Question: I need help with these thankss 1) 2) 3) Your answer is incorrect. The return on total assets measures profitability by combining the effects how

I need help with these thankss

1)

2)

3)

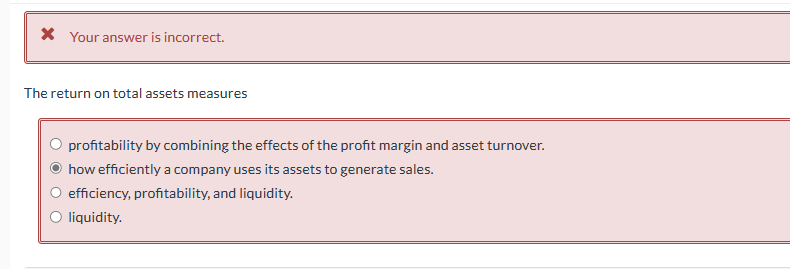

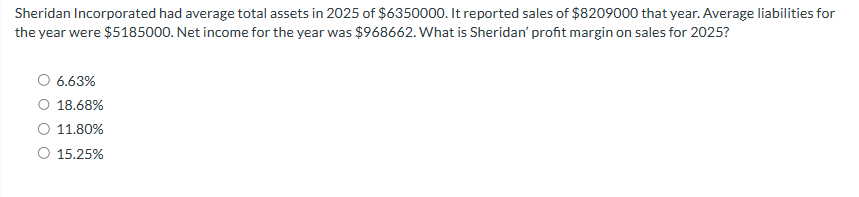

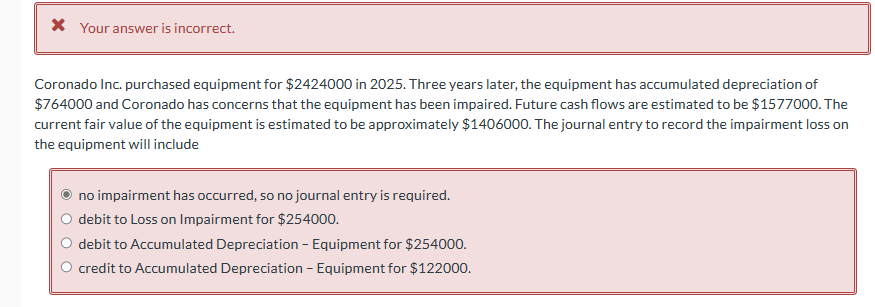

Your answer is incorrect. The return on total assets measures profitability by combining the effects how efficiently a company uses its as efficiency, profitability, and liquidity. Your answer is incorrect. Coronado Inc. purchased equipment for $2424000 in 2025 . Three years later, the equipment has accumulated depreciation of $764000 and Coronado has concerns that the equipment has been impaired. Future cash flows are estimated to be $1577000. The current fair value of the equipment is estimated to be approximately $1406000. The journal entry to record the impairment loss on the equipment will include no impairment has occurred, so no journal entry is required. debit to Loss on Impairment for $254000. debit to Accumulated Depreciation - Equipment for $254000. credit to Accumulated Depreciation - Equipment for $122000. Sheridan Incorporated had average total assets in 2025 of $6350000. It reported sales of $8209000 that year. Average liabilities for the year were $5185000. Net income for the year was $968662. What is Sheridan' profit margin on sales for 2025 ? 6.63%18.68%11.80%15.25%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts