Question: I need help with this problem. Bradley's Appliance Store, a new business, had the following transactions during the month of May 2016. 1. Open the

I need help with this problem.

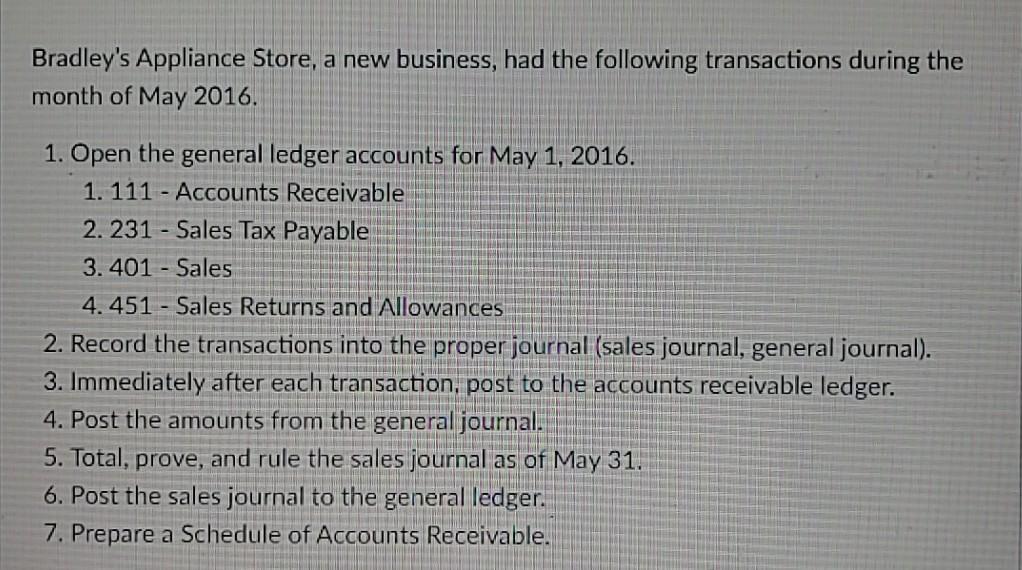

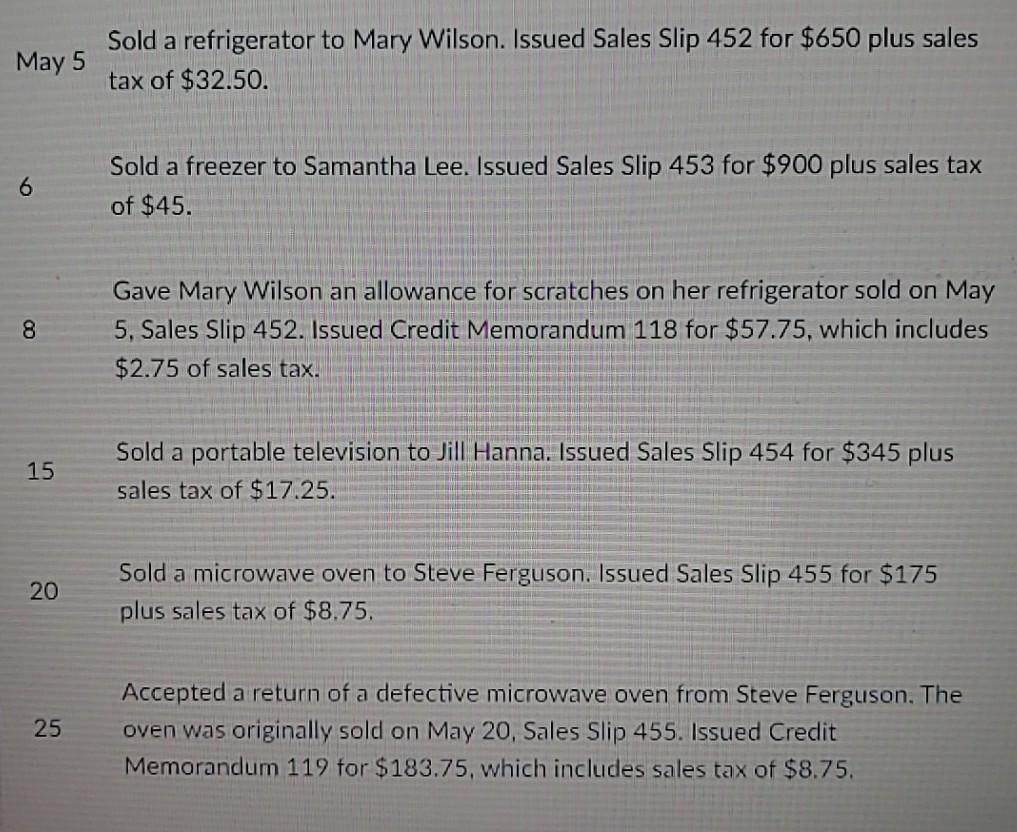

Bradley's Appliance Store, a new business, had the following transactions during the month of May 2016. 1. Open the general ledger accounts for May 1, 2016. 1. 111 - Accounts Receivable 2.231 - Sales Tax Payable 3. 401 - Sales 4.451 - Sales Returns and Allowances 2. Record the transactions into the proper journal (sales journal, general journal). 3. Immediately after each transaction, post to the accounts receivable ledger. 4. Post the amounts from the general journal. 5. Total, prove, and rule the sales journal as of May 31. 6. Post the sales journal to the general ledger. 7. Prepare a Schedule of Accounts Receivable. LA May 5 Sold a refrigerator to Mary Wilson. Issued Sales Slip 452 for $650 plus sales tax of $32.50. 6 Sold a freezer to Samantha Lee. Issued Sales Slip 453 for $900 plus sales tax of $45. 8 Gave Mary Wilson an allowance for scratches on her refrigerator sold on May 5, Sales Slip 452. Issued Credit Memorandum 118 for $57.75, which includes $2.75 of sales tax. 15 Sold a portable television to Jill Hanna. Issued Sales Slip 454 for $345 plus sales tax of $17.25. 20 Sold a microwave oven to Steve Ferguson. Issued Sales Slip 455 for $175 plus sales tax of $8.75. 25 Accepted a return of a defective microwave oven from Steve Ferguson. The oven was originally sold on May 20, Sales Slip 455. Issued Credit Memorandum 119 for $183.75, which includes sales tax of $8.75

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts