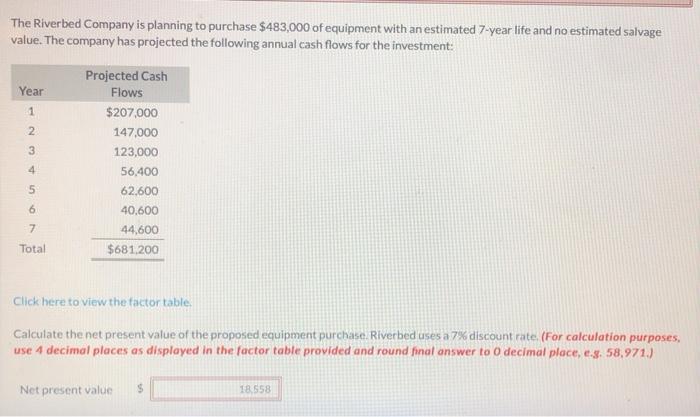

Question: i need help with this question from chapter 9 number 5 please and thank you. The Riverbed Company is planning to purchase $483,000 of equipment

The Riverbed Company is planning to purchase $483,000 of equipment with an estimated 7-year life and no estimated salvage value. The company has projected the following annual cash flows for the investment: Year 1 2 3 Projected Cash Flows $207,000 147,000 123,000 56,400 62,600 40,600 44,600 $681.200 6 7 Total Click here to view the factor table, Calculate the net present value of the proposed equipment purchase. Riverbed uses a 7% discount rate (For calculation purposes, use 4 decimal places as displayed in the factor table provided and round final answer to decimal place, c.8. 58,971.) Net present value $ 18.558

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts