Question: I need help with this capital allocation exercise. Please help. Only the literal e. It is a continuous exercise, for that I have to post

I need help with this capital allocation exercise. Please help. Only the literal e.

It is a continuous exercise, for that I have to post all the literals for better understanding

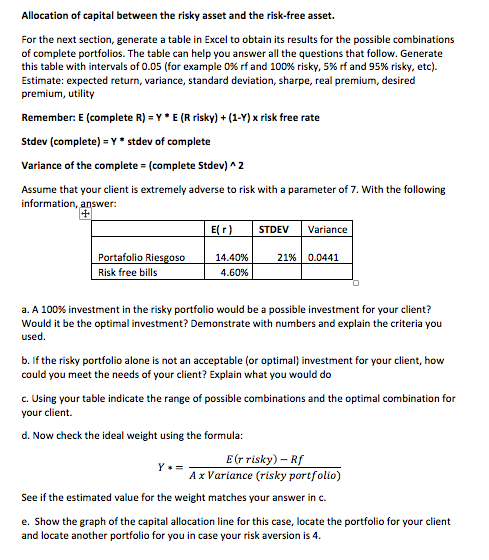

Allocation of capital between the risky asset and the risk-free asset. For the next section, generate a table in Excel to obtain its results for the possible combinations of complete portfolios. The table can help you answer all the questions that follow. Generate this table with intervals of 0.05 (for example 0% rf and 100% risky, 5% rf and 95% risky, etc). Estimate: expected return, variance, standard deviation, sharpe, real premium, desired premium, utility Remember: E (complete R) Y E (R risky)(1-Y) x risk free rate Stdev (complete) Ystdev of complete variance of the complete-(complete Stdev) ^ 2 Assume that your client is extremely adverse to risk with a parameter of 7. With the following information, answer STDEV Variance Portafolio Rie Risk free bills 14.40% 4.60% 21% | 0.0441 a. A 100% investment in the risky portfolio would be a possible investment for your client? Would it be the optimal investment? Demonstrate with numbers and explain the criteria you used b. If the risky portfolio alone is not an acceptable (or optimal) investment for your client, how could you meet the needs of your client? Explain what you would do c. Using your table indicate the range of possible combinations and the optimal combination for your client. d. Now check the ideal weight using the formula: E(rrisky)-Rf A x Variance (risky portfolio) See if the estimated value for the weight matches your answer in c. e. Show the graph of the capital allocation line for this case, locate the portfolio for your client and locate another portfolio for you in case your risk aversion is 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts