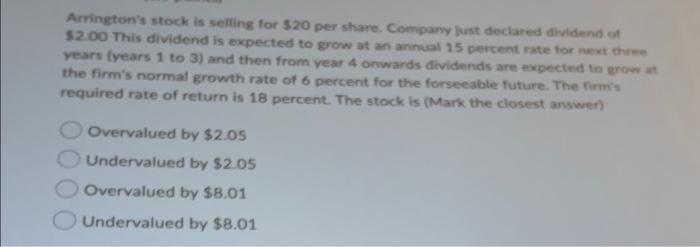

Question: I need help with this question in 10 min please Arrington's stock is setting for $20 per share. Company ust declared dividend of $2.00 This

Arrington's stock is setting for $20 per share. Company ust declared dividend of $2.00 This dividend is expected to grow at an annual 15 percent rate for next three years lyears 1 to 3) and then from year 4 onwards dividends are expected to grow the firm's normal growth rate of 6 percent for the forseeable future. The firm's required rate of return is 18 percent. The stock is (Mark the closest answer) Overvalued by $2.05 Undervalued by $2.05 Overvalued by $8.01 Undervalued by $8.01

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts