Question: I need help with these two questions. It would be better to use the easiest solution. Thanks. Common information for questions 10-11 Acme is considering

I need help with these two questions. It would be better to use the easiest solution. Thanks.

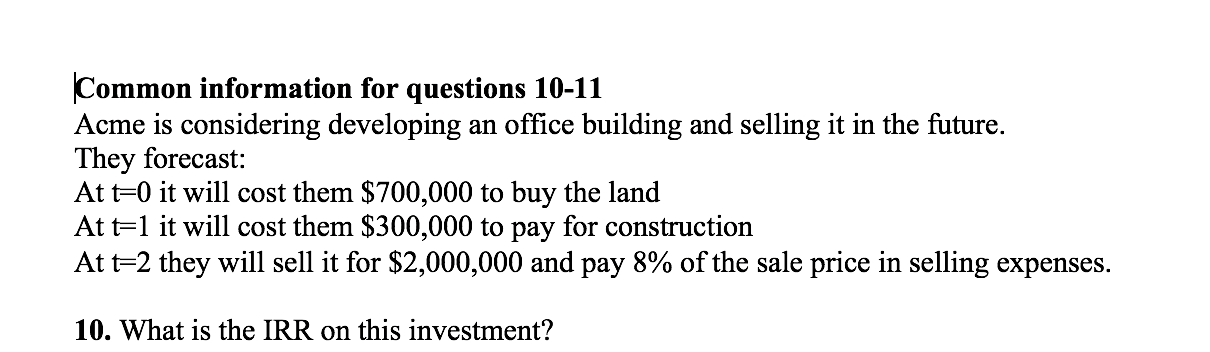

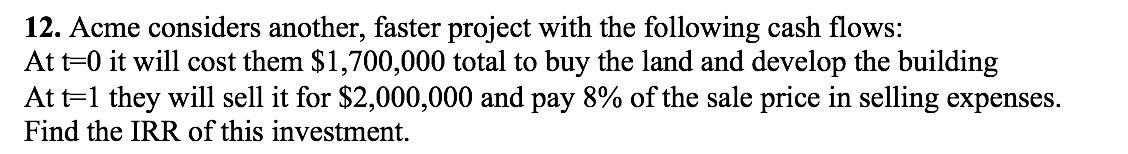

Common information for questions 10-11 Acme is considering developing an office building and selling it in the future. They forecast: At t=0 it will cost them $700,000 to buy the land At t=1 it will cost them $300,000 to pay for construction At t=2 they will sell it for $2,000,000 and pay 8% of the sale price in selling expenses. 10. What is the IRR on this investment? 12. Acme considers another, faster project with the following cash flows: At t=0 it will cost them $1,700,000 total to buy the land and develop the building At t=1 they will sell it for $2,000,000 and pay 8% of the sale price in selling expenses. Find the IRR of this investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts