Question: I need help with this please label like 1.A for example thats all i need A-E just tell me what it is Yea i need

I need help with this please label like 1.A for example thats all i need A-E just tell me what it is Yea i need answers

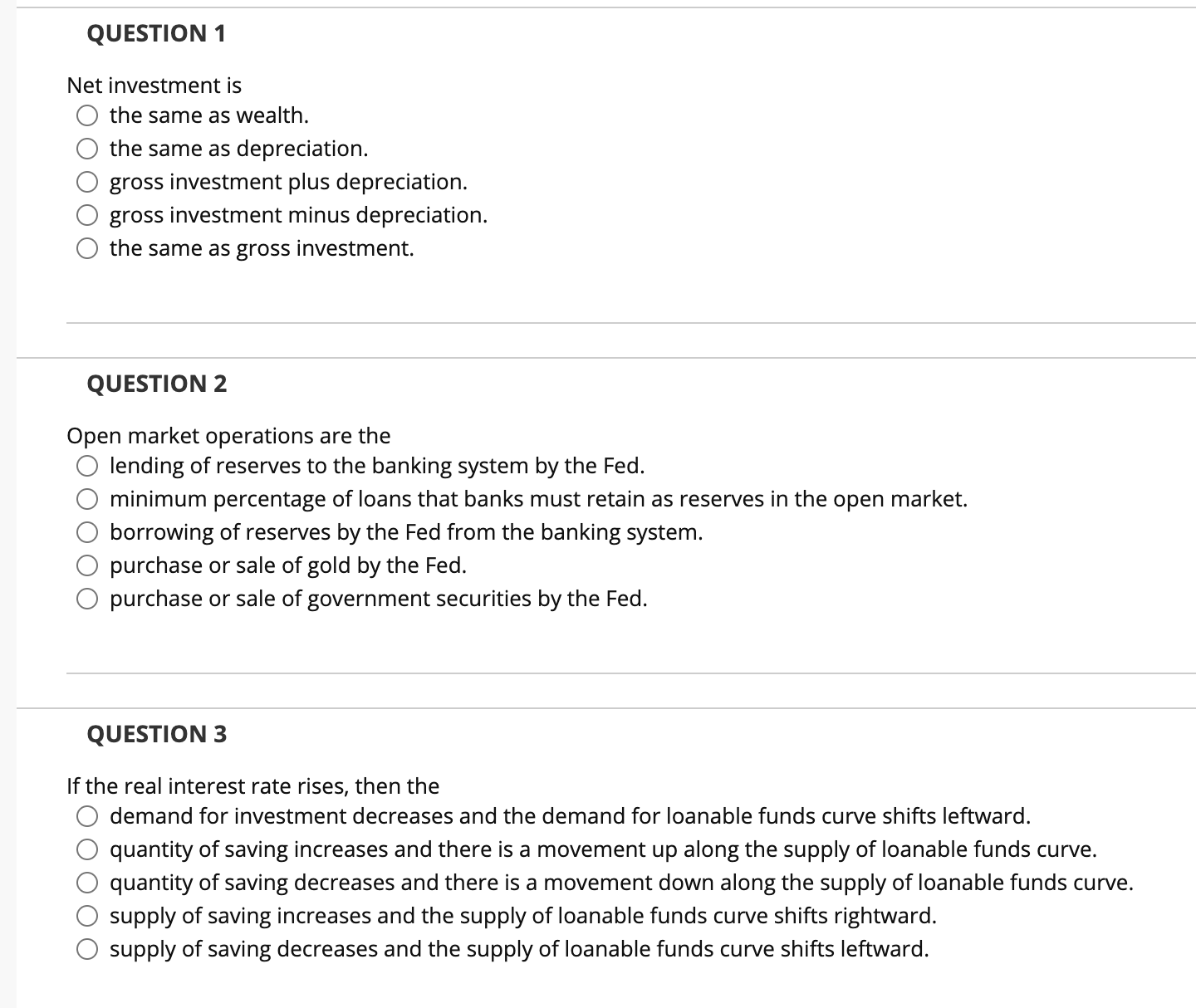

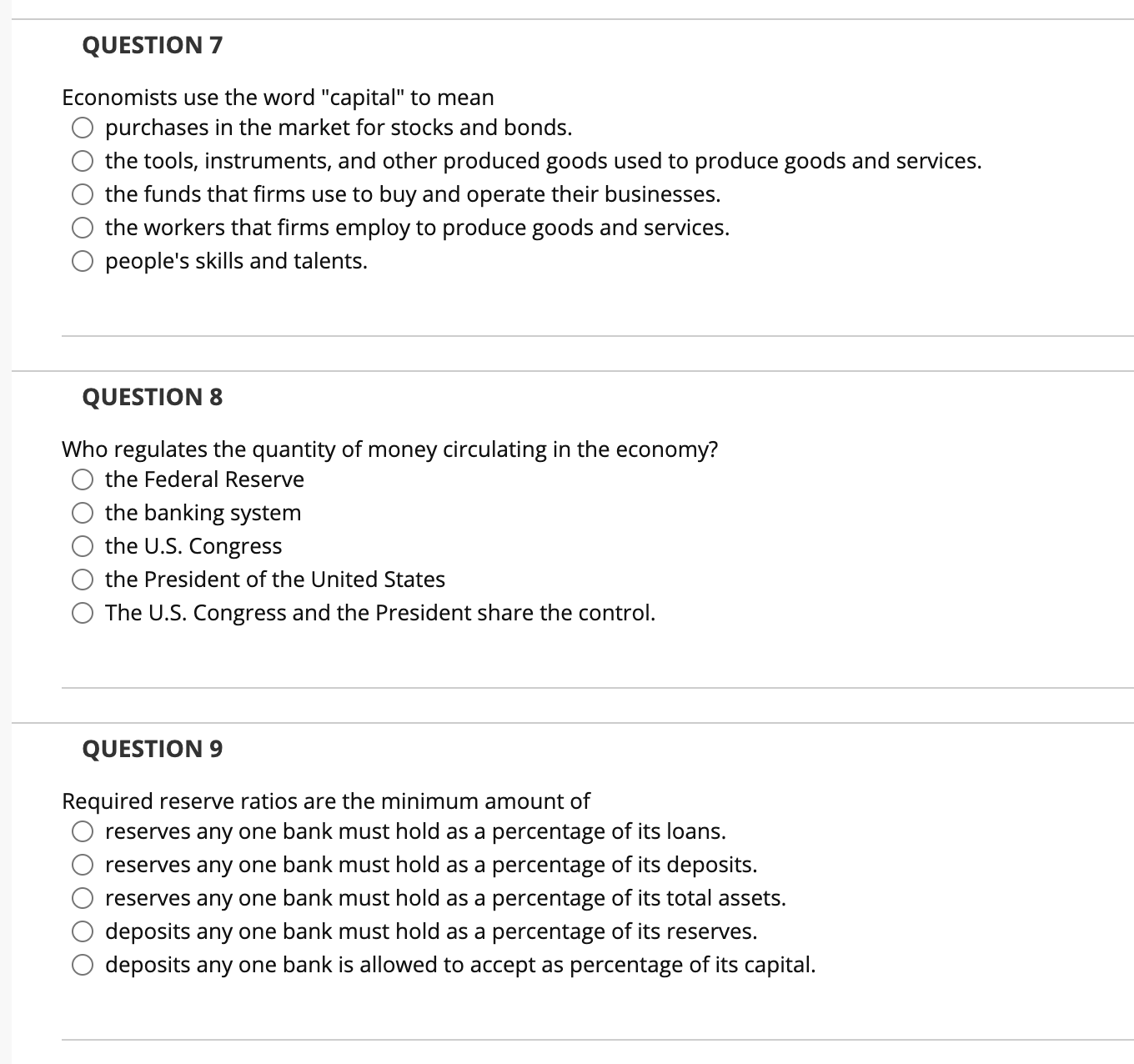

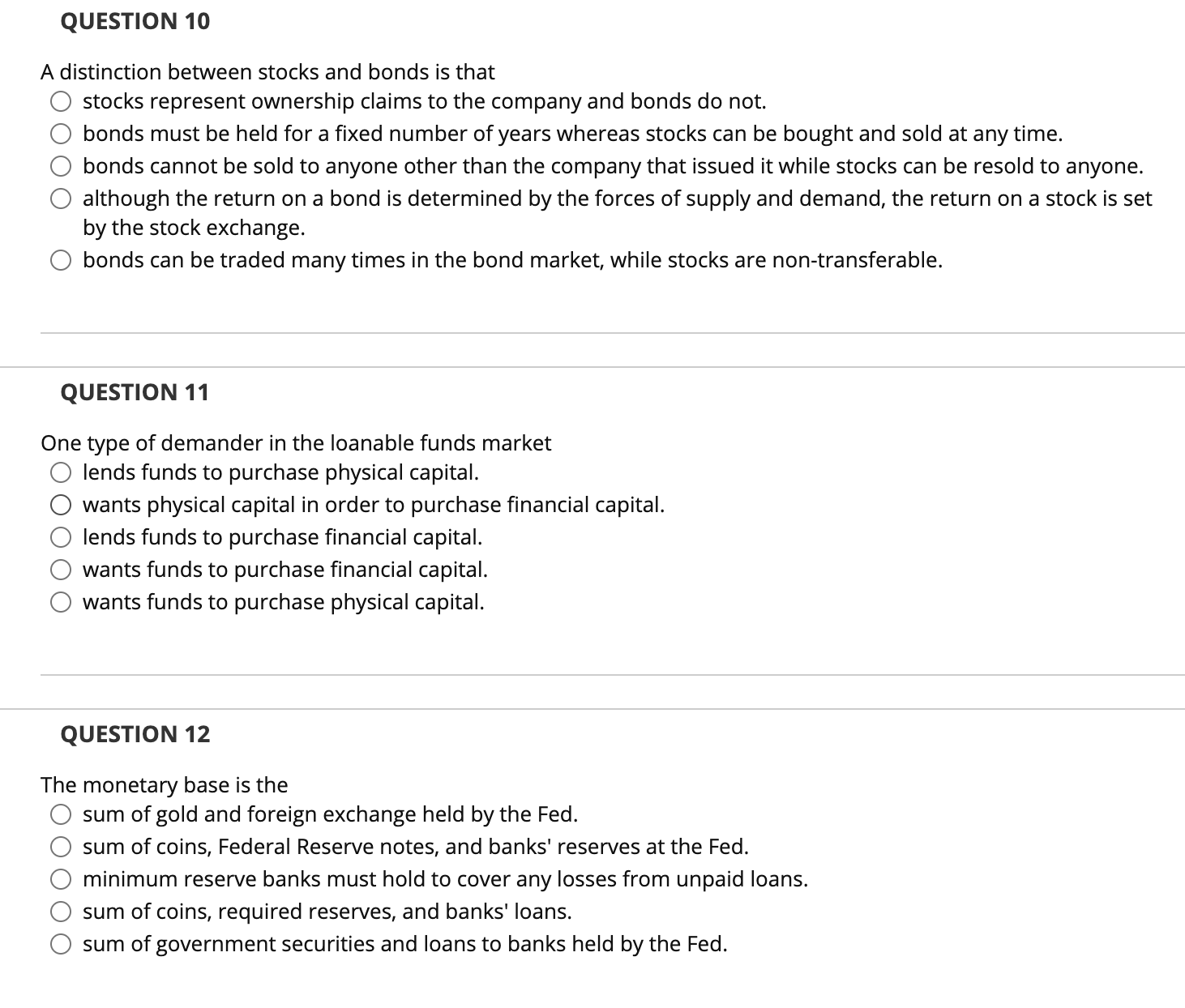

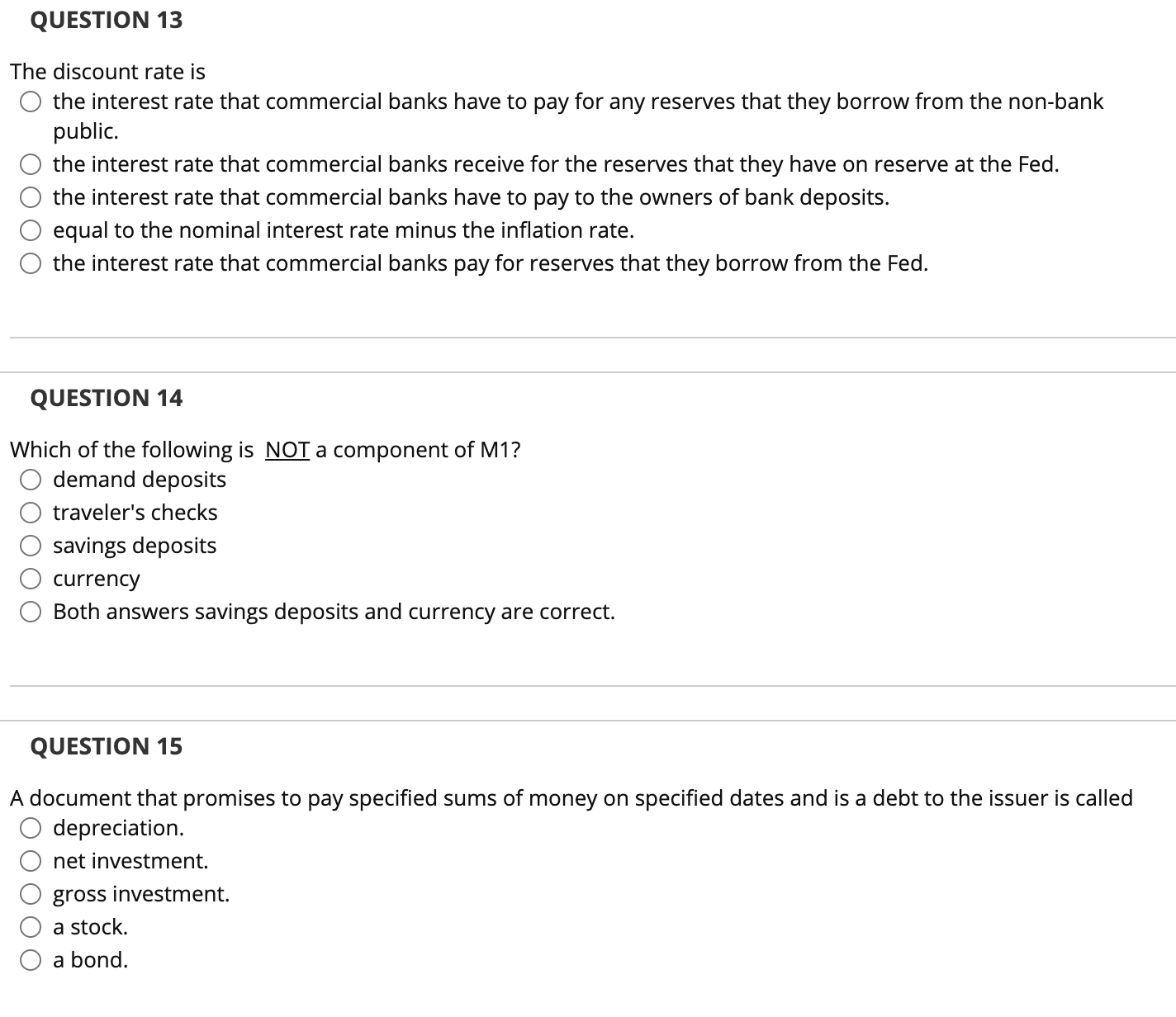

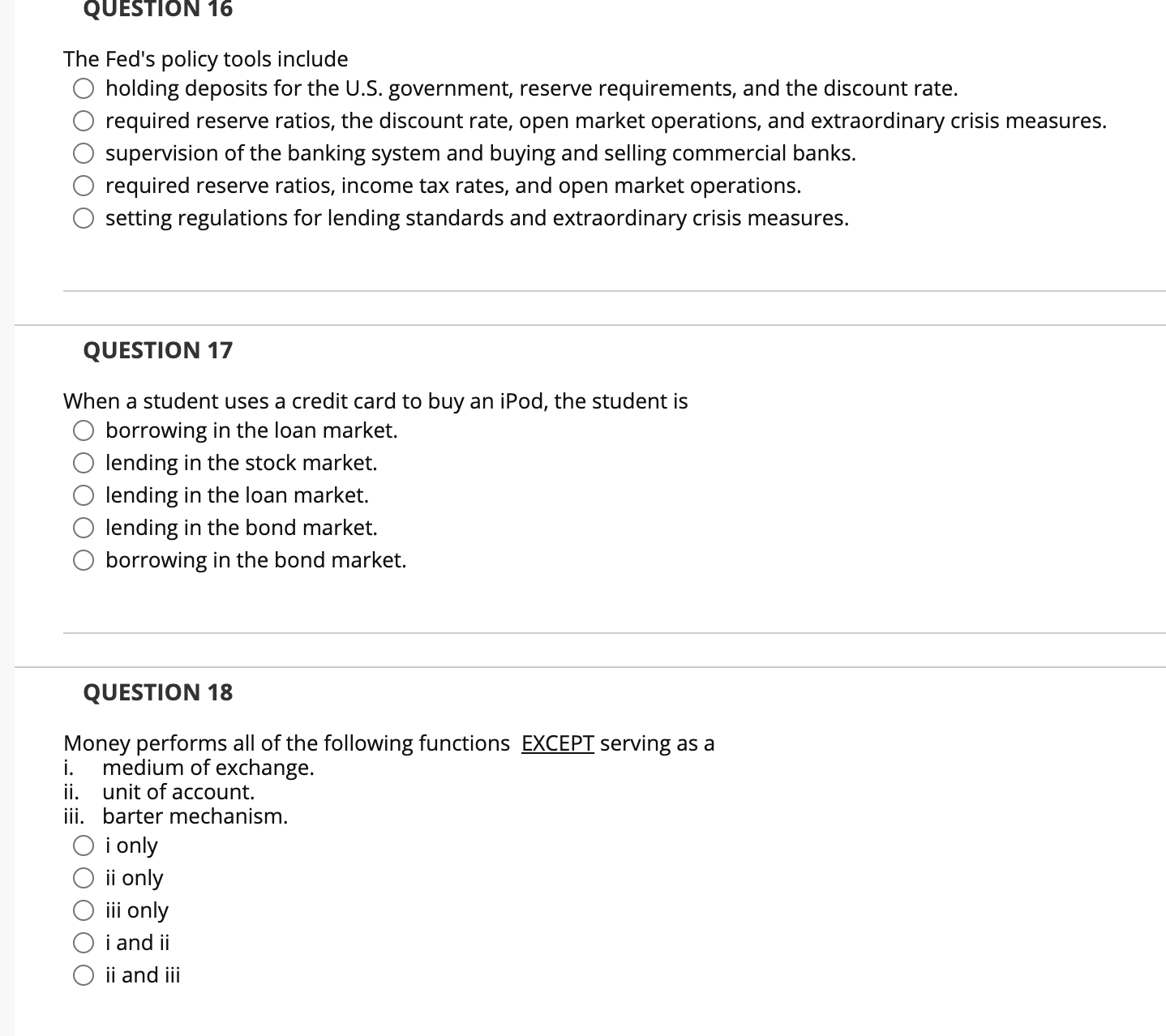

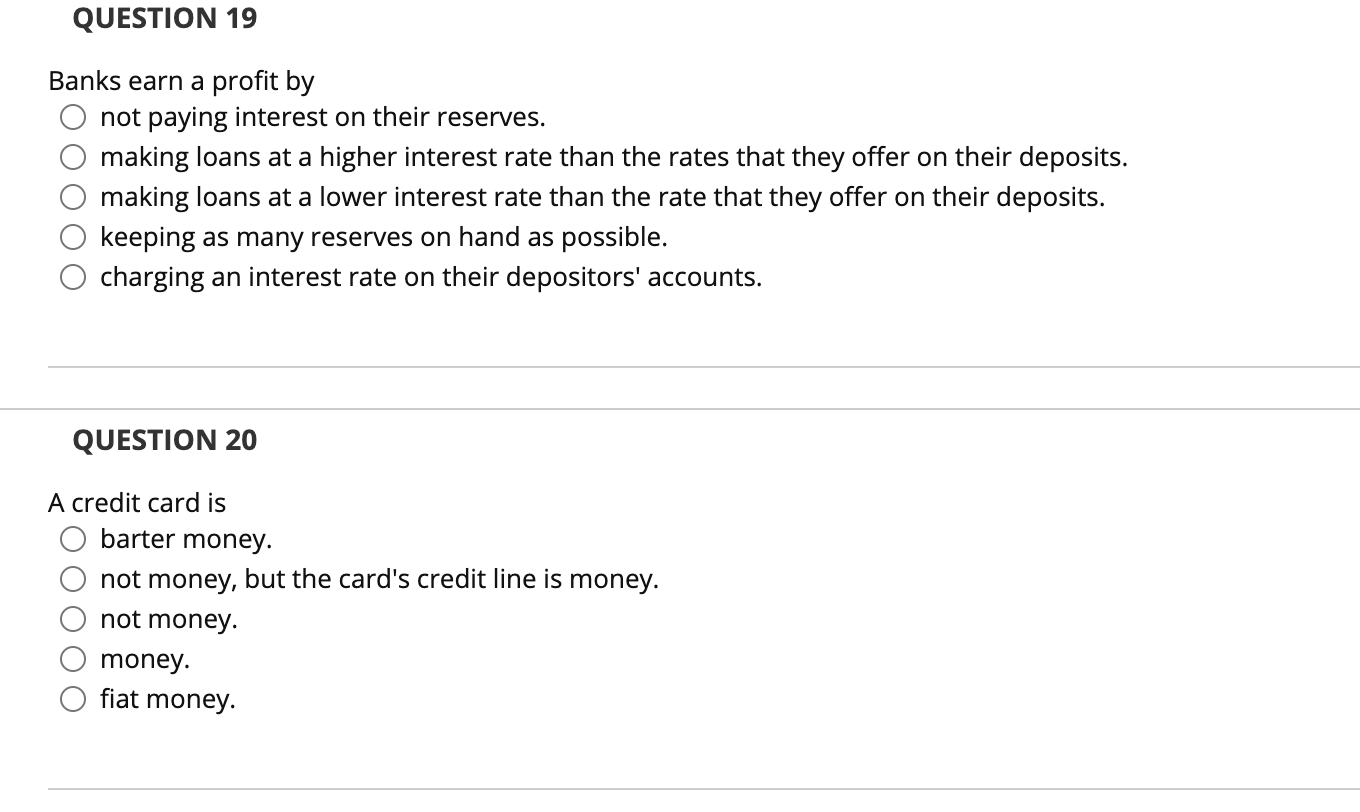

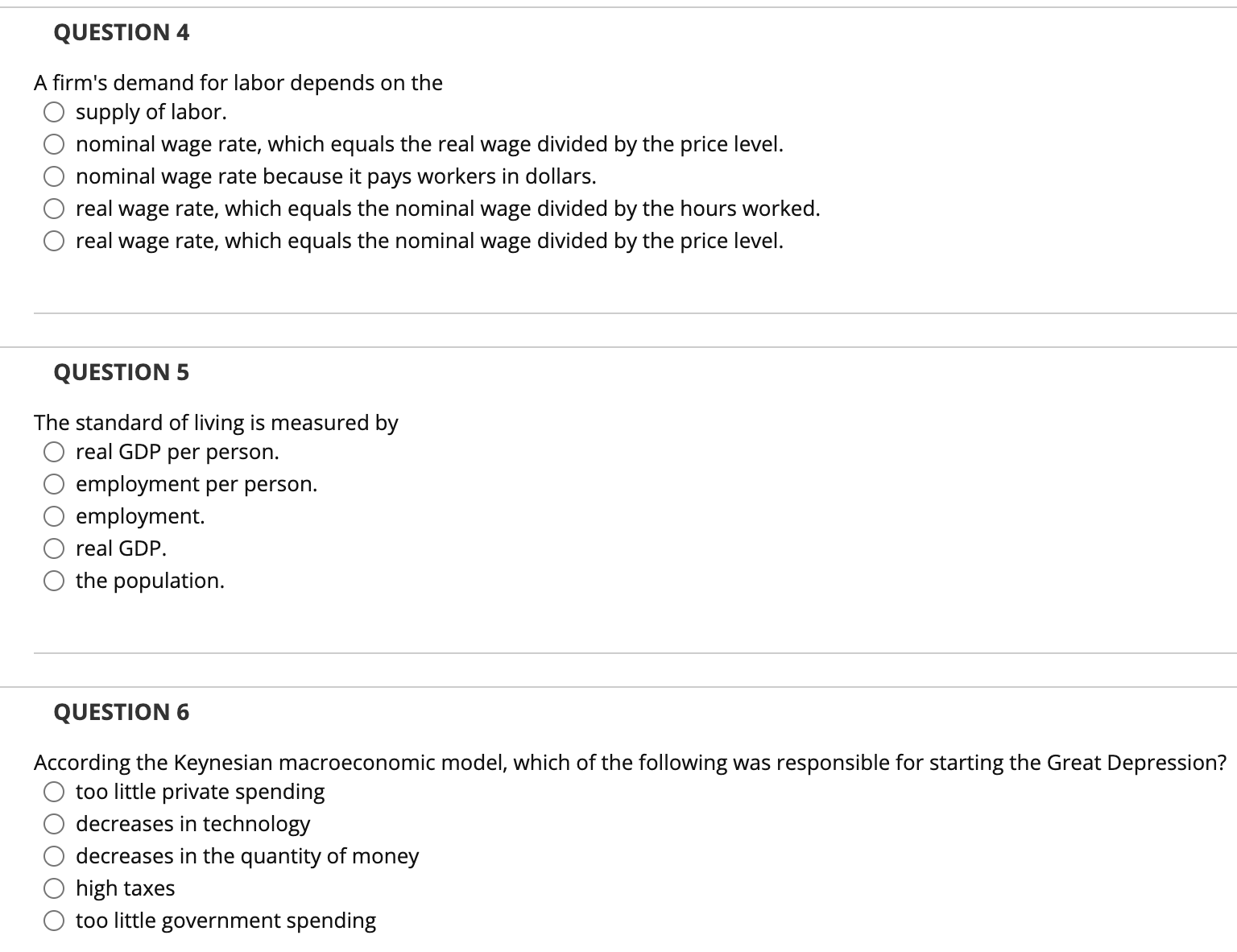

QUESTION 1 Net investment is O the same as wealth. O the same as depreciation. 0 gross investment plus depreciation. 0 gross investment minus depreciation. O the same as gross investment. QUESTION 2 Open market operations are the O lending of reserves to the banking system by the Fed. 0 minimum percentage of loans that banks must retain as reserves in the open market. 0 borrowing of reserves by the Fed from the banking system. 0 purchase or sale of gold by the Fed. 0 purchase or sale of government securities by the Fed. QUESTION 3 If the real interest rate rises, then the O demand for investment decreases and the demand for loanable funds curve shifts leftward. 0 quantity of saving increases and there is a movement up along the supply of loanable funds curve. 0 quantity of saving decreases and there is a movement down along the supply of loanable funds curve. 0 supply of saving increases and the supply of loanable funds curve shifts rightward. 0 supply of saving decreases and the supply of loanable funds curve shifts leftward. QUESTION 7 Economists use the word "capital" to mean 0 purchases in the market for stocks and bonds. 0 the tools, instruments, and other produced goods used to produce goods and services. 0 the funds that rms use to buy and operate their businesses. 0 the workers that rms employ to produce goods and services. 0 people's skills and talents. QUESTION 8 Who regulates the quantity of money circulating in the economy? 0 the Federal Reserve 0 the banking system Q the U.S. Congress 0 the President of the United States 0 The US Congress and the President share the control. QUESTION 9 Required reserve ratios are the minimum amount of 0 reserves any one bank must hold as a percentage of its loans. 0 reserves any one bank must hold as a percentage of its deposits. 0 reserves any one bank must hold as a percentage of its total assets. 0 deposits any one bank must hold as a percentage of its reserves. 0 deposits any one bank is allowed to accept as percentage of its capital. QUESTION 10 A distinction between stocks and bonds is that O stocks represent ownership claims to the company and bonds do not. 0 bonds must be held for a fixed number of years whereas stocks can be bought and sold at any time. 0 bonds cannot be sold to anyone other than the company that issued it while stocks can be resold to anyone. 0 although the return on a bond is determined by the forces of supply and demand, the return on a stock is set by the stock exchange. 0 bonds can be traded many times in the bond market, while stocks are non-transferable. QUESTION 11 One type of demander in the loanable funds market 0 lends funds to purchase physical capital. 0 wants physical capital in order to purchase nancial capital. 0 lends funds to purchase nancial capital. 0 wants funds to purchase nancial capital. 0 wants funds to purchase physical capital. QUESTION 12 The monetary base is the 0 sum of gold and foreign exchange held by the Fed. 0 sum of coins, Federal Reserve notes, and banks' reserves at the Fed. 0 minimum reserve banks must hold to cover any losses from unpaid loans. 0 sum of coins, required reserves, and banks' loans. 0 sum of government securities and loans to banks held by the Fed. QUESTION 13 The discount rate is O the interest rate that commercial banks have to pay for any reserves that they borrow from the non-bank public. 0 the interest rate that commercial banks receive for the reserves that they have on reserve at the Fed. O the interest rate that commercial banks have to pay to the owners of bank deposits. 0 equal to the nominal interest rate minus the ination rate. Q the interest rate that commercial banks pay for reserves that they borrow from the Fed. QUESTION 14 Which of the following is NOT a component of M1? 0 demand deposits 0 traveler's checks 0 savings deposits 0 currency 0 Both answers savings deposits and currency are correct. QUESTION 15 A document that promises to pay specified sums of money on specied dates and is a debt to the issuer is called 0 depreciation. O netinvestment. 0 gross investment. 0 a stock. 0 a bond. QUESTION 16 The Fed's policy tools include 0 holding deposits for the U5. government, reserve requirements, and the discount rate. 0 required reserve ratios, the discount rate, open market operations, and extraordinary crisis measures. 0 supervision of the banking system and buying and selling commercial banks. 0 required reserve ratios, income tax rates, and open market operations. 0 setting regulations for lending standards and extraordinary crisis measures. QUESTION 17 When a student uses a credit card to buy an iPod, the student is O borrowing in the loan market. 0 lending in the stock market. 0 lending in the loan market. 0 lending in the bond market. 0 borrowing in the bond market. QUESTION 18 Money performs all of the following functions EXCEPT serving as a i. medium of exchange. ii. unit of account. iii. barter mechanism. 0 iand ii 0 ii and iii QUESTION 19 Banks earn a profit by 0 not paying interest on their reserves. 0 making loans at a higher interest rate than the rates that they offer on their deposits. 0 making loans at a lower interest rate than the rate that they offer on their deposits. 0 keeping as many reserves on hand as possible. 0 charging an interest rate on their depositors' accounts. QUESTION 20 A credit card is O barter money. 0 not money, but the card's credit line is money. 0 not money. 0 money. 0 fiat money. QUESTION 4 A firm's demand for labor depends on the 0 supply of labor. 0 nominal wage rate, which equals the real wage divided by the price level. 0 nominal wage rate because it pays workers in dollars. 0 real wage rate, which equals the nominal wage divided by the hours worked. 0 real wage rate, which equals the nominal wage divided by the price level. QUESTION 5 The standard of living is measured by 0 real GDP per person. 0 employment per person. 0 employment. 0 real GDP. 0 the population. QUESTION 6 According the Keynesian macroeconomic model, which of the following was responsible for starting the Great Depression? 0 too little private spending 0 decreases in technology 0 decreases in the quantity of money 0 high taxes 0 too little government spending

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts