Question: I need help with this exercise please, thank you! 6. Analysis of a replacement project Consider the case of Johnson Company: The managers of Johnson

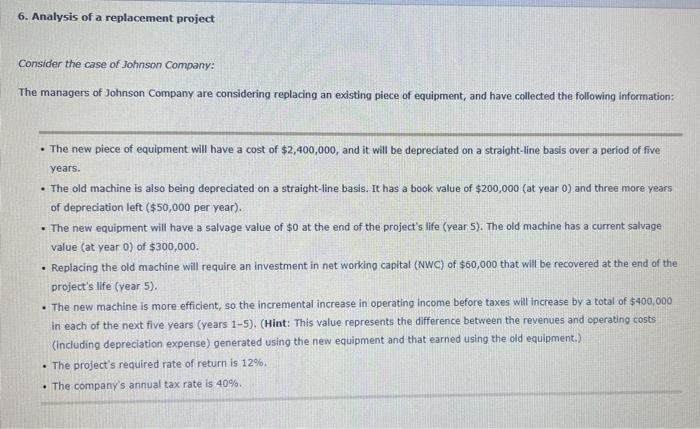

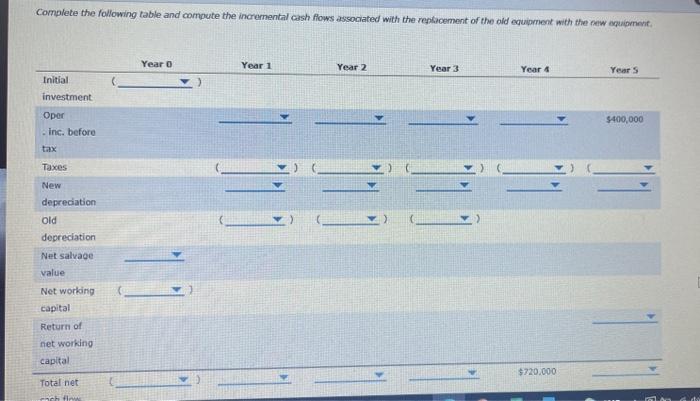

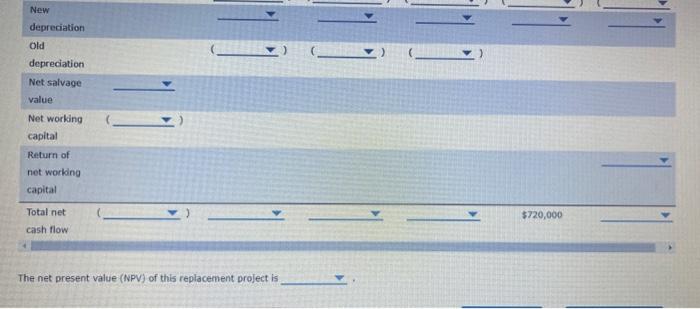

6. Analysis of a replacement project Consider the case of Johnson Company: The managers of Johnson Company are considering replacing an existing piece of equipment, and have collected the following information: The new piece of equipment will have a cost of $2,400,000, and it will be depreciated on a straight-line basis over a period of five years. The old machine is also being depreciated on a straight-line basis. It has a book value of $200,000 (at year 0) and three more years of depreciation left ($50,000 per year). The new equipment will have a salvage value of $o at the end of the project's life (year 5). The old machine has a current salvage value (at year 0) of $300,000. Replacing the old machine will require an investment in net working capital (NWC) of $60,000 that will be recovered at the end of the project's life (year 5). The new machine is more efficient, so the incremental increase in operating Income before taxes will increase by a total of $400,000 in each of the next five years (years 1-5). (Hint: This value represents the difference between the revenues and operating costs (including depreciation expense) generated using the new equipment and that earned using the old equipment.) The project's required rate of return is 12% The company's annual tax rate is 40% Complete the following table and compute the incremental cash flows associated with the replacement of the old equipment with the new querit. Year o Year 1 Year 2 Year 3 Year 4 Years Initial investment Oper inc. before $400,000 tax Taxes New depreciation Old depreciation Net salvage value Net working capital Return of net working capital $720.000 Total net New depreciation Old depreciation Net salvage value Networking capital Return of net worldng capital Total net cash flow $720,000 The net present value (NPV) of this replacement project is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts