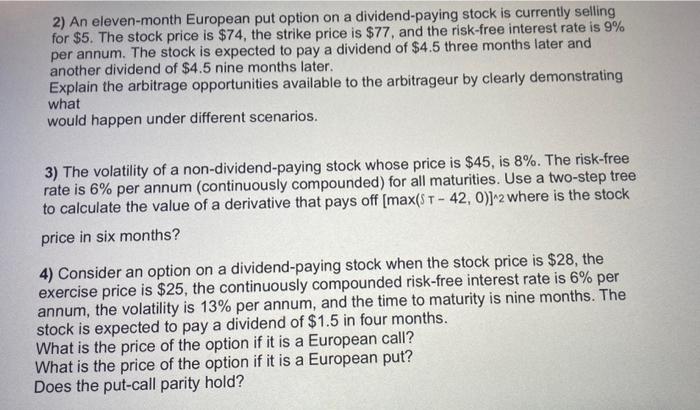

Question: i need help with this 6 questions in the 3rd question there is a typo, max[S_T-42,0]^2 is correct. 2) An eleven-month European put option on

![there is a typo, max[S_T-42,0]^2 is correct. 2) An eleven-month European put](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66ff77359d6ae_22966ff77351d534.jpg)

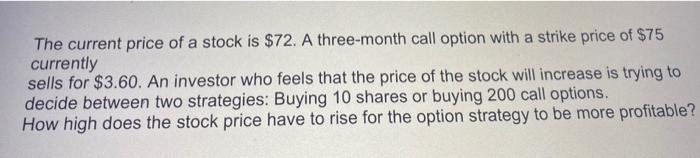

2) An eleven-month European put option on a dividend-paying stock is currently selling for $5. The stock price is $74, the strike price is $77, and the risk-free interest rate is 9% per annum. The stock is expected to pay a dividend of $4.5 three months later and another dividend of $4.5 nine months later. Explain the arbitrage opportunities available to the arbitrageur by clearly demonstrating what would happen under different scenarios. 3) The volatility of a non-dividend-paying stock whose price is $45, is 8%. The risk-free rate is 6% per annum (continuously compounded) for all maturities. Use a two-step tree to calculate the value of a derivative that pays off [max(ST42,0)]22 where is the stock price in six months? 4) Consider an option on a dividend-paying stock when the stock price is $28, the exercise price is $25, the continuously compounded risk-free interest rate is 6% per annum, the volatility is 13% per annum, and the time to maturity is nine months. The stock is expected to pay a dividend of $1.5 in four months. What is the price of the option if it is a European call? What is the price of the option if it is a European put? Does the put-call parity hold? 5) Suppose that the 1-year interest rates in Germany and the United States are 1% and 2.5% (continuously compounded). The spot exchange rate between the euro (EUR) and the US dollar (USD) is 1.14 USD per EUR. Suppose that the 1-year forward exchange rate is 1.16. How can an arbitrageur generate arbitrage profits? Explain in detail. 6) Seven months ago, a stock was expected to pay a dividend of $0.50 per share in two months, in five months and in eight months. The stock price was $35, and the risk-free rate of interest was 6% per annum with continuous compounding for all maturities. You had taken a short position in a ninemonth forward contract on the stock. Today, the price of the stock has become $37 and the risk-free rate of interest is still 6% per annum. What is the value your position? The current price of a stock is $72. A three-month call option with a strike price of $75 currently sells for $3.60. An investor who feels that the price of the stock will increase is trying to decide between two strategies: Buying 10 shares or buying 200 call options. How high does the stock price have to rise for the option strategy to be more profitable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts