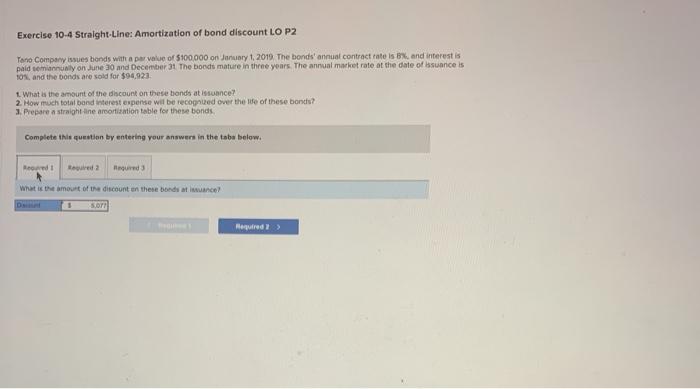

Question: I need help with these two Exercise 10-4 Straight-Line: Amortization of bond discount LO P2 Tano Company issues bonds with a par value of $100.000

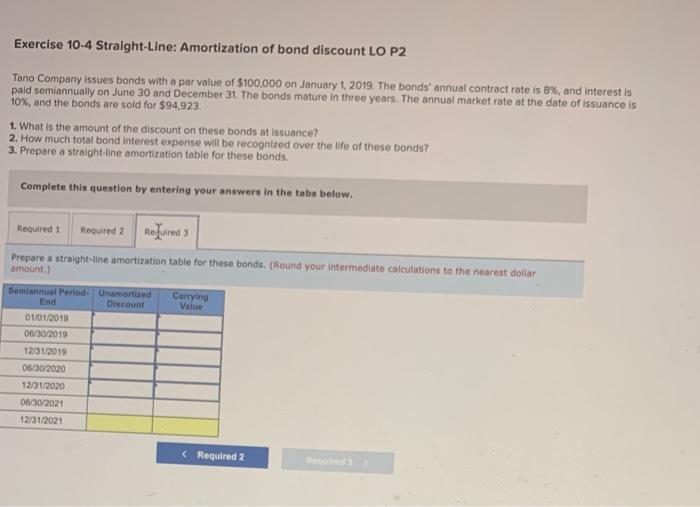

Exercise 10-4 Straight-Line: Amortization of bond discount LO P2 Tano Company issues bonds with a par value of $100.000 on January 1, 2010. The bonds' annual contract rate is, and interestis pald semiannusly on June 30 and December 31 The bonds mature in three years. The annual market rate at the date of issuance is 10%, and the bonds are sold for $94.921 1. What is the amount of the discount on these bonds at issuance? 2. How much total band interest expense wil be recognued over the le of these bonds? 2. Prepare a straight line arcortization table for these bonds Complete this question by entering your answers in the tabs below. Rond 1 tvegured what is the amount of the discount on these boods at lunce SOFT Hequired Exercise 10-4 Straight-Line: Amortization of bond discount LO P2 Tano Company issues bonds with a par value of $100,000 on January 1, 2019. The bonds' annual contract rate is 8%, and interest is paid semiannually on June 30 and December 31. The bonds mature in three years. The annual market rate at the date of issuance is 10%, and the bonds are sold for $94,923. 1. What is the amount of the discount on these bonds at issuance? 2. How much total bond interest expense will be recognized over the life of these bonds? 3. Prepare a straight line amortization table for these bonds. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Refuired Prepare a straight-line amortization table for these bonds. (Round your intermediate calculations to the nearest dollar amount.) End Carrying Value Samiannual Period: Unamortid Discount 01/01/2019 06/30/2019 12/31/2019 06/30/2020 12/31/2020 06/30/2021 12/31/2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts