Question: i need help with this question circle your answers please 14-8./ Global Financial Corporation (GFC) has 10 million shares outstanding, each currently worth $80 per

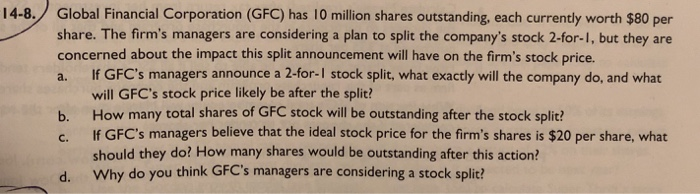

14-8./ Global Financial Corporation (GFC) has 10 million shares outstanding, each currently worth $80 per share. The firm's managers are considering a plan to split the company's stock 2-for-1, but they are concerned about the impact this split announcement will have on the firm's stock price. a. If GFC's managers announce a 2-for-I stock split, what exactly will the company do, and what will GFC's stock price likely be after the split? b. How many total shares of GFC stock will be outstanding after the stock split? . If GFC's managers believe that the ideal stock price for the firm's shares is $20 per share, what should they do? How many shares would be outstanding after this action? Why do you think GFC's managers are considering a stock split? d

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts