Question: I NEED HELP WITH THIS PROBLEM PLEASE, NOT SURE WHAT I ' M DOING WRONG, THANKS. Alicia has been working for JMM Corporation for 3

I NEED HELP WITH THIS PROBLEM PLEASE, NOT SURE WHAT IM DOING WRONG, THANKS.

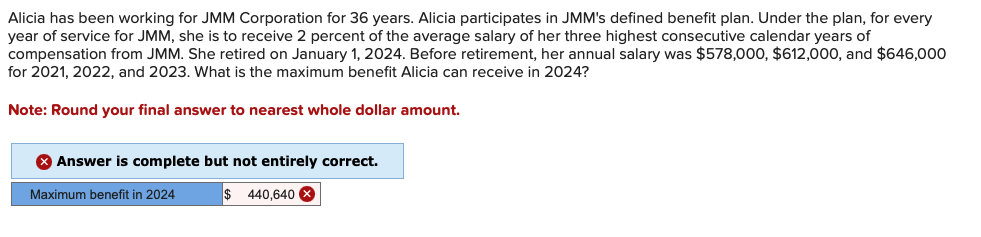

Alicia has been working for JMM Corporation for years. Alicia participates in JMMs defined benefit plan. Under the plan, for every year of service for JMM she is to receive percent of the average salary of her three highest consecutive calendar years of compensation from JMM She retired on January Before retirement, her annual salary was $ $ and $ for and What is the maximum benefit Alicia can receive in

Note: Round your final answer to nearest whole dollar amount.

Answer is complete but not entirely correct.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock