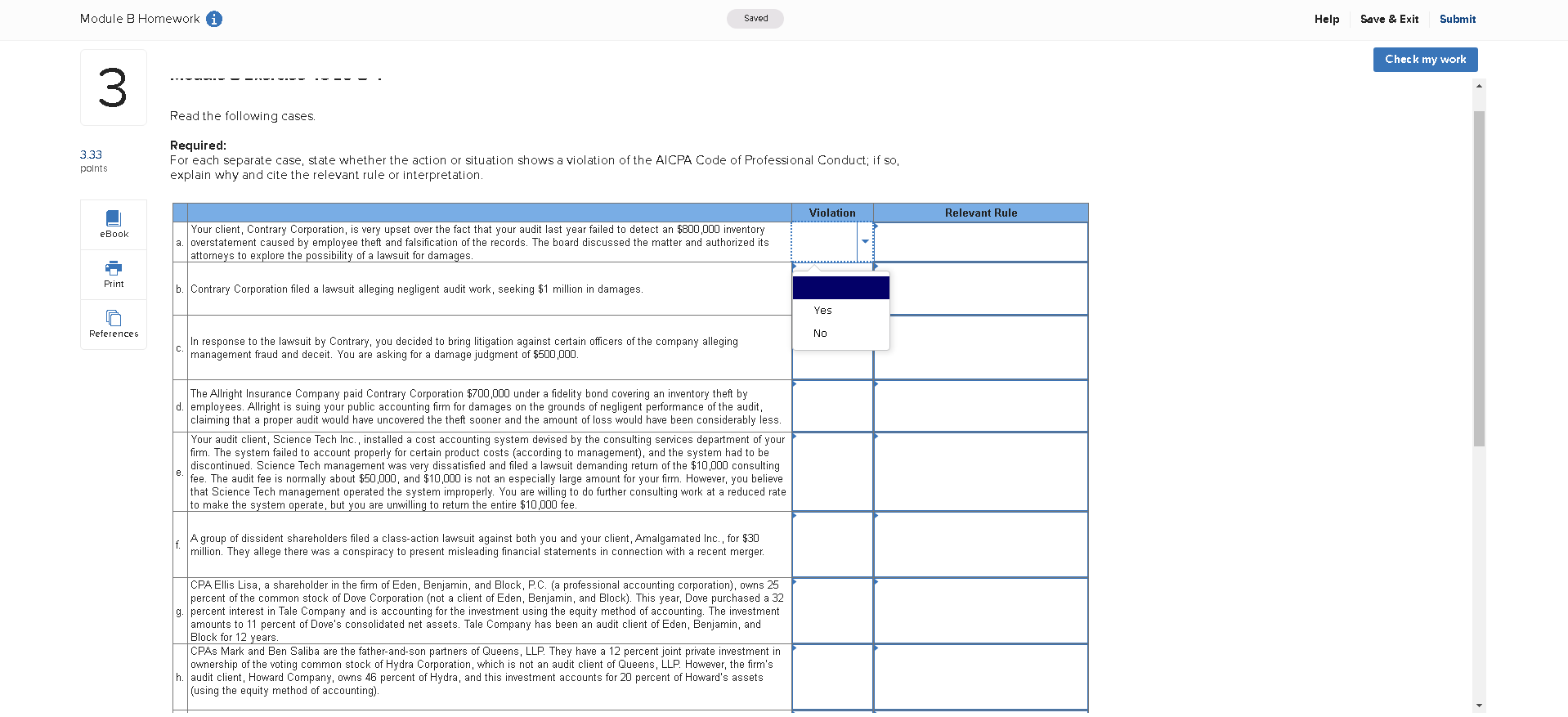

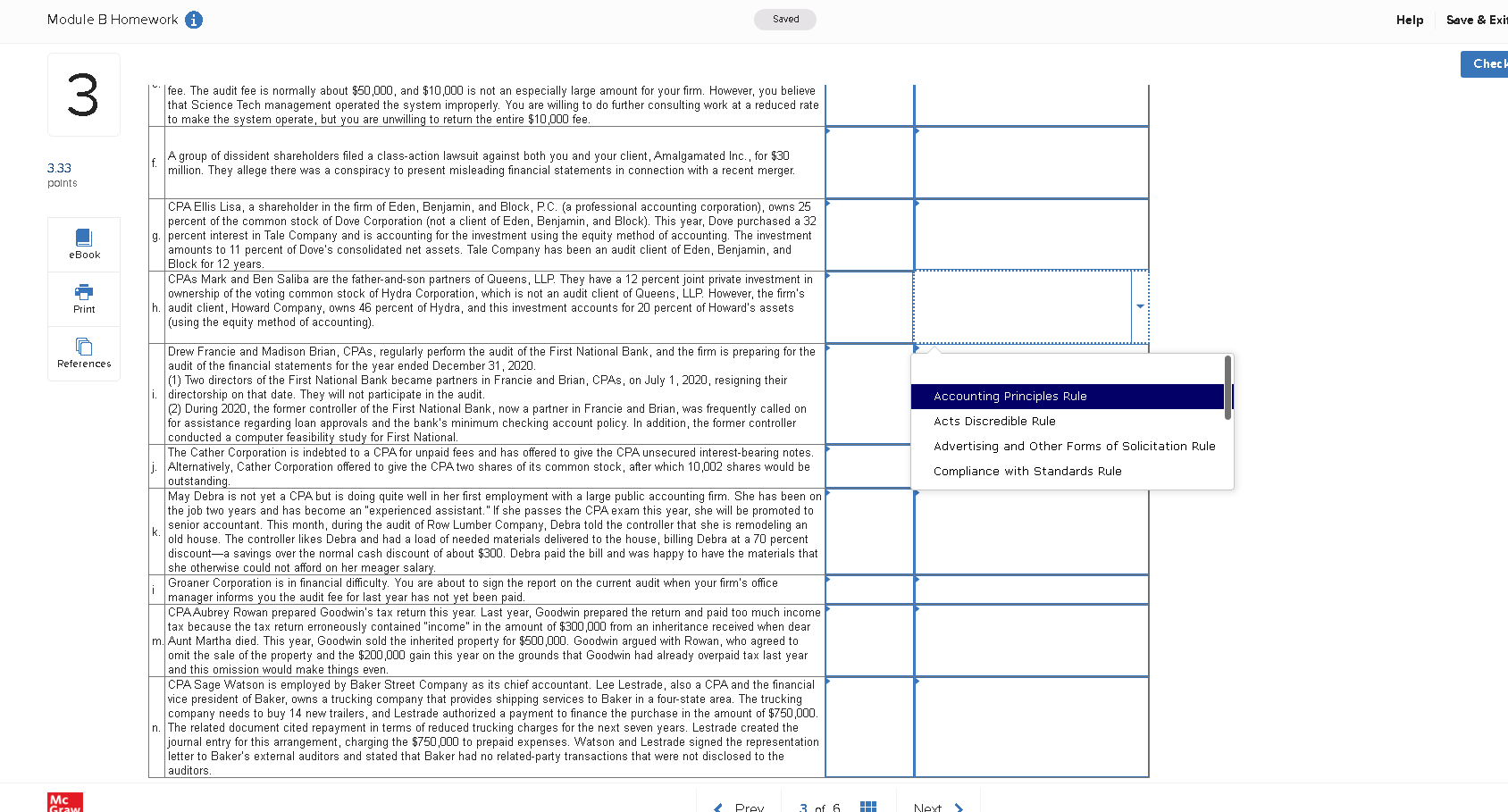

Question: I need help with this question asap P.S the list of options for the relevant rule part are (2nd column): Independence rule, integrity and objectivity

I need help with this question asap

P.S the list of options for the relevant rule part are (2nd column):

Independence rule, integrity and objectivity rule, general standards rule, forms of organization and name rule, fees and other types of renumeration rule, compliance with standards rule, advertising and other forms of solicitation rules, acts discreditable rule, accounting principles rule

\fModule B Homework i Saved Help Save & Ex Check 3 " fee. The audit fee is normally about $50,000, and $10,000 is not an especially large amount for your firm. However, you believe that Science Tech management operated the system improperly. You are willing to do further consulting work at a reduced rate to make the system operate, but you are unwilling to return the entire $10,000 fee. A group of dissident shareholders filed a class-action lawsuit against both you and your client, Amalgamated Inc. , for $30 3.33 f. million. They allege there was a conspiracy to present misleading financial statements in connection with a recent merger. points CPA Ellis Lisa, a shareholder in the firm of Eden, Benjamin, and Block, P.C. (a professional accounting corporation), owns 25 percent of the common stock of Dove Corporation (not a client of Eden, Benjamin, and Block). This year, Dove purchased a 32 percent interest in Tale Company and is accounting for the investment using the equity method of accounting. The investment Book amounts to 11 percent of Dove's consolidated net assets. Tale Company has been an audit client of Eden, Benjamin, and Block for 12 years. CPAs Mark and Ben Saliba are the father-and-son partners of Queens, LLP. They have a 12 percent joint private investment in ownership of the voting common stock of Hydra Corporation, which is not an audit client of Queens, LLP. However, the firm's Print h. audit client, Howard Company, owns 46 percent of Hydra, and this investment accounts for 20 percent of Howard's assets (using the equity method of accounting). Drew Francie and Madison Brian, CPAS, regularly perform the audit of the First National Bank, and the firm is preparing for the References audit of the financial statements for the year ended December 31, 2020. (1) Two directors of the First National Bank became partners in Francie and Brian, CPAs, on July 1, 2020, resigning their i. directorship on that date. They will not participate in the audit Accounting Principles Rule (2) During 2020, the former controller of the First National Bank, now a partner in Francie and Brian, was frequently called on or assistance regarding loan approvals and the bank's minimum checking account policy. In addition, the former controller Acts Discredible Rule conducted a computer feasibility study for First National. The Cather Corporation is indebted to a CPA for unpaid fees and has offered to give the CPA unsecured interest-bearing notes Advertising and Other Forms of Solicitation Rule J. Alternatively, Cather Corporation offered to give the CPA two shares of its common stock, after which 10,002 shares would be Compliance with Standards Rule outstanding May Debra is not yet a CPA but is doing quite well in her first employment with a large public accounting firm. She has been on the job two years and has become an come an "experienced assistant. "If she passes the CPA exam this year, she will be promoted to k . senior accountant. This month, during the audit of Row Lumber Company, Debra told the controller that she is remodeling an old house. The controller likes Debra and had a load of needed materials delivered to the house, billing Debra at a 70 percent discount-a savings over the normal cash discount of about $300. Debra paid the bill and was happy to have the materials that she otherwise could not afford on her meager salary. Groaner Corporation is in financial difficulty. You are about to sign the report on the current audit when your firm's office manager informs you the audit fee for last year has not yet been paid CPAAubrey Rowan prepared Goodwin's tax return this year. Last year, Goodwin prepared the return and paid too much income tax because the tax return erroneously contained "income" in the amount of $300,000 from an inheritance received when dear m. Aunt Martha died. This year, Goodwin sold the inherited property for $500,JOU. Goodwin argued with Rowan, who agreed to omit the sale of the property and the $200,000 gain this year on the grounds that Goodwin had already overpaid tax last year and this omission would make things even. CPA Sage Watson is employed by Baker Street Company as its chief accountant. Lee Lestrade, also a CPA and the financial vice president of Baker, owns a trucking company that provides shipping services to Baker in a four-state area. The trucking company needs to buy 14 new trailers, and Lestrade authorized a payment to finance the purchase in the amount of $750,000. n. The related document cited repayment in terms of reduced trucking charges for the next seven years. Lestrade created the journal entry for this arrangement, charging the $750,000 to prepaid expenses. Watson and Lestrade signed the representation letter to Baker's external auditors and stated that Baker had no related-party transactions that were not disclosed to the auditors. Mc