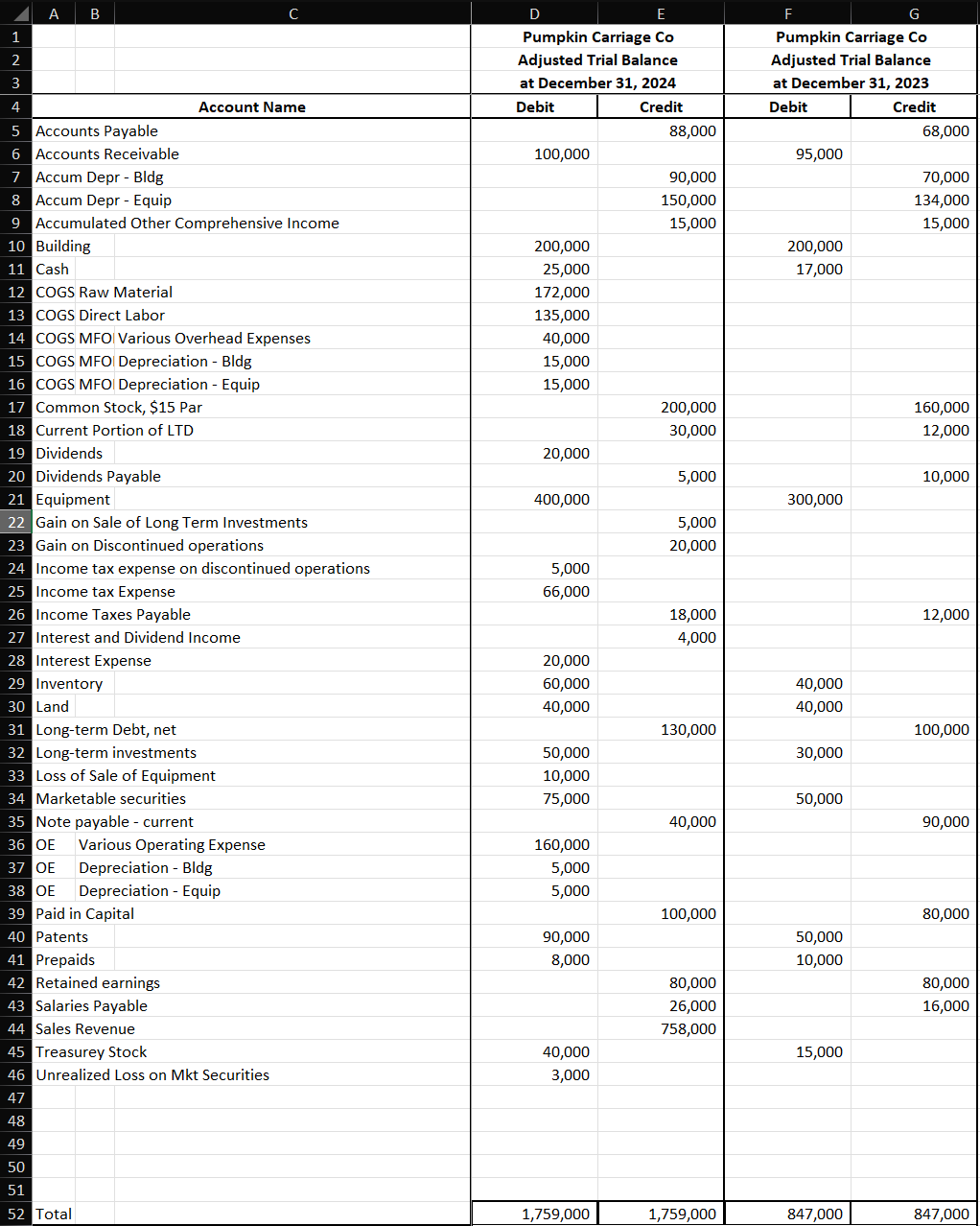

Question: i need help with this accounting problem. here are a few keys knowns to remember going into it: 1 ) We sold marketable securities at

i need help with this accounting problem. here are a few keys knowns to remember going into it:

We sold marketable securities at no gain or loss that had a cost of $

Proceeds from the sale of equipment, with a Cost of $

The Longterm investments that were sold had NO cost basis, ie BV was zero

Gain on sale of Discontinued Operations was totally from Operations, NO assets were sold

Attached is a screenshot of the beginning and ending trail balances for being referred to the accounts are in alphabetical order, NOT classification or Chart of Accounts order. So I have to figure out where the items go in the requirements below:

Between the trial balances and the additional information I am required to do the following:

The formal MultiStep income statement for

The formal statement of Retained earnings for

The formal Classified Balance Sheet for

The formal Statement of Cash Flows for

i don't particularly understand this part below

If ie these don't effect any work abovethe company had the following Comprehensive income items prepare the Schedule of Comprehensive income based upon the income arrived at in above

a Foreign currency translation Loss of $ net of tax

b Cost of Defined Benefits plans is $ net of tax

i also have to show all my work and calculations in order to get full credit. thanks!

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock