Question: I need help with this question. I do not really understand what the professor asks. I can get the first column at 0, but it

I need help with this question. I do not really understand what the professor asks. I can get the first column at 0, but it is hard for me to get the second one. Please

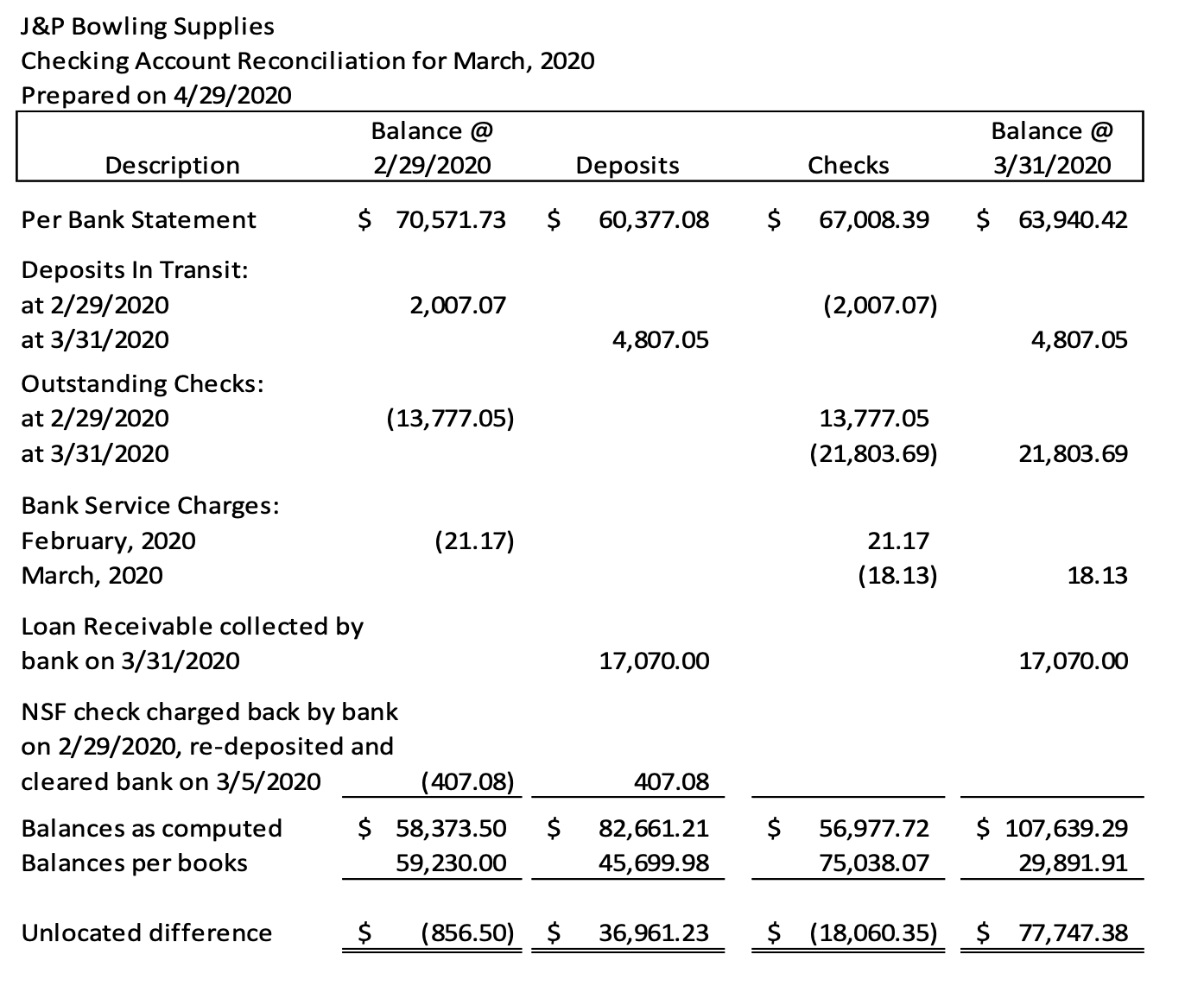

You are the lead auditor for the upcoming audit of your client's financial statements and are training a recently hired staff auditor. In anticipation of the upcoming audit, you assigned the reconciliation of your client's March 31, 2020 cash balance held in a checking account to the new auditor. The next day, your auditor brought the spreadsheet below to you and asked for help, expressing frustration at not being able to locate the differences between the bank statement and your client' 5 General Ledger cash account. You look at the spreadsheet and can quickly see that your new auditor needs assistance from you explaining timing differences and how to add and subtract certain items when comparing one set of financial records to another. Required: Make the necessary corrections to the spreadsheet so that the unlocated difference in each column is $0. J&P Bowling Supplies Checking Account Reconciliation for March, 2020 Prepared on 4/29/2020 Balance @ Description 2/ 29/2020 Per Bank Statement $ 70,571.73 Deposits In Transit: at 2/29/2020 2,007.07 at 3/31/2020 Outstanding Checks: at 2/29/2020 (13,777.05) at 3/31/2020 Bank Service Charges: February, 2020 (21.17) March, 2020 Loan Receivable collected by bank on 3/31/2020 NSF check charged back by bank on 2/29/2020, re-deposited and cleared bank on 3/5/2020 (407.08) Balances as computed $ 58,373.50 Balances per books 59,230.00 Unlocated difference 5 (856.50) S Deposits 60,377.03 4, 807. 05 17, 070.00 407.08 82, 661. 21 45, 699. 98 36, 961.23 Checks $ 67,003.39 (2, 007. 07) 13,777.05 (21,803.69) 21.17 (18.13) $ 56,977.72 75,033.07 $ (18,060.35) Balance @ 3/31/2020 5 63,940.42 4, 807. 05 21, 803. 69 18.13 17,070.00 5 107, 639. 29 29, 891. 91 s 77,747.33