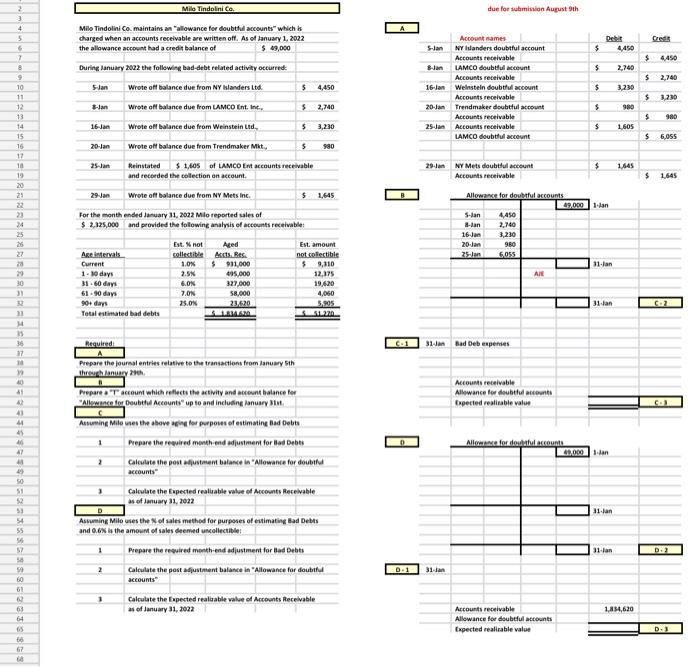

Question: i need help with this problem Milo Tindolini Co. Milo Tindolini Co. maintains an allowance for doubtful accounts which is charged when an accounts receivable

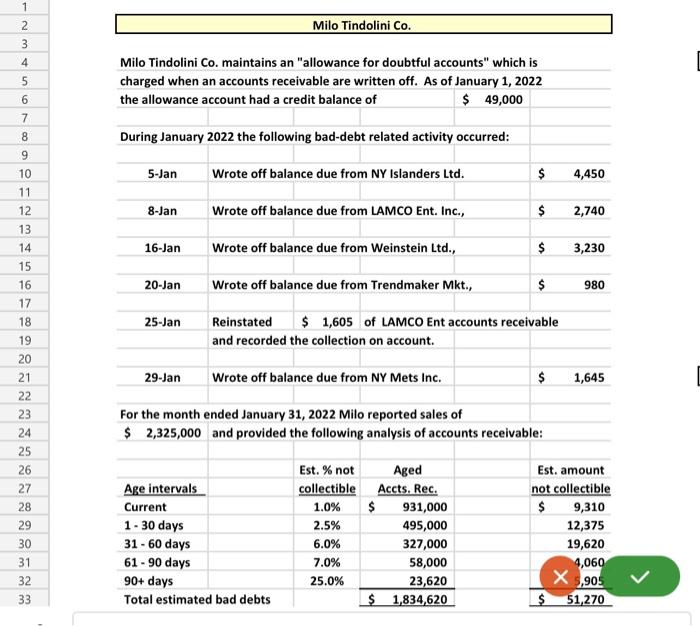

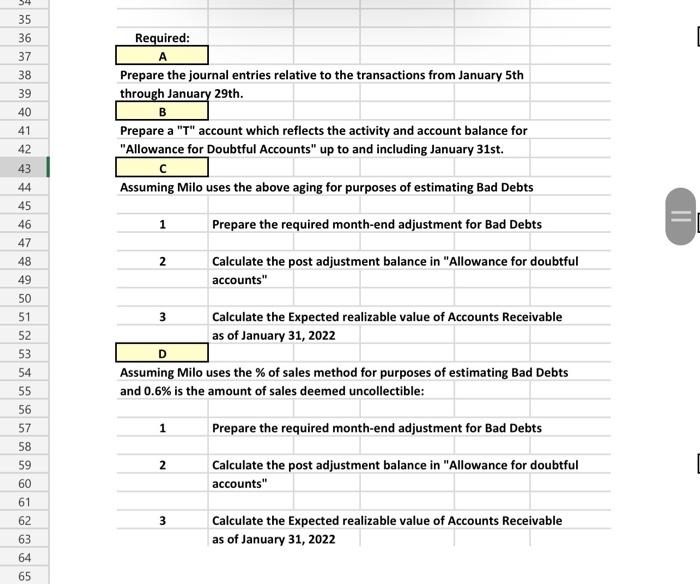

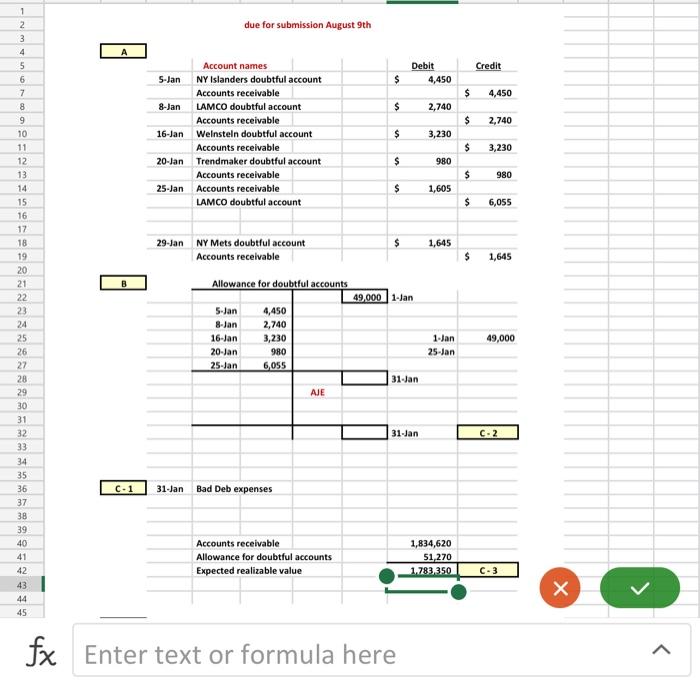

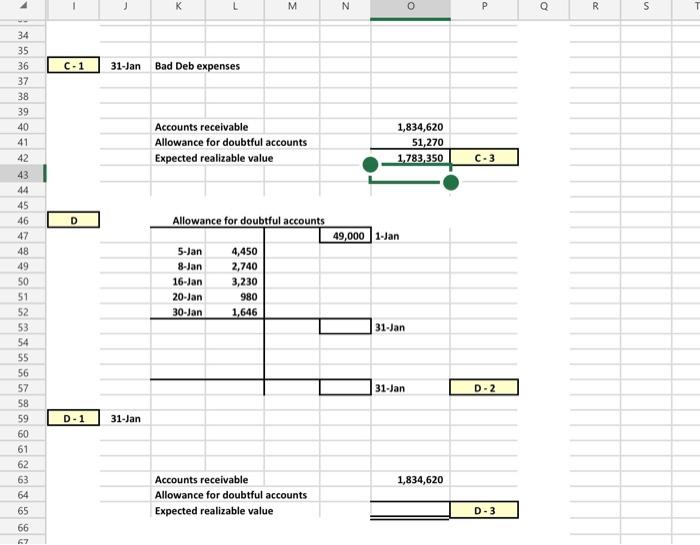

Milo Tindolini Co. Milo Tindolini Co. maintains an "allowance for doubtful accounts" which is charged when an accounts receivable are written off. As of January 1,2022 the allowance account had a credit balance of $49,000 During January 2022 the following bad-debt related activity occurred: Required: Prepare the journal entries relative to the transactions from January 5 th \begin{tabular}{l} through January 29 th. \\ \hline B \end{tabular} Prepare a "T" account which reflects the activity and account balance for "Allowance for Doubtful Accounts" up to and including January 31st. \begin{tabular}{c|} \hline C \\ Assuming Milo uses the above aging for purposes of estimating Bad Debts \end{tabular} \begin{tabular}{|l|l|l|l|l|} \hline 1 & Prepare the required month-end adjustment for Bad Debts \\ \hline 2 & Calculate the post adjustment balance in "Allowance for doubtful \\ \hline & accounts" \\ \hline 3 & Calculate the Expected realizable value of Accounts Receivable \\ \hline D & asofJanuary3 \end{tabular} Assuming Milo uses the \% of sales method for purposes of estimating Bad Debts and 0.6% is the amount of sales deemed uncollectible: due for submission August 9th A Allowance for doubtful accounts \begin{tabular}{rr|r|r|} \hline & & & 49,000 \\ \hline 5-Jan & 4,450 & & \\ \hline 8-Jan & 2,740 & & \\ \hline 16-Jan & 3,230 & & \\ \hline 20 -Jan & 980 & & \\ \hline 25 -Jan & 6,055 & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} C.1 31-Jan Bad Deb expenses Accounts receivable Allowance for doubtful accounts Expected realizable value Enter text or formula here

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts