Question: I need help with this question and i would really appricate if anyone could help me a. Details of Prepaid Insurance are shown in the

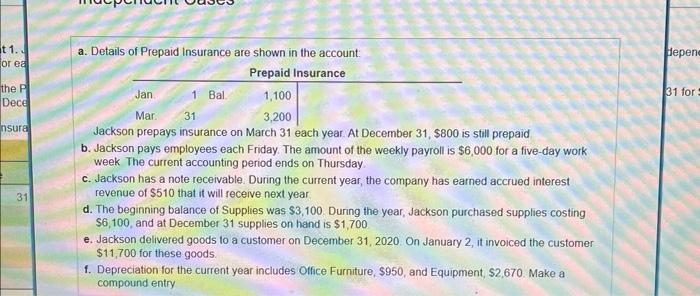

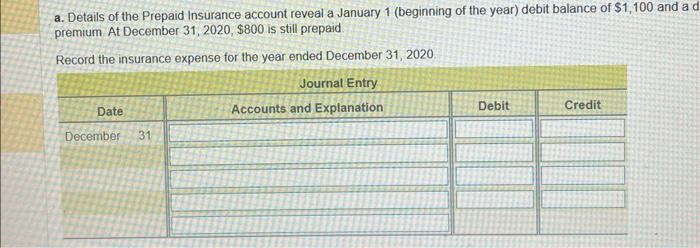

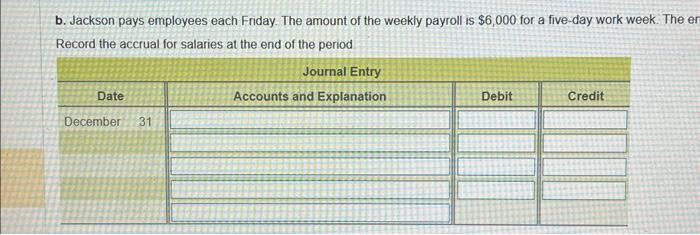

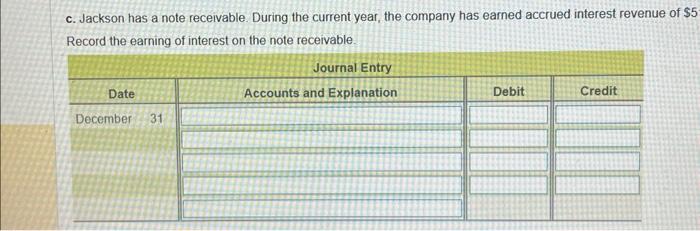

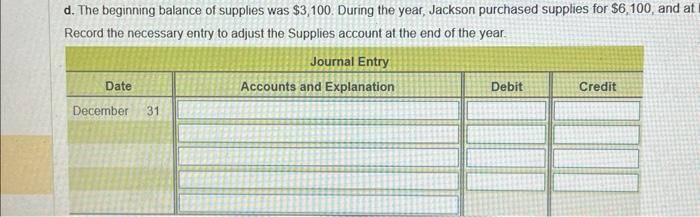

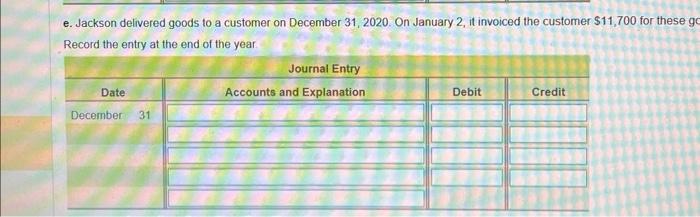

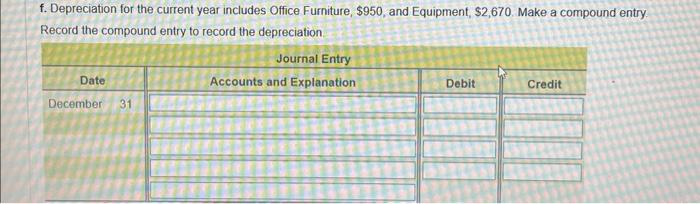

a. Details of Prepaid Insurance are shown in the account: Jackson prepays insurance on March 31 each year. At December 31,$800 is still prepaid b. Jackson pays employees each Friday. The amount of the weekly payroll is $6,000 for a five-day work week The current accounting period ends on Thursday c. Jackson has a note receivable. During the current year, the company has earned accrued interest revenue of $510 that it will recerve next year d. The beginning balance of Supplies was \$3,100. During the year, Jackson purchased supplies costing $6,100, and at December 31 supplies on hand is $1,700 e. Jackson delivered goods to a customer on December 31, 2020 On January 2, it invoiced the customer $11,700 for these goods. f. Depreciation for the current year includes Office Furniture, \$950, and Equipment, \$2,670. Make a compound entry d. The beginning balance of supplies was $3,100. During the year, Jackson purchased supplies for $6,100, and Record the necessary entry to adjust the Supplies account at the end of the year. a. Details of the Prepaid Insurance account reveal a January 1 (beginning of the year) debit balance of $1,100 and a premium At December 31,2020,$800 is still prepaid Record the insurance expense for the year ended December 31,2020 c. Jackson has a note receivable. During the current year, the company has earned accrued interest revenue of Record the earning of interest on the note receivable. f. Depreciation for the current year includes Office Furniture, $950, and Equipment, $2,670. Make a compound entry. Record the compound entry to record the depreciation e. Jackson delivered goods to a customer on December 31,2020 . On January 2 , it invoiced the customer $11,700 for these gc Record the entry at the end of the year. b. Jackson pays employees each Friday. The amount of the weekly payroll is $6,000 for a five-day work week. The Record the accrual for salaries at the end of the period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts