Question: I need help with this question below. Above the answer was A. When using the existing material, the expected monetary value (EMV)= ______ (enter your

I need help with this question below. Above the answer was A.

I need help with this question below. Above the answer was A.

When using the existing material, the expected monetary value (EMV)= ______ (enter your response as a whole number).

Please explain, and show your work. Thank you.

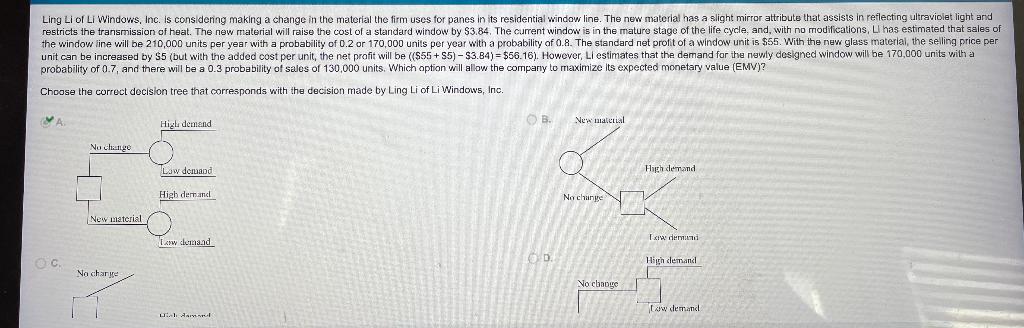

Ling Li of Li Windows, Inc. is considering making a change in the material the firm uses for panes in its residential window line. The new material has a slight mirror attribute that assists in reflecting ultraviolet light and restricts the transmission of heat. The new material will raise the cost of a standard window by $3.84. The current window is in the mature stage of the life cycle and, with no modifications, L has estimated that sales of the window line will be 210,000 units per year with a probability of 0.2 or 170,000 units per year with a probability of 0.8. The standard net profit of a window unit is $55. With the new glass material, the selling price per unit can be increased by S5 (but with the added cost per unit, the net profit will be (($65 +55) - $3.84)= $56.16). However, Li estimates that the demand for the newly designed window will be 170,000 units with a probability of 0.7, and there will be a 0.3 probability of sales of 130,000 units. Which option will allow the company to maximize its expected monetary value (EMV)? Choose the correct docision tree that corresponds with the decision made by Ling Li of LI Windows, Inc A B. Higl demand New material Nuch Law demand High demand High dersanel No change 1 New material Txwder Low densad C High demand Na chance No change Law demand . AAAStep by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts