Question: i need help with these two questions Question 28 (1 point) A firm is considering a potential investment project that would result in an immediate

i need help with these two questions

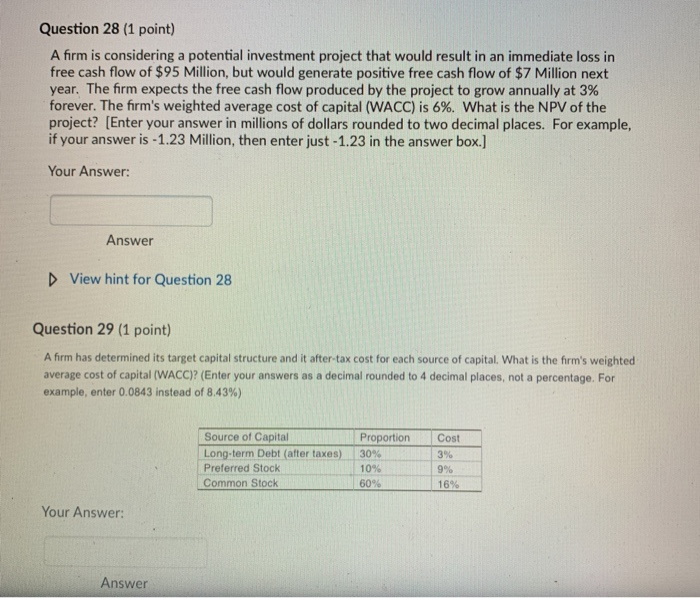

i need help with these two questionsQuestion 28 (1 point) A firm is considering a potential investment project that would result in an immediate loss in free cash flow of $95 Million, but would generate positive free cash flow of $7 Million next year. The firm expects the free cash flow produced by the project to grow annually at 3% forever. The firm's weighted average cost of capital (WACC) is 6%. What is the NPV of the project? [Enter your answer in millions of dollars rounded to two decimal places. For example, if your answer is -1.23 Million, then enter just -1.23 in the answer box.] Your Answer: Answer D View hint for Question 28 te Question 29 (1 point) A firm has determined its target capital structure and it after-tax cost for each source of capital, What is the firm's weighted average cost of capital (WACC)? (Enter your answers as a decimal rounded to 4 decimal places, not a percentage. For example, enter 0.0843 instead of 8.43%) Proportion Cost Source of Capital Long-term Debt (after taxes) Preferred Stock Common Stock , 30% 3% 9% 16% 10% | 60% Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts