Question: I need help with this question. I don't want an excel table. I need equations and formulas step by step in order to solve this

I need help with this question. I don't want an excel table. I need equations and formulas step by step in order to solve this problem.

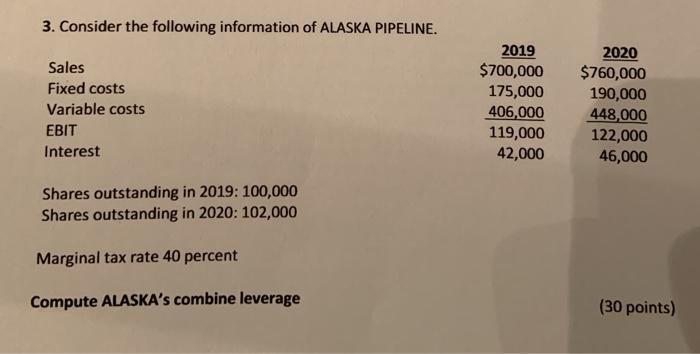

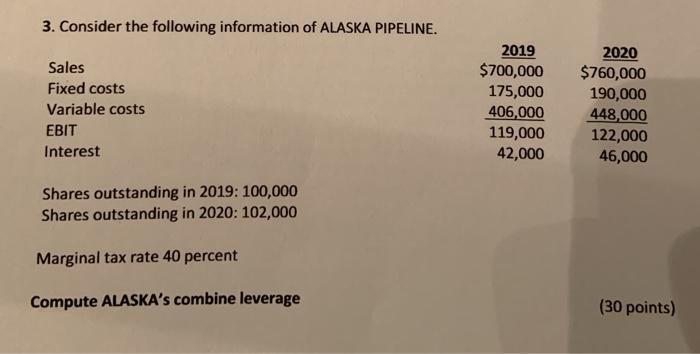

3. Consider the following information of ALASKA PIPELINE. Sales Fixed costs Variable costs EBIT Interest 2019 $700,000 175,000 406,000 119,000 42,000 2020 $760,000 190,000 448,000 122,000 46,000 Shares outstanding in 2019: 100,000 Shares outstanding in 2020: 102,000 Marginal tax rate 40 percent Compute ALASKA's combine leverage (30 points)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock