Question: I need help with this I You are the manager for a $100 million portfolio, which may be invested in any combination of Asian stocks

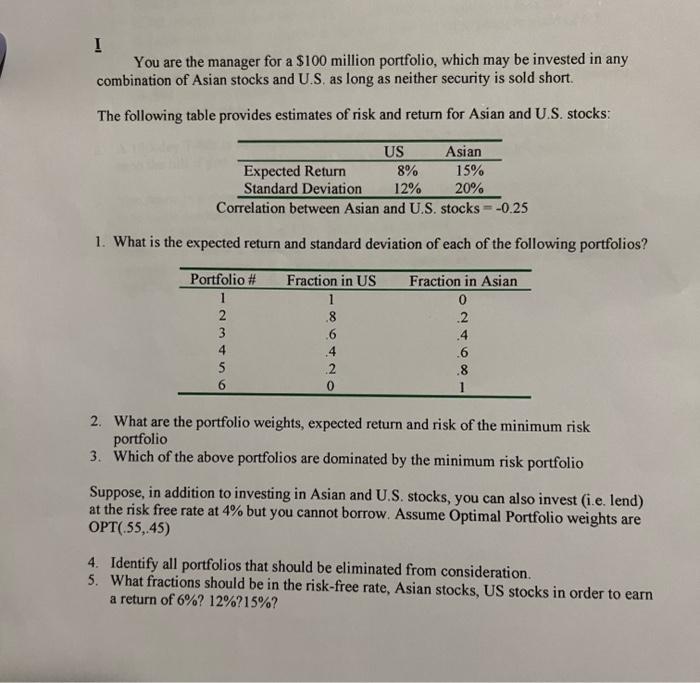

I You are the manager for a $100 million portfolio, which may be invested in any combination of Asian stocks and U.S. as long as neither security is sold short. The following table provides estimates of risk and return for Asian and U.S. stocks: US Asian Expected Return 8% 15% Standard Deviation 12% 20% Correlation between Asian and U.S. stocks = -0.25 1. What is the expected return and standard deviation of each of the following portfolios? Portfolio # 1 2 3 4 5 6 Fraction in US 1 .8 .6 4 2 0 Fraction in Asian 0 .2 .4 o C .8 1 2. What are the portfolio weights, expected return and risk of the minimum risk portfolio 3. Which of the above portfolios are dominated by the minimum risk portfolio Suppose, in addition to investing in Asian and U.S. stocks, you can also invest i.e. lend) at the risk free rate at 4% but you cannot borrow. Assume Optimal Portfolio weights are OPT(.55.45) 4. Identify all portfolios that should be eliminated from consideration 5. What fractions should be in the risk-free rate, Asian stocks, US stocks in order to earn a return of 6%? 12%?15%? I You are the manager for a $100 million portfolio, which may be invested in any combination of Asian stocks and U.S. as long as neither security is sold short. The following table provides estimates of risk and return for Asian and U.S. stocks: US Asian Expected Return 8% 15% Standard Deviation 12% 20% Correlation between Asian and U.S. stocks = -0.25 1. What is the expected return and standard deviation of each of the following portfolios? Portfolio # 1 2 3 4 5 6 Fraction in US 1 .8 .6 4 2 0 Fraction in Asian 0 .2 .4 o C .8 1 2. What are the portfolio weights, expected return and risk of the minimum risk portfolio 3. Which of the above portfolios are dominated by the minimum risk portfolio Suppose, in addition to investing in Asian and U.S. stocks, you can also invest i.e. lend) at the risk free rate at 4% but you cannot borrow. Assume Optimal Portfolio weights are OPT(.55.45) 4. Identify all portfolios that should be eliminated from consideration 5. What fractions should be in the risk-free rate, Asian stocks, US stocks in order to earn a return of 6%? 12%?15%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts