Question: I need help with this accounting assignment. Please see instructions and show/explain all transactions!!! Please. Thanks a lot. Below you find a list of business

I need help with this accounting assignment. Please see instructions and show/explain all transactions!!! Please. Thanks a lot.

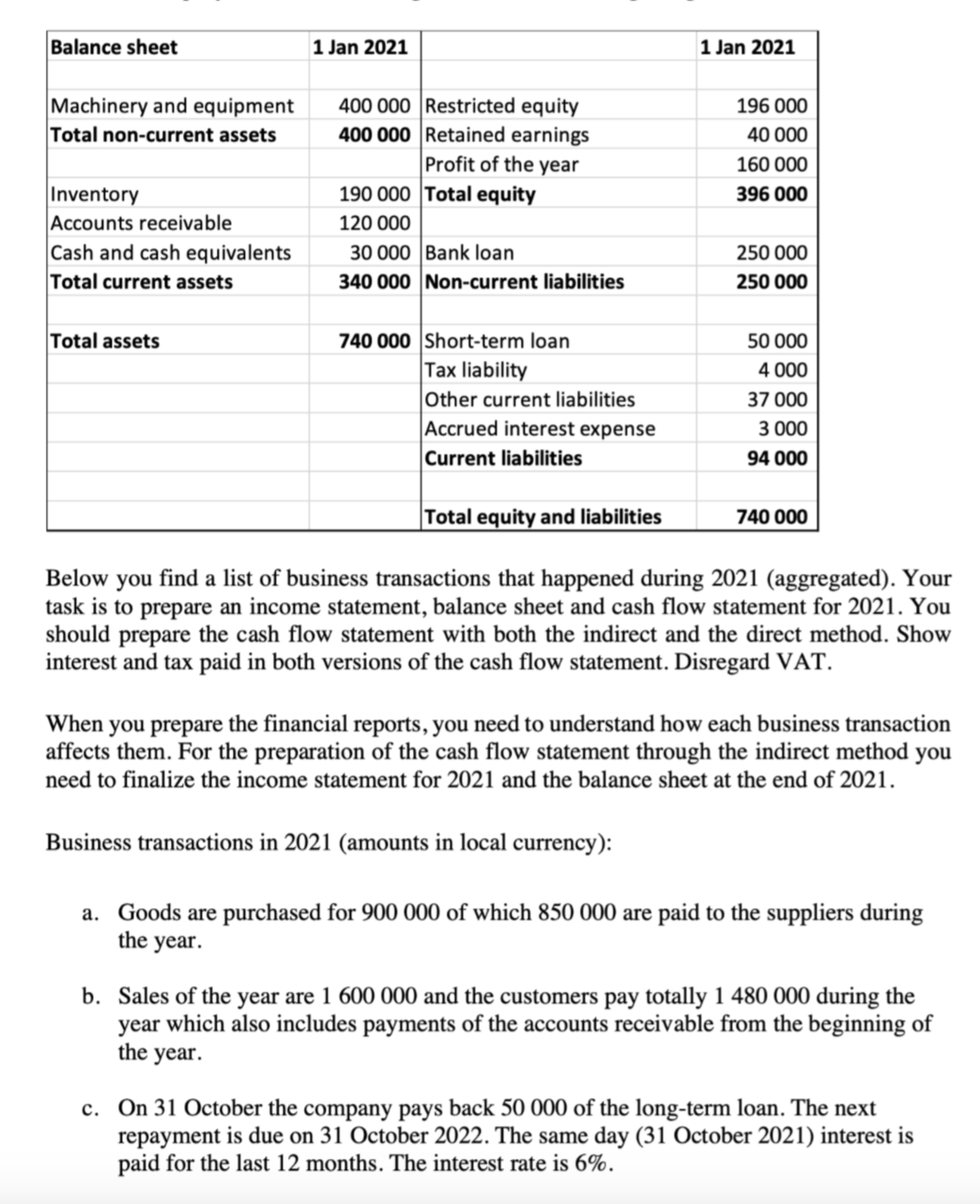

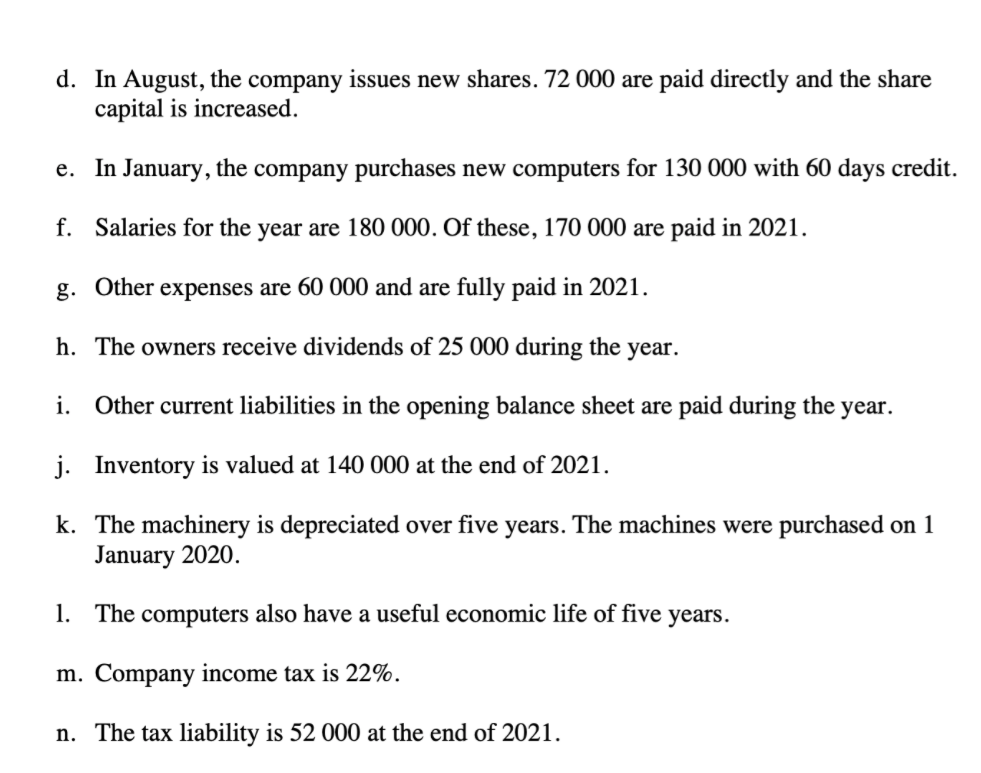

Below you find a list of business transactions that happened during 2021 (aggregated). Your task is to prepare an income statement, balance sheet and cash flow statement for 2021. You should prepare the cash flow statement with both the indirect and the direct method. Show interest and tax paid in both versions of the cash flow statement. Disregard VAT. When you prepare the financial reports, you need to understand how each business transaction affects them. For the preparation of the cash flow statement through the indirect method you need to finalize the income statement for 2021 and the balance sheet at the end of 2021 . Business transactions in 2021 (amounts in local currency): a. Goods are purchased for 900000 of which 850000 are paid to the suppliers during the year. b. Sales of the year are 1600000 and the customers pay totally 1480000 during the year which also includes payments of the accounts receivable from the beginning of the year. c. On 31 October the company pays back 50000 of the long-term loan. The next repayment is due on 31 October 2022. The same day (31 October 2021) interest is paid for the last 12 months. The interest rate is 6%. d. In August, the company issues new shares. 72000 are paid directly and the share capital is increased. e. In January, the company purchases new computers for 130000 with 60 days credit. f. Salaries for the year are 180000 . Of these, 170000 are paid in 2021. g. Other expenses are 60000 and are fully paid in 2021. h. The owners receive dividends of 25000 during the year. i. Other current liabilities in the opening balance sheet are paid during the year. j. Inventory is valued at 140000 at the end of 2021. k. The machinery is depreciated over five years. The machines were purchased on 1 January 2020. 1. The computers also have a useful economic life of five years. m. Company income tax is 22%. n. The tax liability is 52000 at the end of 2021 . Below you find a list of business transactions that happened during 2021 (aggregated). Your task is to prepare an income statement, balance sheet and cash flow statement for 2021. You should prepare the cash flow statement with both the indirect and the direct method. Show interest and tax paid in both versions of the cash flow statement. Disregard VAT. When you prepare the financial reports, you need to understand how each business transaction affects them. For the preparation of the cash flow statement through the indirect method you need to finalize the income statement for 2021 and the balance sheet at the end of 2021 . Business transactions in 2021 (amounts in local currency): a. Goods are purchased for 900000 of which 850000 are paid to the suppliers during the year. b. Sales of the year are 1600000 and the customers pay totally 1480000 during the year which also includes payments of the accounts receivable from the beginning of the year. c. On 31 October the company pays back 50000 of the long-term loan. The next repayment is due on 31 October 2022. The same day (31 October 2021) interest is paid for the last 12 months. The interest rate is 6%. d. In August, the company issues new shares. 72000 are paid directly and the share capital is increased. e. In January, the company purchases new computers for 130000 with 60 days credit. f. Salaries for the year are 180000 . Of these, 170000 are paid in 2021. g. Other expenses are 60000 and are fully paid in 2021. h. The owners receive dividends of 25000 during the year. i. Other current liabilities in the opening balance sheet are paid during the year. j. Inventory is valued at 140000 at the end of 2021. k. The machinery is depreciated over five years. The machines were purchased on 1 January 2020. 1. The computers also have a useful economic life of five years. m. Company income tax is 22%. n. The tax liability is 52000 at the end of 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts