Question: I need help with these tax accouting problems 2. L.0.1 Which of the following items are inclusions in gross income? a. During the year, stock

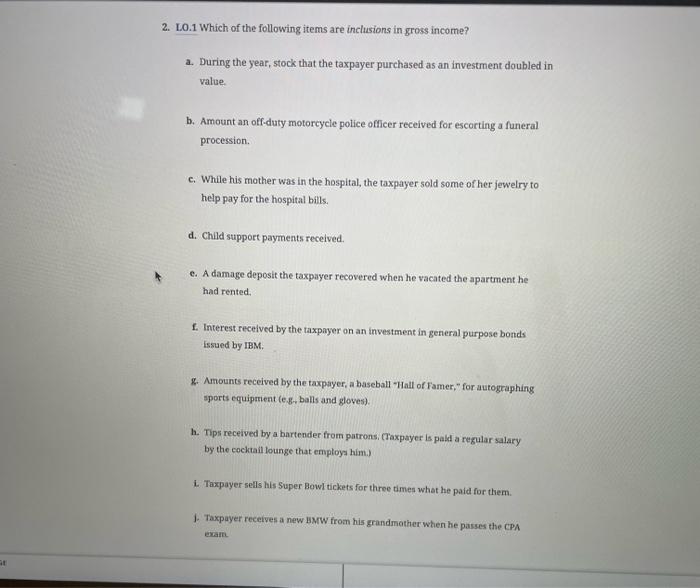

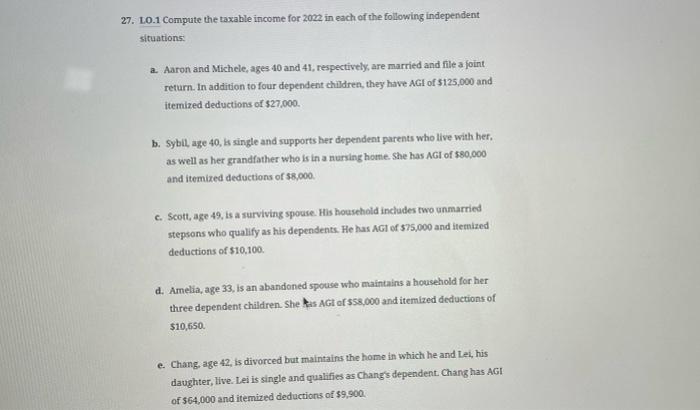

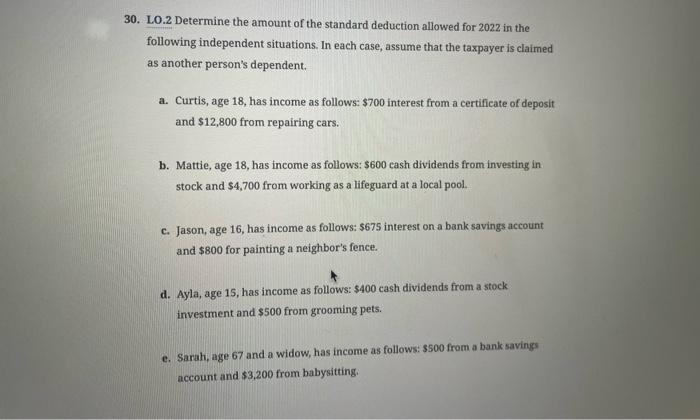

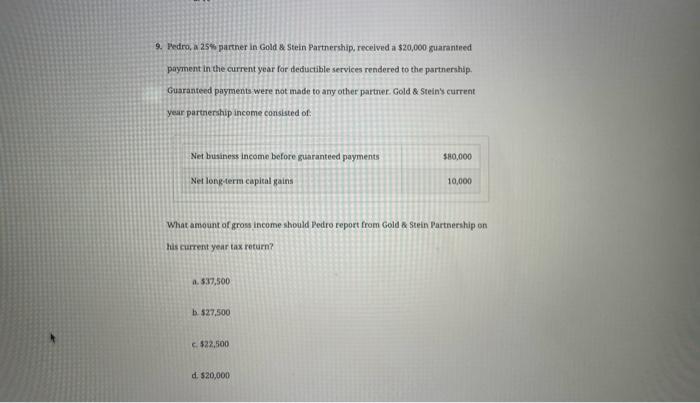

2. L.0.1 Which of the following items are inclusions in gross income? a. During the year, stock that the taxpayer purchased as an investment doubled in value. b. Amount an off-duty motorcycle police officer received for escorting a funeral procession. c. While his mother was in the hospital, the taxpayer sold some of her jewelry to help pay for the hospital bills. d. Child stupport payments received. e. A damage deposit the taxpayer recovered when he vacated the apartment he had rented, f. Interest received by the taxpayer on an investment in general purpose bonds issued by IBM. g. Amounts received by the taxpayer, a baseball "Hall of Famer, " for autographing sports equipment (eg. balls and gloves). h. Tips received by a bartender from patrons, Traxpayer is pald a regular salary by the cocktail lounge that employ= him.) i. Taxpayer sells his Super Bowl tickets for three times what he paid for them. 1. Taxpayer receives a new BMW from his grandmother when he passes the CPA exam 27. LO.1 Compute the taxable income for 2022 in each of the following independent situations: a. Aaron and Michele, ages 40 and 41, respectively, are married and file a foint return. In addition to four dependent children, they have AGI of $125,000 and itemired deductions of $27,000. b. SyblL, age 40, is single and supports her dependent parents who live with her, as well as her grandfather who is in a nursing home. \$he has AGI of 580,000 and itemized deductions of 58,000 . c. Scott, age 49, is a surviving spouse. His household includes two unmarried stepsans who qualify as his dependents. He has AGI of 575,000 and itemized deductions of $10,100. d. Amelia, age 33, is an abandoned spouse who maintains a household for her three dependent children. She His AGt of $58,000 and itemized deductions of $10,650. e. Chang, age 42, is divorced but maintains the home in which he and tei, his daughter, Hive. Lei is single and qualifies as Chang's dependent. Chang has AGI of $64,000 and iternized deductions of $9,900. 30. LO.2 Determine the amount of the standard deduction allowed for 2022 in the following independent situations. In each case, assume that the taxpayer is claimed as another person's dependent. a. Curtis, age 18, has income as follows: $700 interest from a certificate of deposit and $12,800 from repairing cars. b. Mattie, age 18 , has income as follows: $600 cash dividends from investing in stock and $4,700 from working as a lifeguard at a local pool. c. Jason, age 16, has income as follows: $675 interest on a bank savings account and $800 for painting a neighbor's fence. d. Ayla, age 15 , has income as follows: $400 cash dividends from a stock investment and $500 from grooming pets. e. Sarah, age 67 and a widow, has income as follows: $500 from a bank savings account and $3,200 from babysitting. 9. Fedro, a 25\% partner in Gold \& steinParthership,receiveda$20,000 guaranteed payment in the current year for deductible services rendered to the partnership. Guaranteed payments were not made to any other partmer. Gold \& Steins current year partmership income consisted of: Net buainess income before guaranteed payments Net long-term capieal gains 10,000 What amount of gross income should Pedro report from Gold \& Stein Partnership on his current year tax return? a. 537,500 b $27,500 c. 422.500 d. 520,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts