Question: I need help with this question but can you please provide a detailed explanation as well as any formulas needed 2.) You own a portfolio

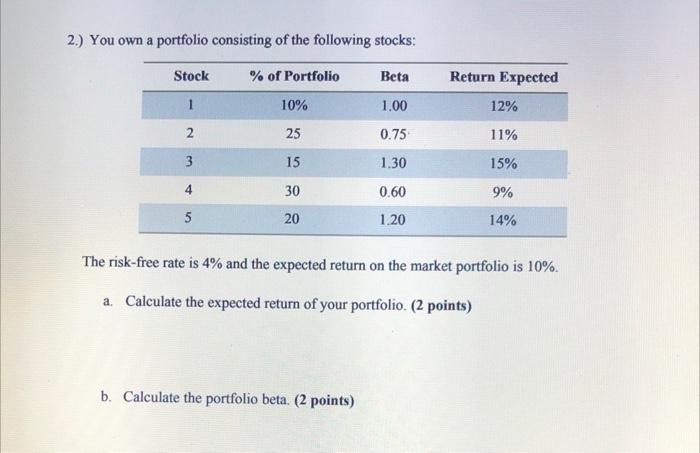

2.) You own a portfolio consisting of the following stocks: Stock % of Portfolio Beta Return Expected 12% 1 10% 1.00 2 25 0.75 11% 3 15 1.30 15% 4 30 0.60 9% 5 20 1.20 14% The risk-free rate is 4% and the expected return on the market portfolio is 10%. a Calculate the expected return of your portfolio (2 points) b. Calculate the portfolio beta. (2 points) c. Which stocks are underpriced and which are overpriced? Explain how you draw conclusion for underpricing/overpricing. (3 points) d. Calculate the portfolio's Required Rate of Return based on CAPM. Explain why the number you calculated differs from your answer in question a. (3 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts