Question: I need help with this assignment. I have to write a performance of my portfolio. this are the stock that I bought this is the

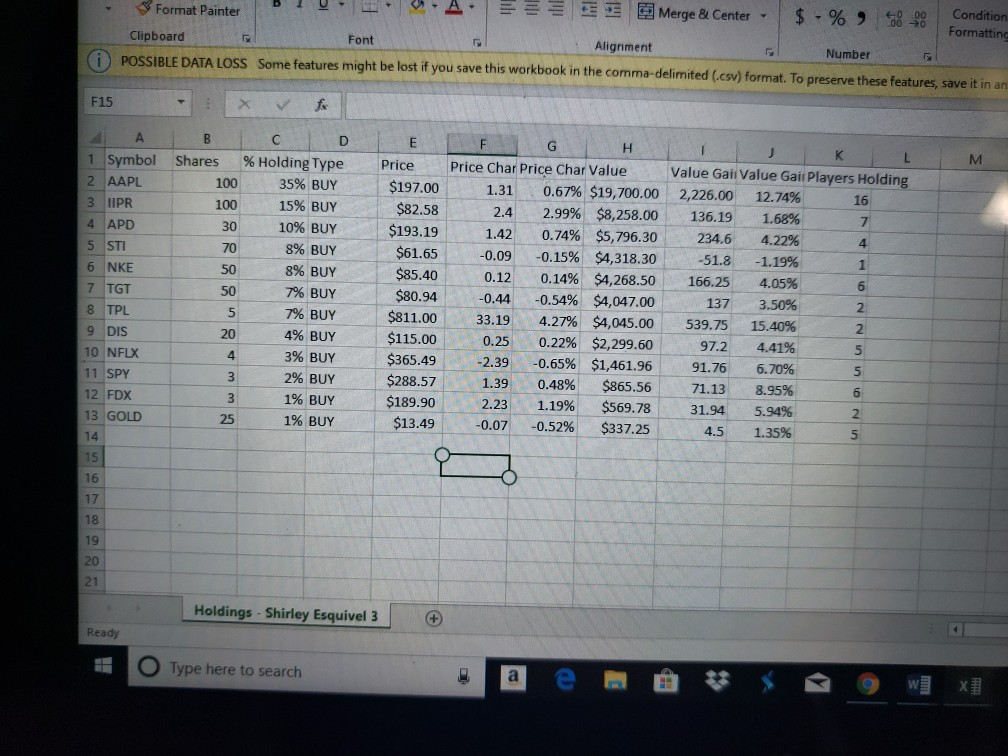

I need help with this assignment. I have to write a performance of my portfolio. this are the stock that I bought

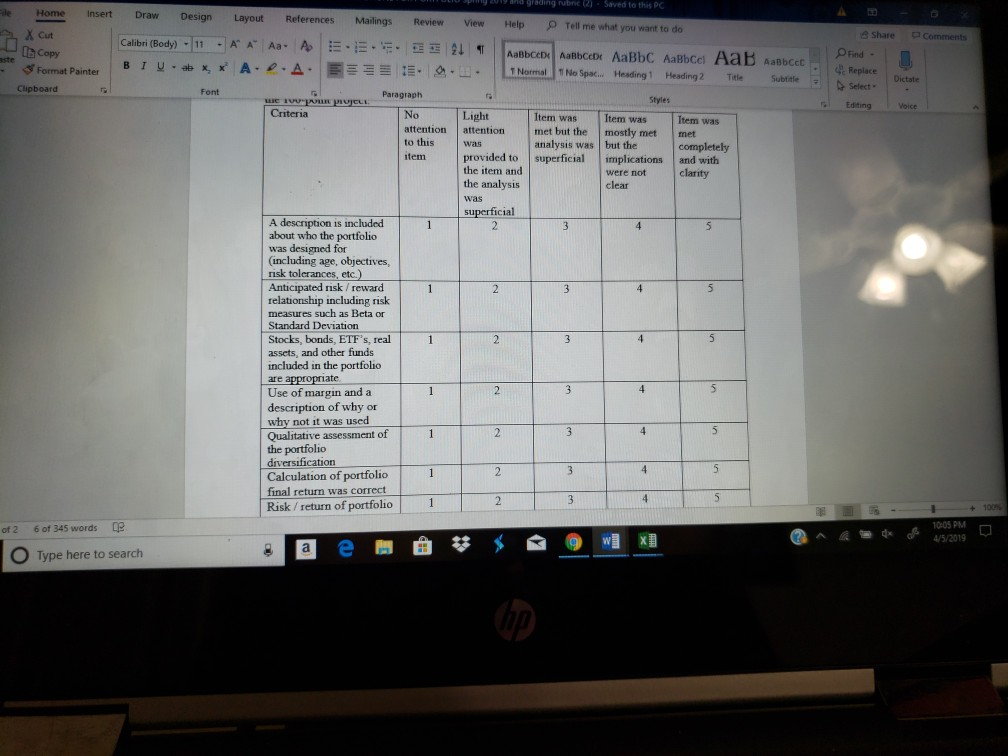

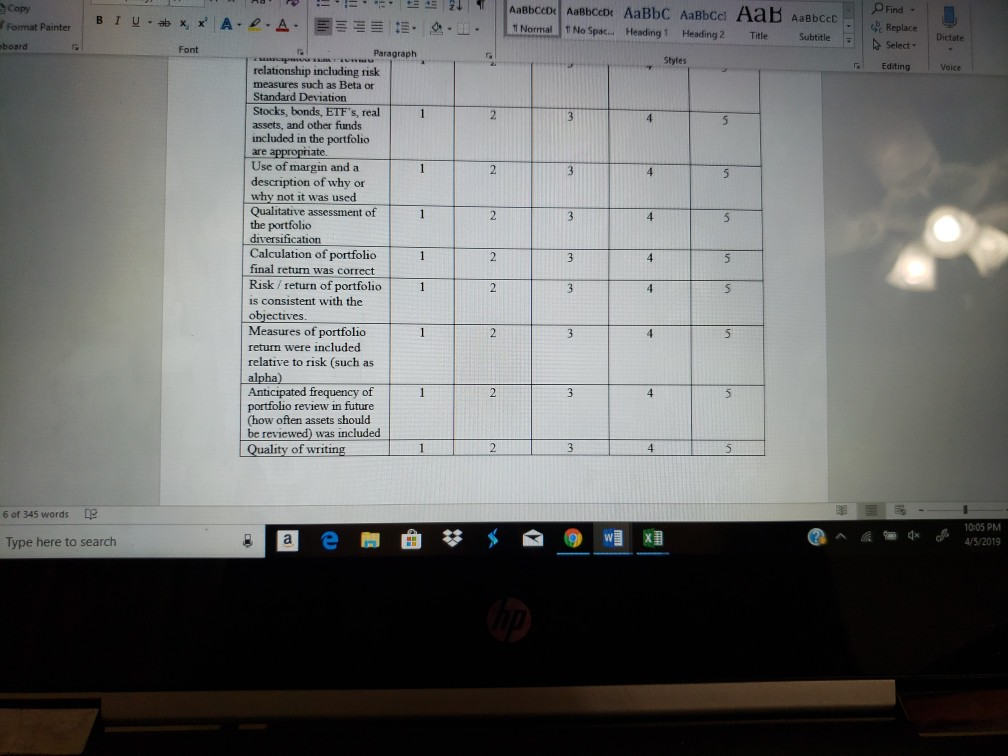

this is the grading rubric

Condition -!Merge & Center Alignment Condition Formattinc B 1 --+| 3-A. s-% , (oo oo e-0 00 00 20 Stormat Panter Format Painter Clipboard Font Number POSSIBLE DATA LOSS Some e features might be lost if you save this workbook in the comma-delimited (csv) format. To preserve these features, save it in an F15 value Ga value Gai players Holding 1 Symbol Shares %Holding Type 2 AAP 3 IIPR 4 APD 5 STI 6 NKE 7 TGT 8 TPL 9 DIS 10 NFLX 11 SPY 12 FDX 13 GOLD Price Price Char Price Char Value 35% BUY 15% BUY 10% BUY 896 BUY 896 BUY 7% BUY 796 BUY 4% BUY $197.00 $82.58 2.4 2.99% $193.19 $61.65-0.09 -0.15% $85.40 0.12 0.14% $80.94-0.44-0.54% $811.00 33.19 4.27% $115.00 $365.49-2.39-0.65% $288.57 . 1.39 0.48% $189.90 223 1.19% $13.49-0.07-0.52% 1.31.0.67%$19,700.00 $8,258.00 $5,796.30 $4,318.30 $4,268.50 $4,047.00 $4,045.00 $2,299.60 $1,461.96 12.74% 1.68% 4.22% 51.8-1.19% 166.25 4.05% 137 3.50% 539.75 15.40% 97.2 4.41% 91.76 6.70% -71.13-8.95% 31.94 5.94% 4.5 1.35% 100 100 30 2,226.00 136.19 234.6 16 7 1.42 0.74% , 50 20 0.25 0.22% . 396 BUY- -5 2% BUY 196 BUY 25-1%BUY $865.56, $569.78 $337.25 - 18 19 21 Holdings Shirley Esquivel 3 Ready O Type here to search grubre (2)-Saved to this PC le Home Insert Draw Design Layout out References Mailings Review View Help Tell me what you want to do Mailings Share Comments Calibri (Body)-11 A A Aa copy 1 Normal 1 No Spa.. Heading1 Heading 2 Tide Subtate Replace Select Paragraph Editing Voice No Item was Item was I Item was attention attention met but the mostly metmet to this was analysis was but the completely provided to superficial implications and with the item and were not clarity clear superficial A description is included about who the portfolic was designed for (including age, objectives, 2 risk tolerances, etc Anticipated risk /reward relationship including risk measures such as Beta or Stocks, bonds, ETF's, real assets, and other funds included in the portfolio are Use of margin and a description of why or why not it was used the portfolio diversification Calculation of portfolio1 final return was correct Risk/return of portfolio1 100% 1005 PM of 2 6 of 345 words e @.~cjx ds e @wa xa O Type here to search 5 Copy Find - Format Painter BIU ab x, x :-.On.L. | LINorrmal-ITNo Spac Replace Heading 1 Heading 2 Title Subtitle Styles ; Editing relationship including risk measures such as Beta or Standard Deviatiorn Stocks, bonds, ETFs, real assets, and other funds included in the portfolio Voice | 1 Use of margin and a description of why or why not it was used Qualitative assessment of the portfolio diversitication Calculation of portfolio final return was correct Risk / return of portfolio 1 is consistent with the objectives Measures of portfolico return were included relative to risk (such as Anticipated frequency of portfolio review in future (how often assets should be reviewed) was included Quality of writing 6 of 345 words 10:05 PM Type here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts