Question: I need help with this please Learn Corp. (Ticker: LC), an education technology company, is considered to be one of the least risky companies in

I need help with this please

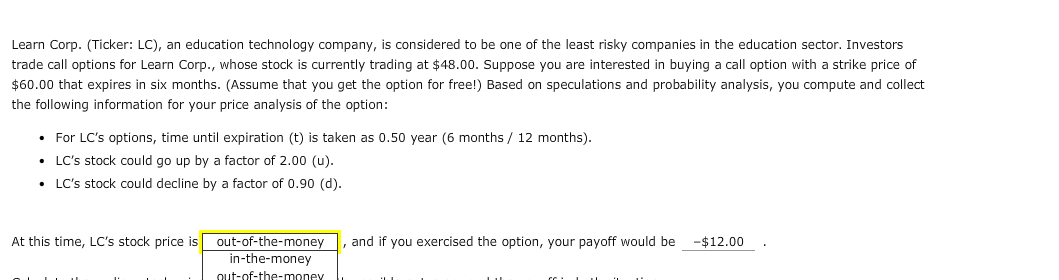

Learn Corp. (Ticker: LC), an education technology company, is considered to be one of the least risky companies in the education sector. Investors trade call options for Learn Corp., whose stock is currently trading at $48.00. Suppose you are interested in buying a call option with a strike price of $60.00 that expires in six months. (Assume that you get the option for free!) Based on speculations and probability analysis, you compute and collect the following information for your price analysis of the option: For LC's options, time until expiration (t) is taken as 0.50 year (6 months / 12 months). LC's stock could go up by a factor of 2.00 (u). LC's stock could decline by a factor of 0.90 (d). At this time, LC's stock price is , and if you exercised the option, your payoff would be -$12.00 . out-of-the-money in-the-money out-of-the-money Learn Corp. (Ticker: LC), an education technology company, is considered to be one of the least risky companies in the education sector. Investors trade call options for Learn Corp., whose stock is currently trading at $48.00. Suppose you are interested in buying a call option with a strike price of $60.00 that expires in six months. (Assume that you get the option for free!) Based on speculations and probability analysis, you compute and collect the following information for your price analysis of the option: For LC's options, time until expiration (t) is taken as 0.50 year (6 months / 12 months). LC's stock could go up by a factor of 2.00 (u). LC's stock could decline by a factor of 0.90 (d). At this time, LC's stock price is , and if you exercised the option, your payoff would be -$12.00 . out-of-the-money in-the-money out-of-the-money

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts