Question: I need help with this NPV calculation please: First , How did they arrive at the numbers in the column titled Discount Rate @ 6%

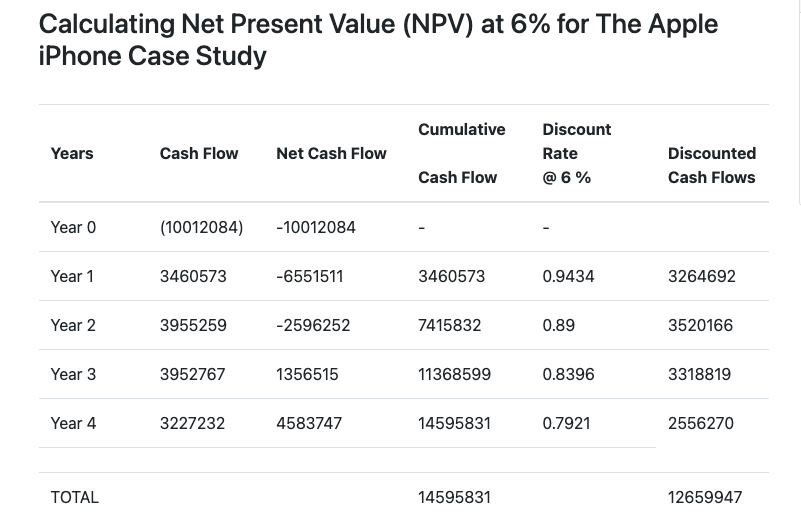

I need help with this NPV calculation please: First, How did they arrive at the numbers in the column titled "Discount Rate @ 6%" I can't figure out the formula they used. Second, are these cash flows or others used in npv calculations all estimated? Like if I wanted to do an NPV calculation on a company, how would I get these numbers? Third, What is the purpose of Net cash flow and cumulative cash flow? I usually only see the discounted cash flow in other npv calculations. Fourth, how come there is no PV column on there? Thank you so much.

My topic is about how npv uses valuations of present values of a stream of income to discount to todays dollars

Calculating Net Present Value (NPV) at 6% for The Apple iPhone Case Study Cumulative Years Cash Flow Net Cash Flow Discount Rate @ 6% Discounted Cash Flows Cash Flow Year 0 (10012084) -10012084 Year 1 3460573 -6551511 3460573 0.9434 3264692 Year 2 3955259 -2596252 7415832 0.89 3520166 Year 3 3952767 1356515 11368599 0.8396 3318819 Year 4 3227232 4583747 14595831 0.7921 2556270 TOTAL 14595831 12659947

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts