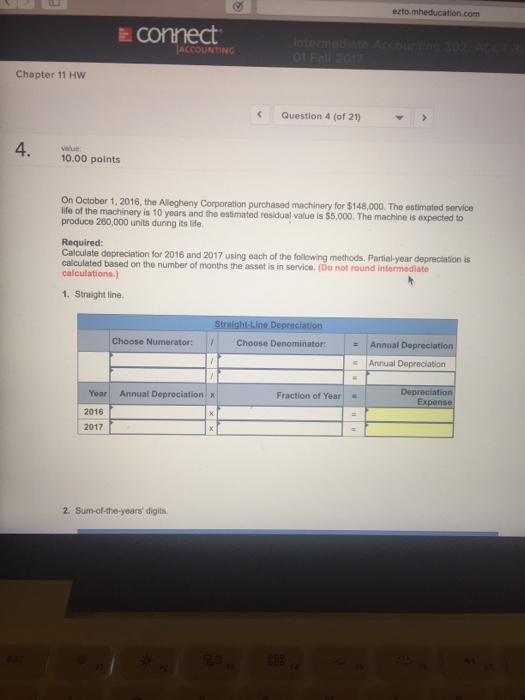

Question: I need help with this question please connect. ACCOUNTING Chapter 11 HW Question 4 (of 21) 4 10.00 points On October life of the machinery

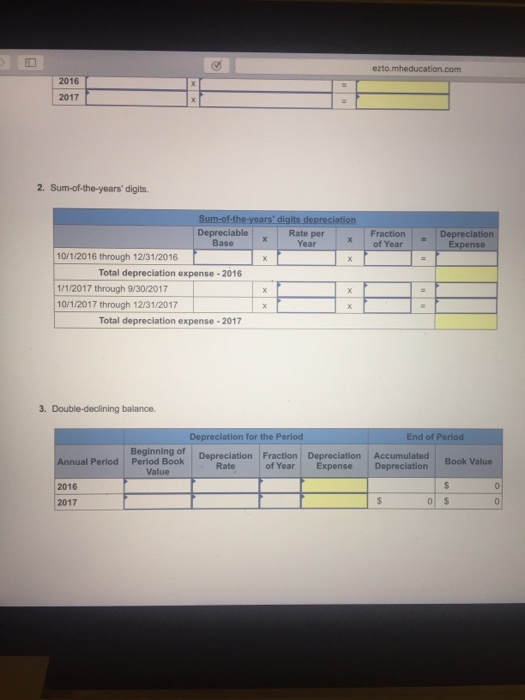

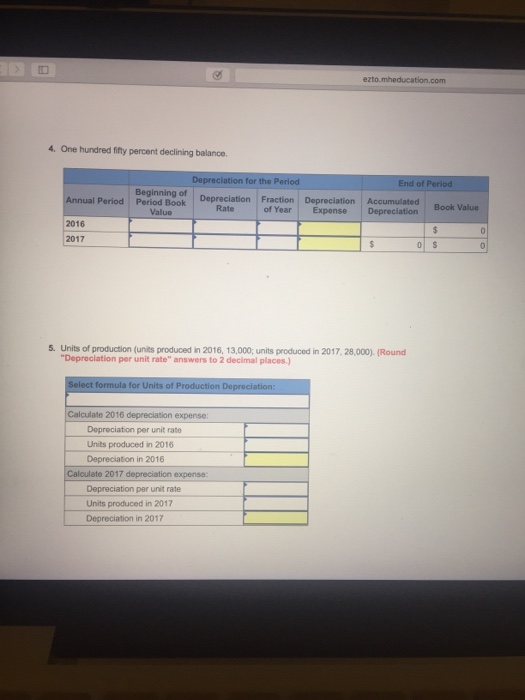

connect. ACCOUNTING Chapter 11 HW Question 4 (of 21) 4 10.00 points On October life of the machinery is 10 years and the estimated residual value is $5,000. The machine is expected to produce 260,000 units during its life. 1, 2016, the Allegheny Corporation purchased machinery for $148,000. The estimated service Required: Calculate depreciation for 2016 and 2017 using each of the following methods. Partial year depreclationis caiculated based on the number of months the asset is in service. (Do not round intermediate calculations.) 1. Straight line. Choose Numerator: Choose Denominator: | = | Annual Depreciation Annual Depreciation Year Annual Deprociation x 2016 2017 Fraction of Year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts