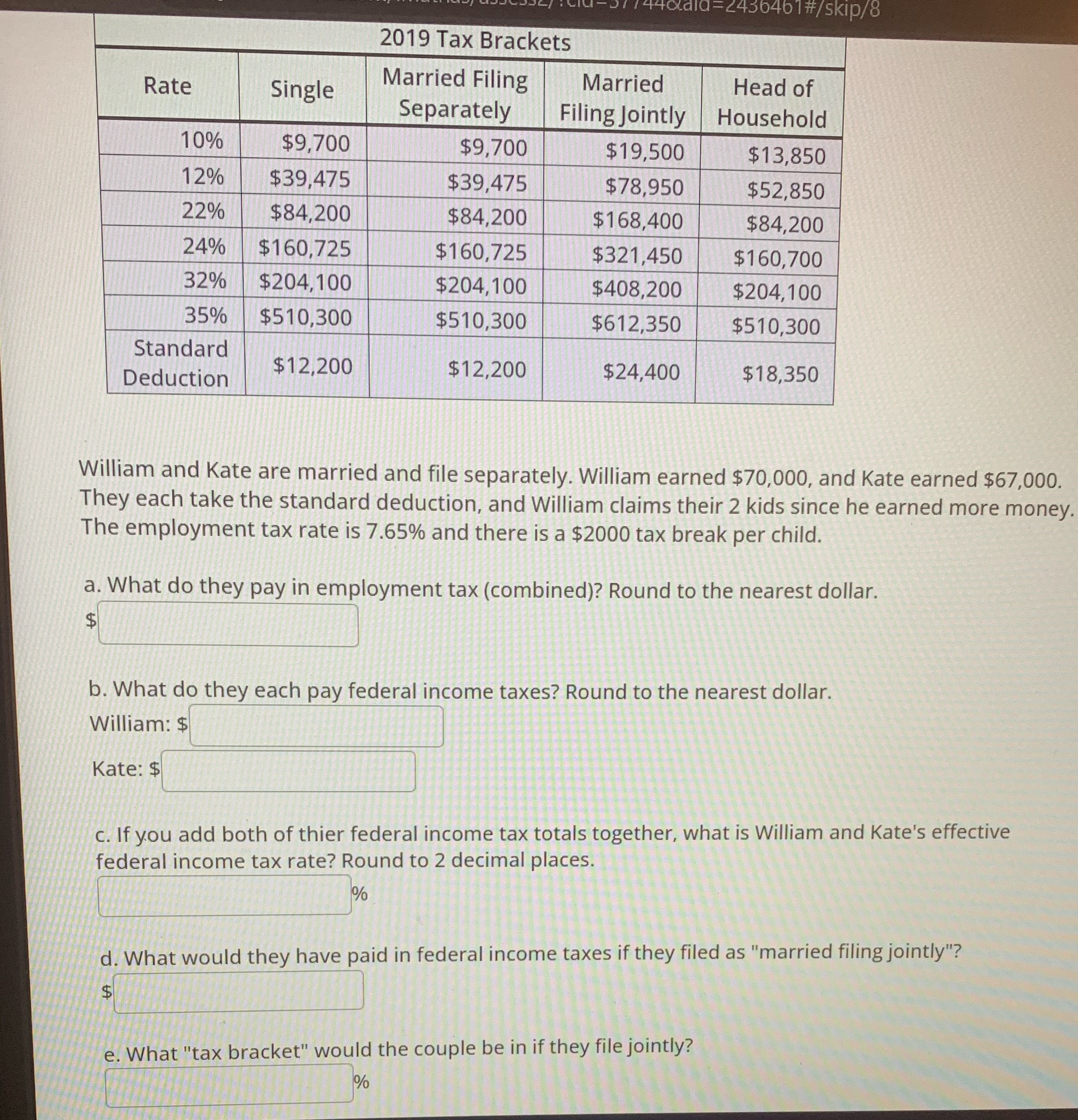

Question: I need help with this question. 2019 Tax Brackets Rate Single Married Filing Married Head of Separately FilingJointly Household 10% $9,700 $19,500 4_ $160,725 $321

I need help with this question.

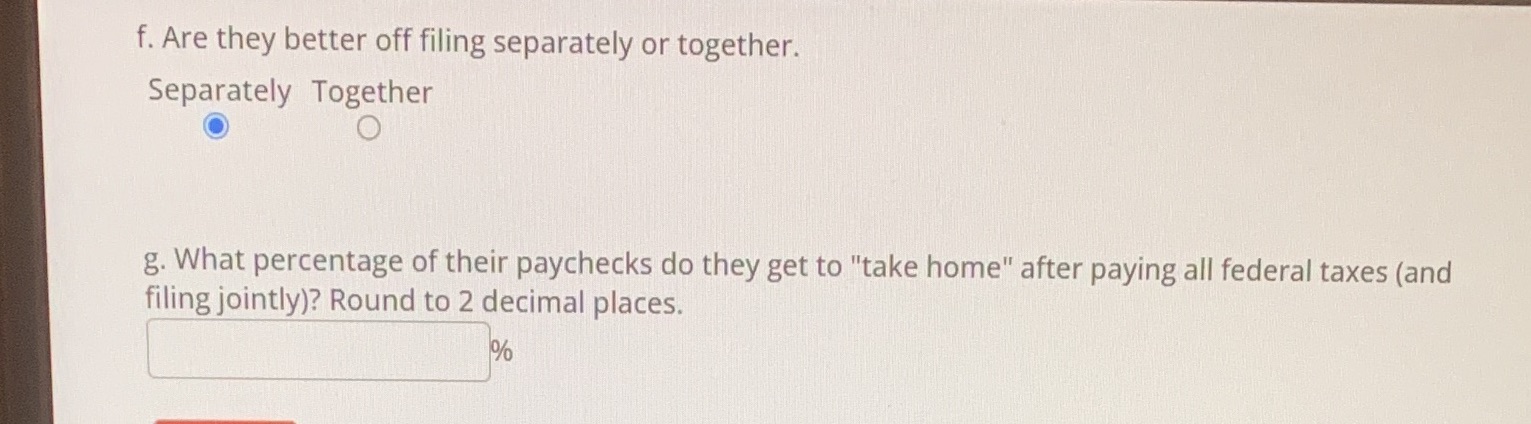

2019 Tax Brackets Rate Single Married Filing Married Head of Separately FilingJointly Household 10% $9,700 $19,500 4_ $160,725 $321 ,450 J $160,700 32% $204,100 $204,100 $408,200 $204,100 $510,300 $510,300 $612,353j $510,300 $18,350 Standard Deduction William and Kate are married and le separately. William earned $70,000, and Kate earned $67,000. They each take the standard deduction, and William claims their 2 kids since he earned more money. The employment tax rate is 7.65% and there is a $2000 tax break per child. $12,200J $24,400 a. What do they pay in employment tax (combined)? Round to the nearest dollar. S"'l - _ b. What do they each pay federal i_ncome taxes? Round to the nearest dollar. William: $1 Kate: $l l c if you add both of thier federal income tax totals together, what is William and Kate's effective federal income tax rate? Round to 2 decimal places. l 11/0 d What would they have paid in federal income taxes if they filed as "married lingjointly"? sl l L/fl'b e What "tax bracket" would the couple be in if they filejointly? \f

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts