Question: I need help with this problem please! It's mainly just getting the Sales portion. Problem 23-1A Cook Farm Supply Company manufactures and sells a pesticide

I need help with this problem please! It's mainly just getting the "Sales" portion.

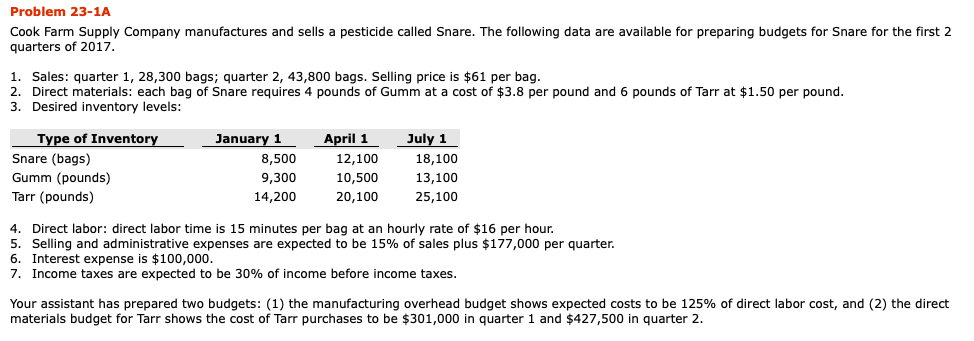

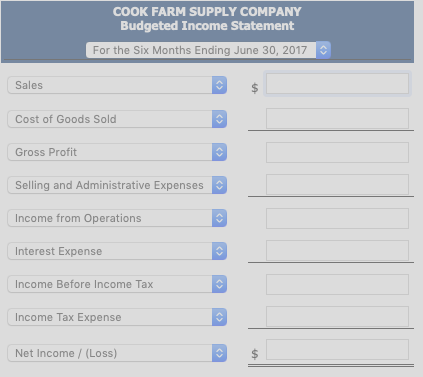

Problem 23-1A Cook Farm Supply Company manufactures and sells a pesticide called Snare. The following data are available for preparing budgets for Snare for the first 2 quarters of 2017 1. Sales: quarter 1, 28,300 bags; quarter 2, 43,800 bags. Selling price is $61 per bag 2. Direct materials: each bag of Snare requires 4 pounds of Gumm at a cost of $3.8 per pound and 6 pounds of Tarr at $1.50 per pound 3. Desired inventory levels: Type of InventoryJanuary 1 April 1 July 1 Snare (bags) Gumm (pounds) Tarr (pounds) 8,500 9,300 14,200 12,100 10,500 20,100 18,100 13,100 25,100 4. Direct labor: direct labor time is 15 minutes per bag at an hourly rate of $16 per hour 5. Selling and administrative expenses are expected to be 15% of sales plus $177,000 per quarter. 6. Interest expense is $100,000 7. Income taxes are expected to be 30% of income before income taxes Your assistant has prepared two budgets: (1) the manufacturing overhead budget shows expected costs to be 125% of direct labor cost, and (2) the direct materials budget for Tarr shows the cost of Tarr purchases to be $301,000 in quarter 1 and $427,500 in quarter 2 COOK FARM SUPPLY COMPANY Budgeted Income Statement For the Six Months Ending June 30, 2017 Sales Cost of Goods Sold Gross Profit Selling and Administrative Expenses Income from Operations Interest Expense Income Before Income Tax Income Tax Expense Net Income/(Loss)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts