Question: I need help with this homework problem. 11:22 AM Fri Feb 28 3-04-WYOMING+Corporation+%28Flows%2C+job+ + A ... The following information comes from the accounting records of

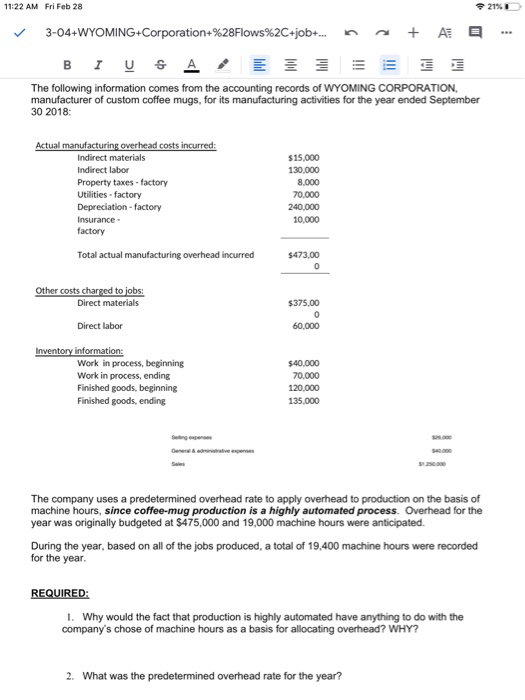

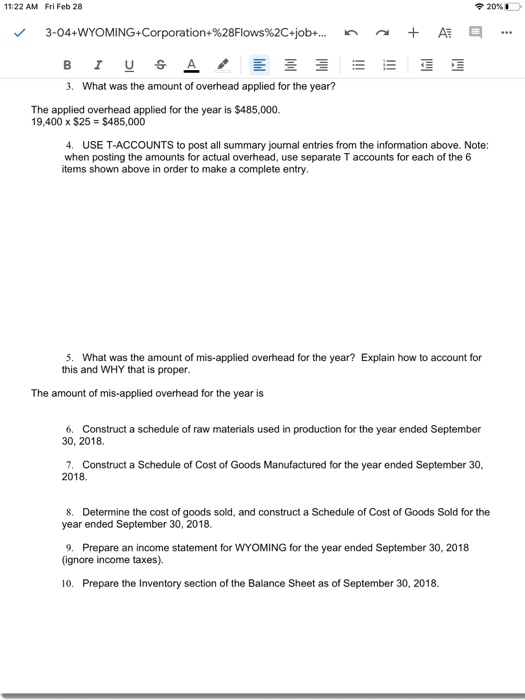

11:22 AM Fri Feb 28 3-04-WYOMING+Corporation+%28Flows%2C+job+ + A ... The following information comes from the accounting records of WYOMING CORPORATION manufacturer of custom coffee mugs, for its manufacturing activities for the year ended September 30 2018: Actual manufacturing overhead costs incurred: Indirect materials Indirect labor Property taxes - factory Utilities - factory Depreciation - factory Insurance factory $15.000 130,000 8.000 70,000 240.000 10,000 Total actual manufacturing overhead incurred $473,00 Other costs charged to jobs: Direct materials $375,00 0 60.000 Direct labor Inventory information: Work in process, beginning Work in process, ending Finished goods, beginning Finished goods, ending $40.000 70,000 120,000 135,000 The company uses a predetermined overhead rate to apply overhead to production on the basis of machine hours, since coffee-mug production is a highly automated process. Overhead for the year was originally budgeted at $475,000 and 19,000 machine hours were anticipated During the year, based on all of the jobs produced a total of 19.400 machine hours were recorded for the year REQUIRED 1. Why would the fact that production is highly automated have anything to do with the company's chose of machine hours as a basis for allocating overhead? WHY? 2. What was the predetermined overhead rate for the year? 11:22 AM Fri Feb 28 3-04+WYOMING+Corporation+%28Flows%2C+job+ 2010 .. + A 3. What was the amount of overhead applied for the year? The applied overhead applied for the year is $485.000 19,400 x $25 = $485,000 4. USE T-ACCOUNTS to post all summary journal entries from the information above. Note: when posting the amounts for actual overhead, use separate T accounts for each of the 6 items shown above in order to make a complete entry. 5. What was the amount of mis-applied overhead for the year? Explain how to account for this and WHY that is proper. The amount of mis-applied overhead for the year is 6. Construct a schedule of raw materials used in production for the year ended September 30, 2018 7. Construct a Schedule of Cost of Goods Manufactured for the year ended September 30, 2018 8. Determine the cost of goods sold, and construct a Schedule of Cost of Goods Sold for the year ended September 30, 2018 9. Prepare an income statement for WYOMING for the year ended September 30, 2018 (ignore income taxes). 10. Prepare the Inventory section of the Balance Sheet as of September 30, 2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts