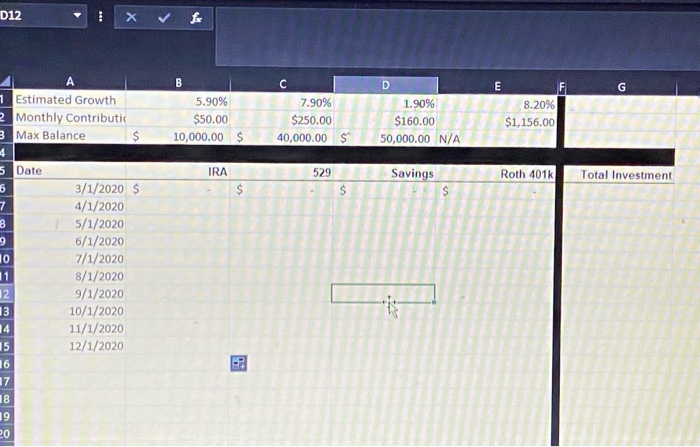

Question: i need help with this problem ill post the whole question down below. First photo is showing what needs to be answered Second phote is

012 X for 8.20% 1 Estimated Growth 2 Monthly Contributi 3 Max Balance 5.90% $50.00 10,000.00 7.90% $250.00 40,000.00 1.90% $160.00 50,000.00 N/A $1,156.00 $ $ $ 5 Date Savings Roth 401k Total Investment 3/1/2020 $ 4/1/2020 5/1/2020 6/1/2020 7/1/2020 8/1/2020 9/1/2020 10/1/2020 11/1/2020 12/1/2020 Estimated Growth Monthly Contributi S SL 156.00 a 10000 M $160.00 400000 5000000 NA Roth 2016 Total Investment 11/2005 4/1/2020 S 5/1/2020 6/1/2003 7/1/2020 $ 1/1/2020 9/1/2020 S 10/1/2020 $ 11/1/2020 $ 12/1/2020 $ 1/1/20215 2/1/2021 S 1/1/2021 S 4/1/2021 S 5/1/20215 6/1/2021 S 7/1/20215 3/1/2021 $ 9/1/20215 10/1/2021 $ 11/1/20215 12/1/2021 $ $0.00 $ 100.25 $ 150.74 201.48 252.47 $ 308.71 $ 355215 106.95 $ 458.95 $ 51121 563.72 $ 616.49 $ 152 $ 722.82 $ 77437 $ 810.19 $ 8:34.27 $ 918.62 $ 911 $ 1048125 1101275 250.00 $ 501.65 $ 744.95 $ 1,009.92 $ 1.966 57 5 1,524.91 $ 1,71445 2.046 20 S 2.110.175 2,575.18 2,142.33 $ 1,111.045 1.101.5) 5 3,650.705 1.127.145 4.200.20 4.401375 4,760.885 5,042.22 5,125.41 $ 810.47 $ 1600S 130 $ 48065 64152 S 802 54S 9631 1.125 135 1.287 125 1.849 15 1,611 45 $ 1,77400 1,936.815 2,099 S 2,263 20 $ 2,426.78 2 550 53 5 2.754.735 2.010.00 $ 3,083.71 $ 3.248 59 $ 3.413. 7 5 1156 00 2,319.90 3401.75 4.67161 5.1995 7.058 SE 8.259.79 9.4722 10.612 05 11,922.09 12.199.49 1440S 42 15.659.85 16,922.85 10.104.50 19.47.81 20,75191 22,061.80 21,368 55 24.63424 26.000 1.616.00 224704 487820 6 524.53 181.11 94800 11.525.27 12.212.99 14.11.23 16 620.06 16 319.55 20 089.76 21810.78 23.562.67 25 325.50 27.099.14 28.884.28 30.680.38 12.487.71 34.306.36 16 116.39 pmt situation not maxed out and no extra pay yes situation maxed out and no extra paymenino situation not maxed out and extra paymer yes situation maxed out and extra payment no pmt no no yes Yes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts