Question: I need help with this finance problem, please dont get it wrong! Free Cash Flow Valuation Dozier Corporation is a fast - growing supplier of

I need help with this finance problem, please dont get it wrong!

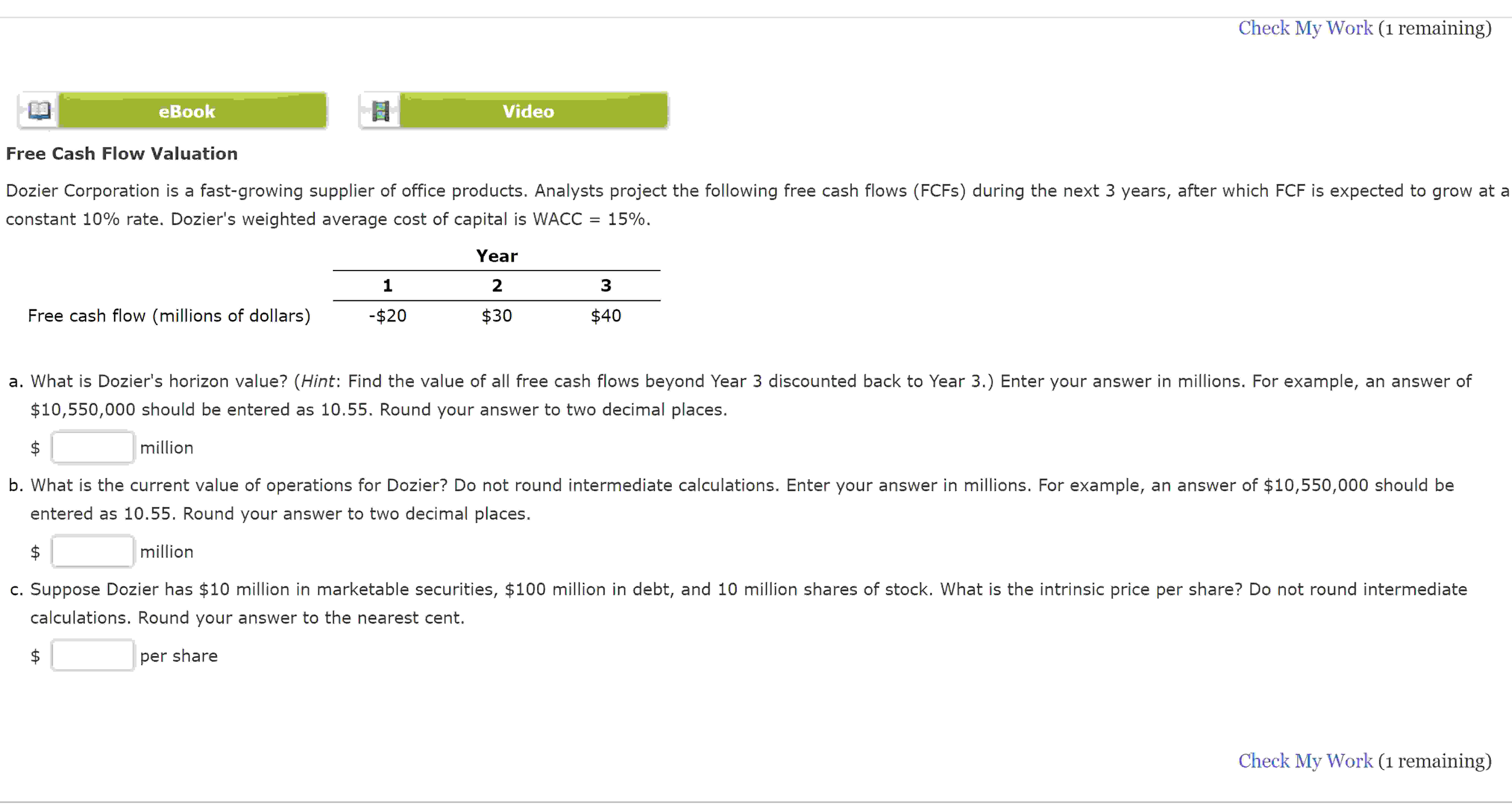

Free Cash Flow Valuation

Dozier Corporation is a fastgrowing supplier of office products. Analysts project the following free cash flows FCFs during the next years, after which FCF is expected to grow at a

constant rate. Dozier's weighted average cost of capital is WACC

a What is Dozier's horizon value? Hint: Find the value of all free cash flows beyond Year discounted back to Year Enter your answer in millions. For example, an answer of

$ should be entered as Round your answer to two decimal places.

$ million

b What is the current value of operations for Dozier? Do not round intermediate calculations. Enter your answer in millions. For example, an answer of $ should be

entered as Round your answer to two decimal places.

$ million

c Suppose Dozier has $ million in marketable securities $ million in debt, and million shares of stock. What is the intrinsic price per share? Do not round intermediate

calculations. Round your answer to the nearest cent.

$ per shar

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock