Question: i need help with this practice question. Transaction Analysis and Trial Balance Make T-accounts for the following accounts that appear in the general ledger of

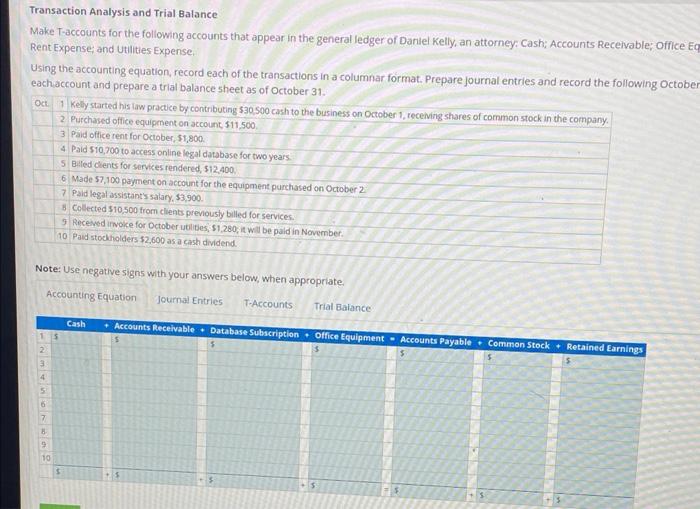

Transaction Analysis and Trial Balance Make T-accounts for the following accounts that appear in the general ledger of Daniel Kelly, an attorney: Cash; Accounts Receivable; Office Eq Rent Expense; and Utilities Expense. Using the accounting equation, record each of the transactions in a columnar format. Prepare journal entries and record the following October each account and prepare a trial balance sheet as of October 31. Oct. 1 Kelly started his law practice by contributing $30,500 cash to the business on October 1, receiving shares of common stock in the company. 2 Purchased office equipment on account, $11,500. 3 Paid office rent for October, $1,800. 4 Paid $10,700 to access online legal database for two years. 5 Billed clients for services rendered, $12,400. 6 Made $7,100 payment on account for the equipment purchased on October 2 Note: Use negative signs with your answers below, when appropriate. Accounting Equation Journal Entries T-Accounts Trial Balance 15 2 3 4 5 6 8. 9 7 Paid legal assistant's salary, $3,900. 8 Collected $10,500 from clients previously billed for services. 9 Received invoice for October utilities, $1,280, it will be paid in November. 10 Paid stockholders $2,600 as a cash dividend. 10 Cash + Accounts Receivable Database Subscription Office Equipment Accounts Payable Common Stock Retained Earnings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts