Question: i need help with these questions please show the working out q) Jess derived taxable income of 30,000 and received reportable Fringe benefit of 8000

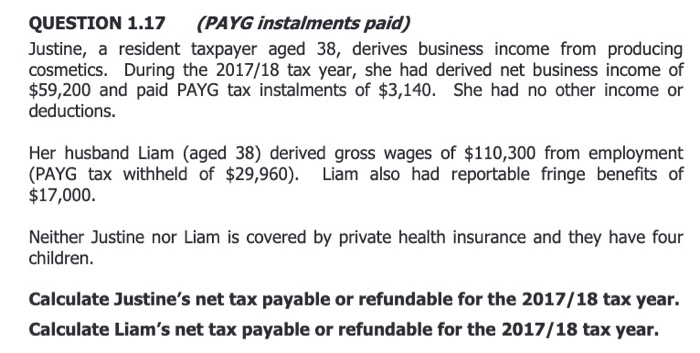

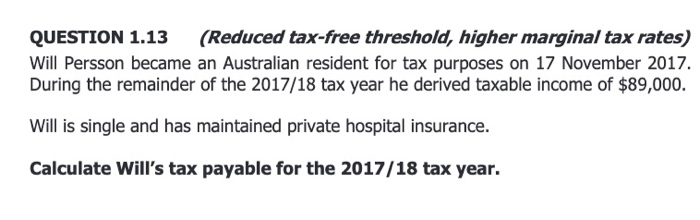

QUESTION 1.17 (PAYG instalments paid) Justine, a resident taxpayer aged 38, derives business income from producing cosmetics. During the 2017/18 tax year, she had derived net business income of $59,200 and paid PAYG tax instalments of $3,140. She had no other income or deductions. Her husband Liam (aged 38) derived gross wages of $110,300 from employment (PAYG tax withheld of $29,960). Liam also had reportable fringe benefits of $17,000. Neither Justine nor Liam is covered by private health insurance and they have four children. Calculate Justine's net tax payable or refundable for the 2017/18 tax year. Calculate Liam's net tax payable or refundable for the 2017/18 tax year. QUESTION 1.13 (Reduced tax-free threshold, higher marginal tax rates) Will Persson became an Australian resident for tax purposes on 17 November 2017. During the remainder of the 2017/18 tax year he derived taxable income of $89,000. Will is single and has maintained private hospital insurance. Calculate Will's tax payable for the 2017/18 tax year. QUESTION 1.17 (PAYG instalments paid) Justine, a resident taxpayer aged 38, derives business income from producing cosmetics. During the 2017/18 tax year, she had derived net business income of $59,200 and paid PAYG tax instalments of $3,140. She had no other income or deductions. Her husband Liam (aged 38) derived gross wages of $110,300 from employment (PAYG tax withheld of $29,960). Liam also had reportable fringe benefits of $17,000. Neither Justine nor Liam is covered by private health insurance and they have four children. Calculate Justine's net tax payable or refundable for the 2017/18 tax year. Calculate Liam's net tax payable or refundable for the 2017/18 tax year. QUESTION 1.13 (Reduced tax-free threshold, higher marginal tax rates) Will Persson became an Australian resident for tax purposes on 17 November 2017. During the remainder of the 2017/18 tax year he derived taxable income of $89,000. Will is single and has maintained private hospital insurance. Calculate Will's tax payable for the 2017/18 tax year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts