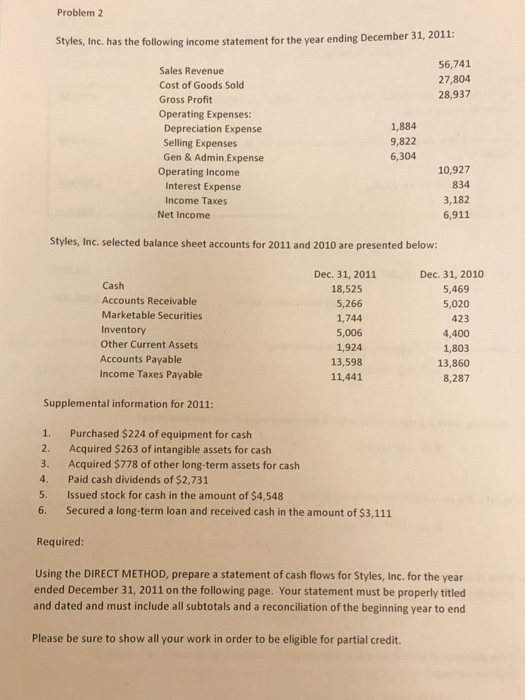

Question: I need help with this cashflow statement Problem 2 Styles, Inc. has the following income statement for the year ending December 31, 2011: 56,741 27,804

Problem 2 Styles, Inc. has the following income statement for the year ending December 31, 2011: 56,741 27,804 28,937 1,884 Sales Revenue Cost of Goods Sold Gross Profit Operating Expenses: Depreciation Expense Selling Expenses Gen & Admin Expense Operating Income Interest Expense Income Taxes Net Income 9,822 6,304 10,927 834 3,182 6,911 Styles, Inc. selected balance sheet accounts for 2011 and 2010 are presented below: Cash Accounts Receivable Marketable Securities Inventory Other Current Assets Accounts Payable Income Taxes Payable Dec 31, 2011 18,525 5,266 1,744 5,006 1,924 13,598 11,441 Dec. 31, 2010 5,469 5,020 423 4,400 1,803 13,860 8,287 Supplemental information for 2011: 2. 3. 4. 5. 6. Purchased $224 of equipment for cash Acquired $263 of intangible assets for cash Acquired $778 of other long-term assets for cash Paid cash dividends of $2,731 Issued stock for cash in the amount of $4,548 Secured a long-term loan and received cash in the amount of $3,111 Required: Using the DIRECT METHOD, prepare a statement of cash flows for Styles, Inc. for the year ended December 31, 2011 on the following page. Your statement must be properly titled and dated and must include all subtotals and a reconciliation of the beginning vear to end case be sure to show all your work in order to be eligible for partial credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts