Question: I need help with this homework, the only options that I've to in the general journal are: account receivable, accumulated depreciation, building, cash, depreciation expensive,

I need help with this homework, the only options that I've to in the general journal are: account receivable, accumulated depreciation, building, cash, depreciation expensive, office supplies, prepaid insurance, rent revenue, salaries expensive, salaries payable, unearned revenue,

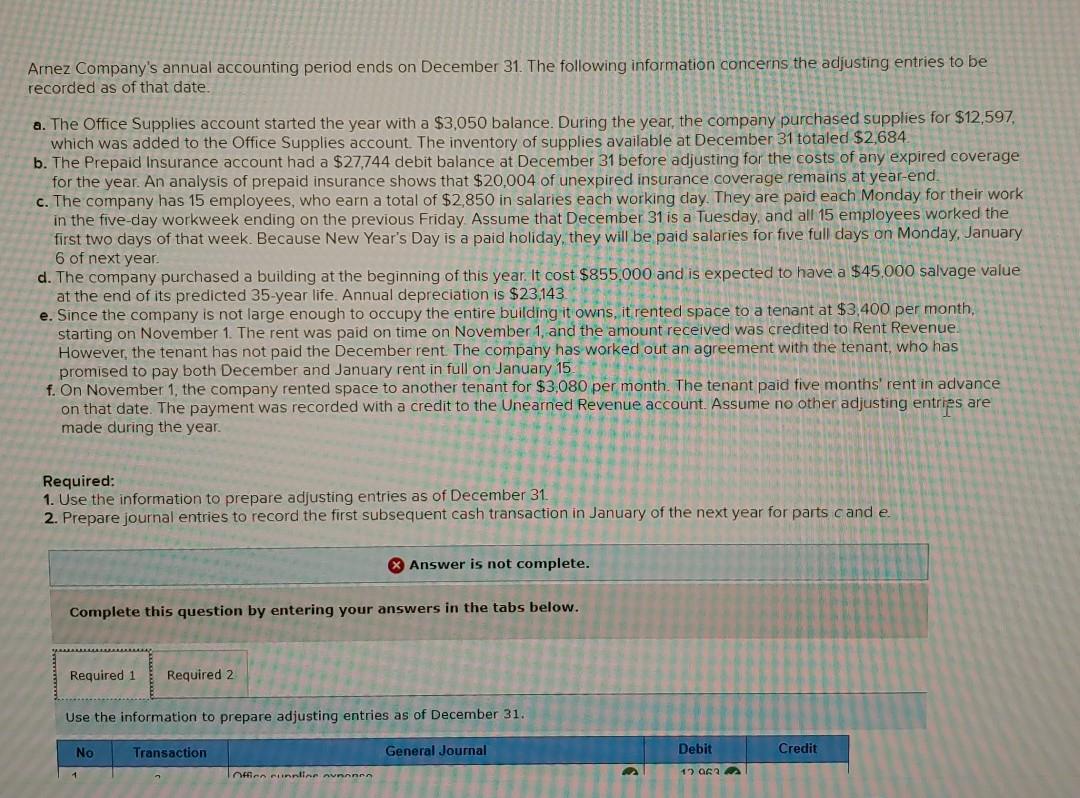

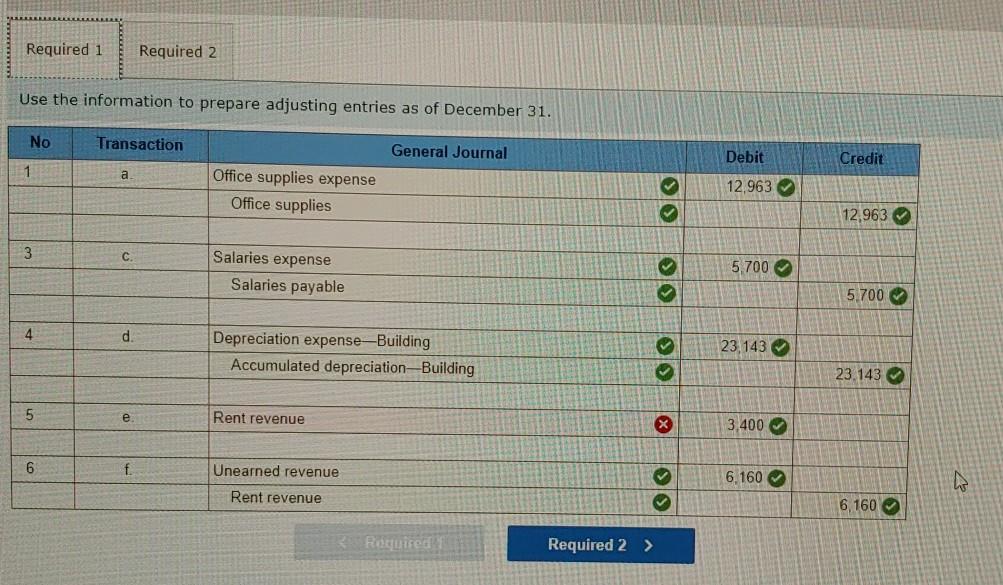

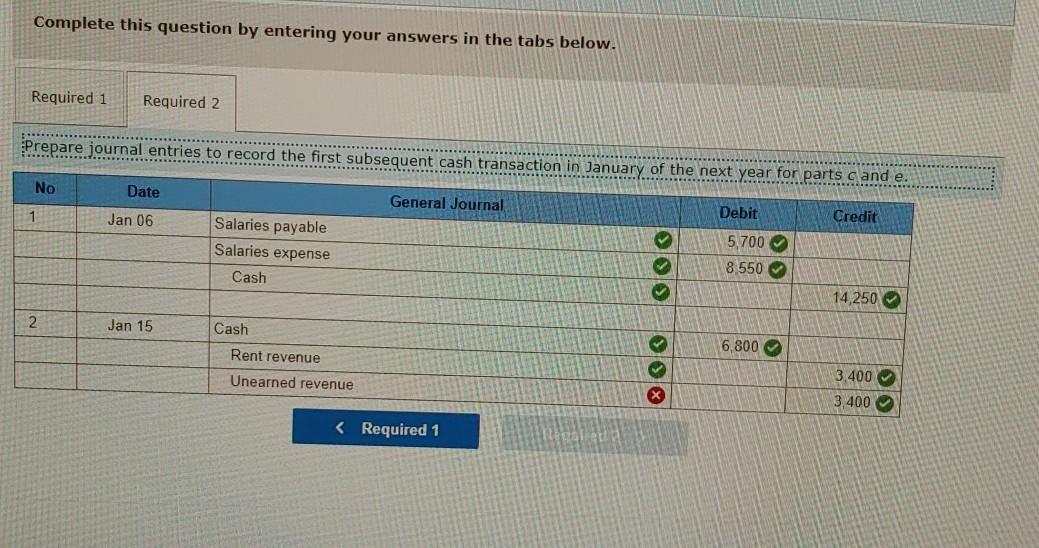

Arnez Company's annual accounting period ends on December 31. The following information concerns the adjusting entries to be recorded as of that date. a. The Office Supplies account started the year with a $3,050 balance. During the year, the company purchased supplies for $12,597, which was added to the Office Supplies account. The inventory of supplies available at December 31 totaled $2,684 b. The Prepaid Insurance account had a $27.744 debit balance at December 31 before adjusting for the costs of any expired coverage for the year. An analysis of prepaid insurance shows that $20,004 of unexpired insurance coverage remains at year-end c. The company has 15 employees, who earn a total of $2,850 in salaries each working day. They are paid each Monday for their work in the five-day workweek ending on the previous Friday. Assume that December 31 is a Tuesday, and all 15 employees worked the first two days of that week. Because New Year's Day is a paid holiday, they will be paid salaries for five full days on Monday, January 6 of next year. d. The company purchased a building at the beginning of this year. It cost $855.000 and is expected to have a $45,000 salvage value at the end of its predicted 35-year life. Annual depreciation is $23.143 e. Since the company is not large enough to occupy the entire building it owns, it rented space to a tenant at $3,400 per month starting on November 1. The rent was paid on time on November 1, and the amount received was credited to Rent Revenue. However, the tenant has not paid the December rent. The company has worked out an agreement with the tenant, who has promised to pay both December and January rent in full on January 15 f. On November 1, the company rented space to another tenant for $3,080 per month. The tenant paid five months' rent in advance on that date. The payment was recorded with a credit the Uneared Revenue account. Assume no other adjusting entries are made during the year. Required: 1. Use the information to prepare adjusting entries as of December 31 2. Prepare journal entries to record the first subsequent cash transaction in January of the next year for parts cand e. Answer is not complete. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Use the information to prepare adjusting entries as of December 31. No Transaction General Journal Debit Credit 1 Office runninn nunnnnn 17 Required 1 Required 2 Use the information to prepare adjusting entries as of December 31. No Transaction General Journal Debit Credit 1 a Office supplies expense Office supplies 12,963 12,963 3 C Salaries expense Salaries payable 5,700 5700 4 d Depreciation expense-Building Accumulated depreciation-Building 23.143 23.143 5 e Rent revenue X 3,400 6 Unearned revenue 6.160 Rent revenue 6,160 Rietuired Required 2 > Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare journal entries to record the first subsequent cash transaction in January of the next year for parts c and e. No Date General Journal 1 Jan 06 Debit Credit Salaries payable Salaries expense 5,700 8.550 Cash 14,250 2 Jan 15 6,800 Cash Rent revenue Unearned revenue 3.400 3,400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts