Question: I need help with this practice midterm question. I don't understand d) Question 2 (S points) Thatcher Corporation's bonds will mature in 10 years. It

I need help with this practice midterm question. I don't understand d)

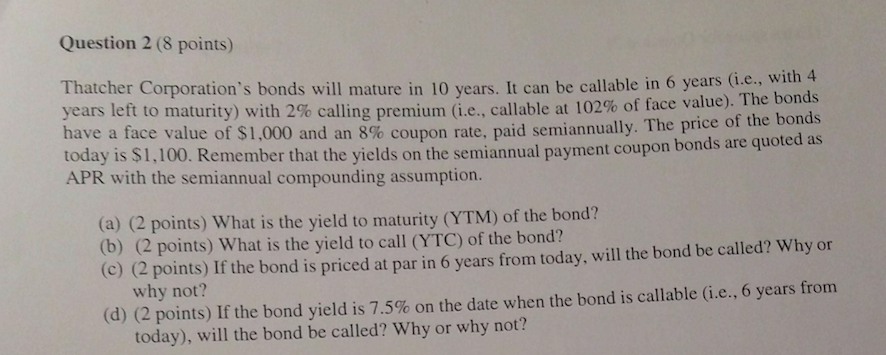

Question 2 (S points) Thatcher Corporation's bonds will mature in 10 years. It can be callable in 6 years (i.e., with 4 years left to maturity) with calling premium (i.e., callable at 102% of face value). The bonds have a face value of Sl.OOO and an coupon rate. paid semiannually. The price of the bonds today is S I , 100. Remember that the yields on the semiannual payment coupon bonds are quoted as APR with the semiannual compounding assumption. (a) (2 points) What is the yield to maturity (YTM) of the bond? (b) (2 points) What is the yield to call (YTC) of the bond? (c) (2 points) Ifthe bond is priced at par in 6 years from today, will the bond be called? Why or why not? (d) (2 points) If the bond yield is 7.5% on the date when the bond is callable (i.e.. 6 years from today), will the bond be called? Why or why not?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts