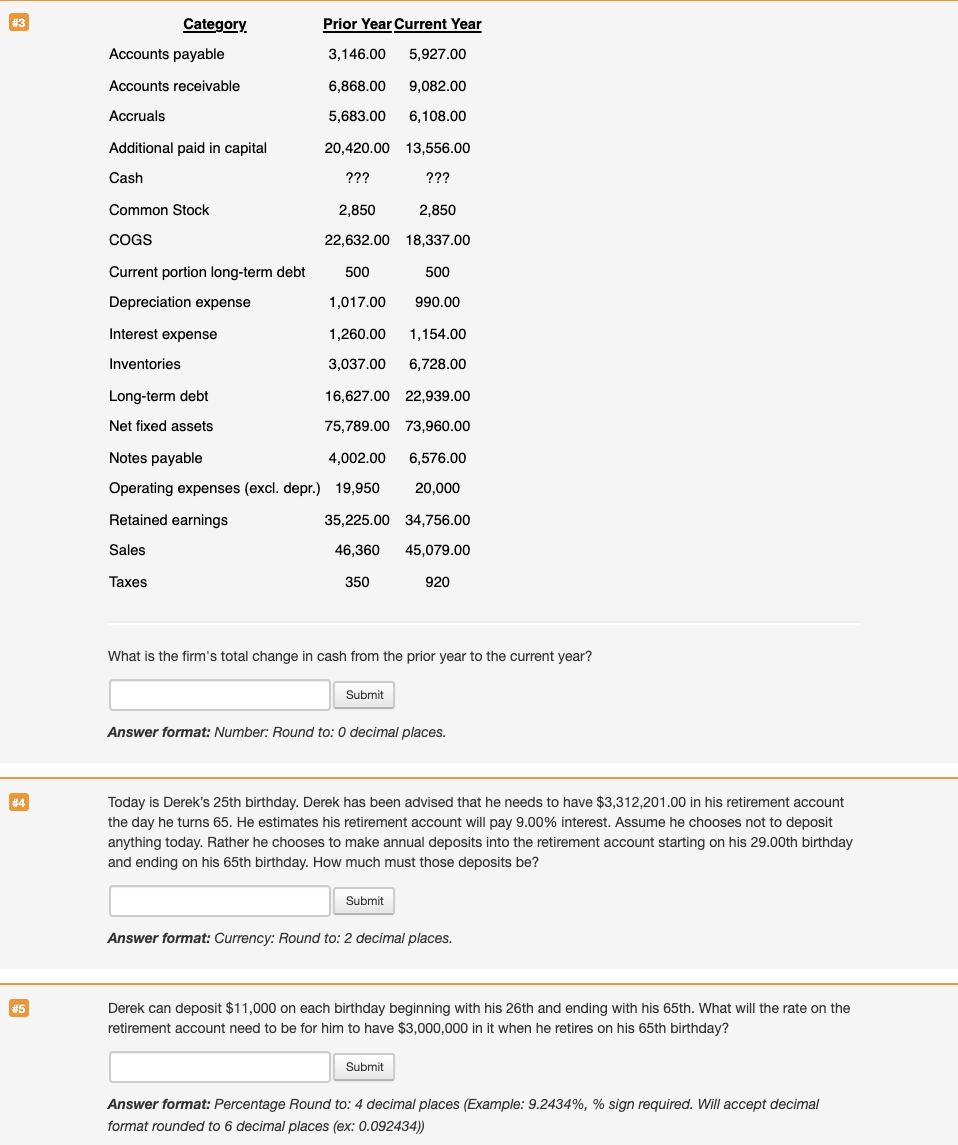

Prior Year Current Year Category Accounts payable 3.146.00 5,927.00 Accounts receivable 6.868.00 9,082.00 Accruals 5,683.00 6, 108.00 Additional paid in capital 20,420.00 13,556.00 Cash ??? ??? Common Stock 2,850 2,850 COGS 22,632.00 18,337.00 Current portion long-term debt 500 500 Depreciation expense 1,017.00 990.00 Interest expense 1,260.00 1,154.00 Inventories 3,037.00 6,728.00 Long-term debt 16,627.00 22,939.00 Net fixed assets 75,789.00 73,960.00 6,576.00 Notes payable 4,002.00 Operating expenses (excl. depr.) 19,950 20,000 Retained earnings 35,225.00 34,756.00 Sales 46,360 45,079.00 Taxes 350 920 What is the firm's total change in cash from the prior year to the current year? Submit Answer format: Number: Round to: 0 decimal places. #4 Today is Derek's 25th birthday. Derek has been advised that he needs to have $3,312,201.00 in his retirement account the day he turns 65. He estimates his retirement account will pay 9.00% interest. Assume he chooses not to deposit anything today. Rather he chooses to make annual deposits into the retirement account starting on his 29.00th birthday and ending on his 65th birthday. How much must those deposits be? Submit Answer format: Currency: Round to: 2 decimal places. #5 Derek can deposit $11,000 on each birthday beginning with his 26th and ending with his 65th. What will the rate on the retirement account need to be for him to have $3,000,000 in it when he retires on his 65th birthday? Submit Answer format: Percentage Round to: 4 decimal places (Example: 9.2434%, % sign required. Will accept decimal format rounded to 6 decimal places (ex: 0.092434))

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts