Question: I need help with this homework problem. Can you please explain how to solve this? Thank you! The Ryan Express, a provider of tax services,

I need help with this homework problem. Can you please explain how to solve this? Thank you!

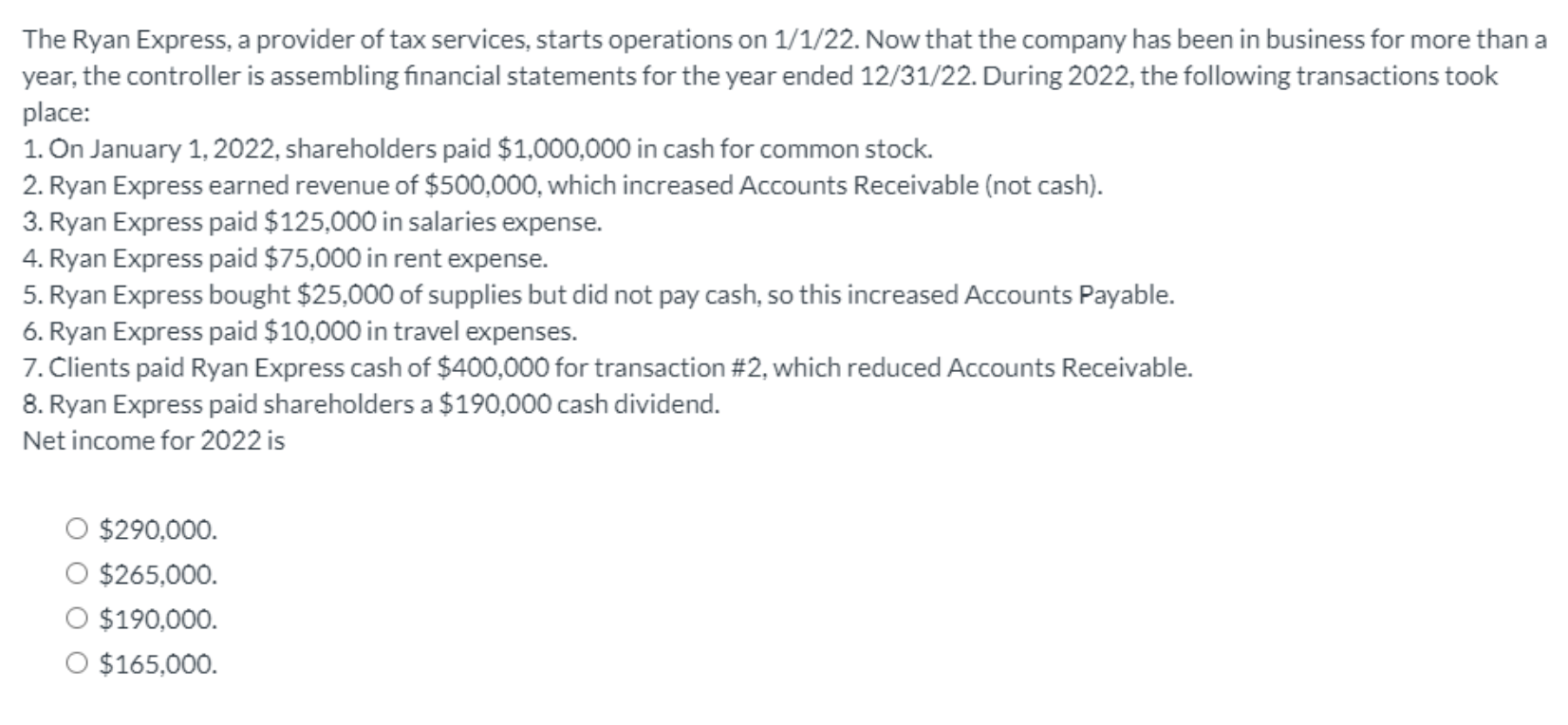

The Ryan Express, a provider of tax services, starts operations on 1/1/22. Now that the company has been in business for more than a year, the controller is assembling financial statements for the year ended 12/31/22. During 2022, the following transactions took place: 1. On January 1, 2022, shareholders paid $1,000,000 in cash for common stock. 2. Ryan Express earned revenue of $500,000, which increased Accounts Receivable (not cash). 3. Ryan Express paid $125,000 in salaries expense. 4. Ryan Express paid $75,000 in rent expense. 5. Ryan Express bought $25,000 of supplies but did not pay cash, so this increased Accounts Payable. 6. Ryan Express paid $10,000 in travel expenses. 7. Clients paid Ryan Express cash of $400,000 for transaction #2, which reduced Accounts Receivable. 8. Ryan Express paid shareholders a $190,000 cash dividend. Net income for 2022 is $290,000 $265,000. $190,000. O $165,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts