Question: I need help with this question. Beru.com recently raised $4.9 miltion with a pre-money value of $9.5 million. They are seeking to raise another $6.6

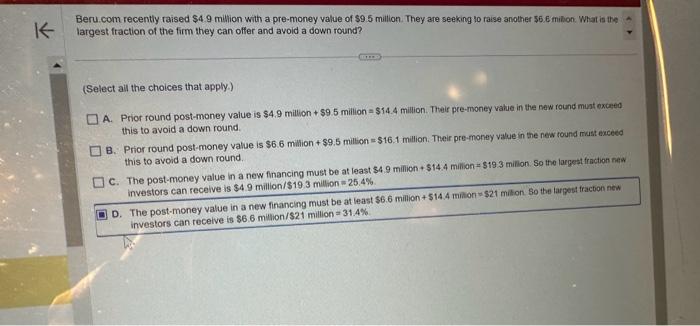

Beru.com recently raised $4.9 miltion with a pre-money value of $9.5 million. They are seeking to raise another $6.6 milion. What is the largest fraction of the firm they can offer and avoid a down round? (Select all the choices that apply.) A. Prior round post-money value is $4.9 million +$9.5 million =$14.4 million. Their pre-money value in the new round must exceed this to avoid a down round. B. Prior round post-money value is $6.6milion+$9.5 million =$16.1 million. Their pre-money value in the new tound nust exceed this to avoid a down round. C. The post-money value in a new financing must be at least $4.9 milion +$14.4 milion =$19.3 million. So the largest fraction new investors can recelve is $4.9 million/ $19.3 million =25.4% D. The post-money value in a new financing must be at least $6.6 milion +$14.4 minton $21 mithon 50 the larpest fracton new investors can recelve is $6.6 milion/ $21 million =31.4%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts