Question: I need help with this question, please. Prepare journal entries to record the following transactions. a. Purchased $400 of supplies on credit. b. Completed $600

I need help with this question, please.

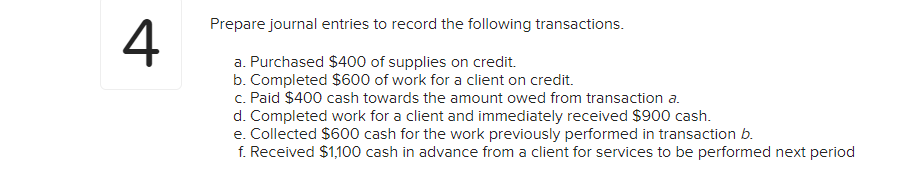

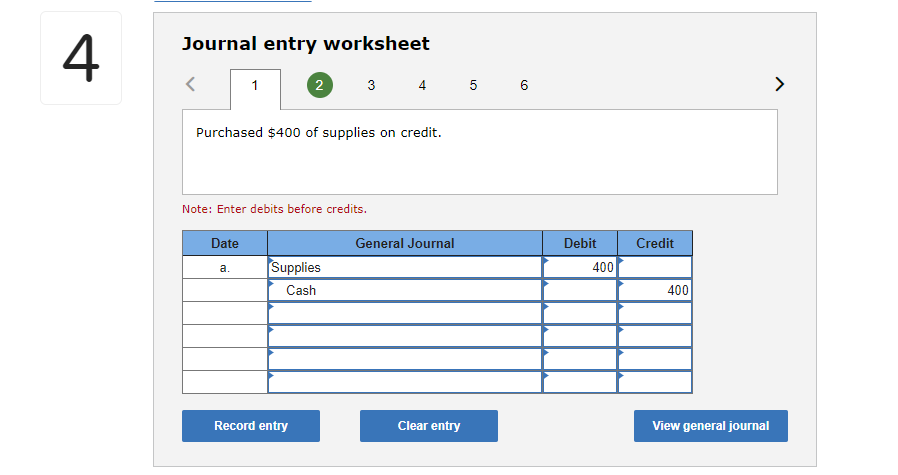

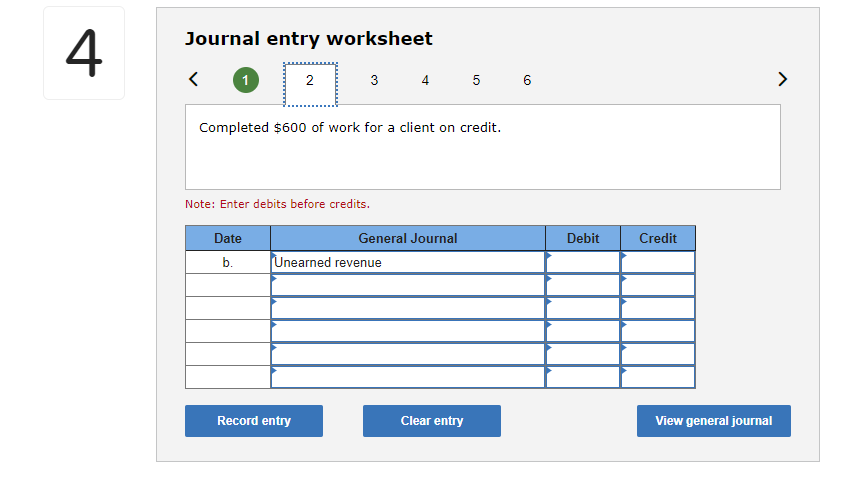

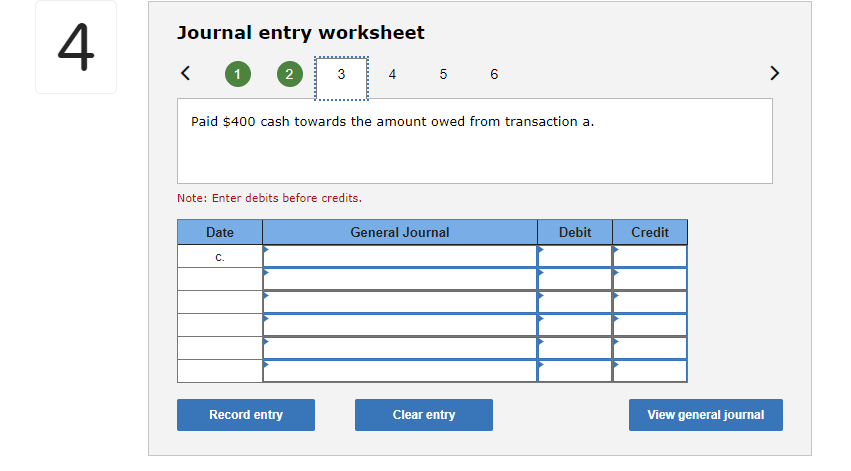

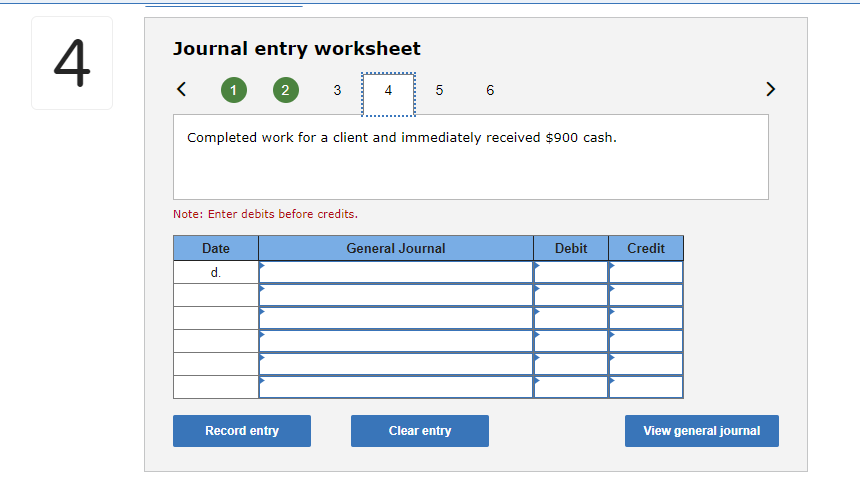

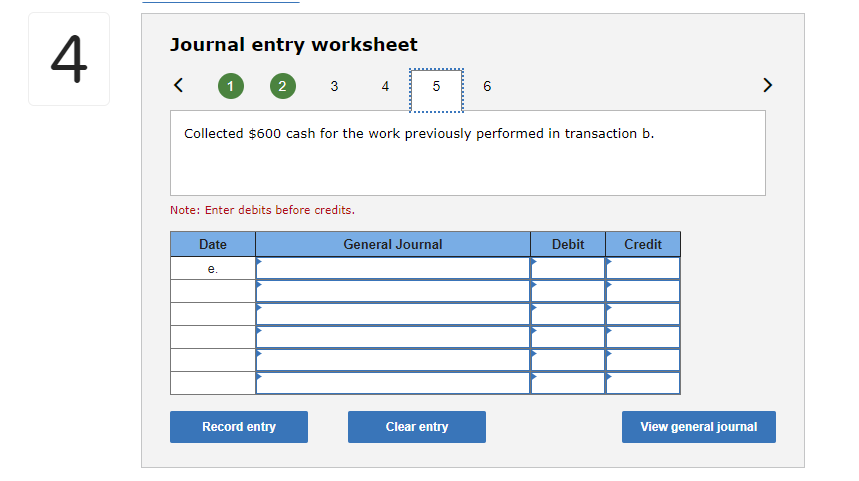

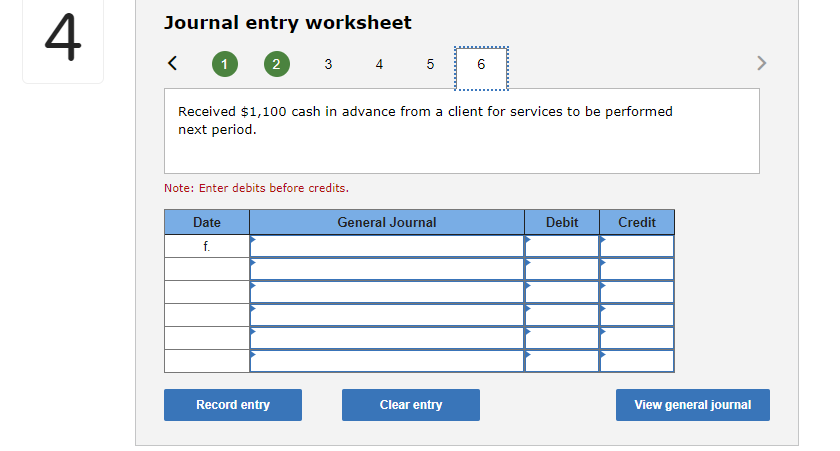

Prepare journal entries to record the following transactions. a. Purchased $400 of supplies on credit. b. Completed $600 of work for a client on credit. c. Paid $400 cash towards the amount owed from transaction a. d. Completed work for a client and immediately received $900 cash. e. Collected $600 cash for the work previously performed in transaction b. f. Received $1,100 cash in advance from a client for services to be performed next period Journal entry worksheet Journal entry worksheet 5 Completed $600 of work for a client on credit. Note: Enter debits before credits. Journal entry worksheet 6 Paid $400 cash towards the amount owed from transaction a. Note: Enter debits before credits. Journal entry worksheet 1 Completed work for a client and immediately received $900 cash. Note: Enter debits before credits. Journal entry worksheet (2) 3 Collected $600 cash for the work previously performed in transaction b. Note: Enter debits before credits. Journal entry worksheet 1 3 Received $1,100 cash in advance from a client for services to be performed next period. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts