Question: I need help with this question Question 11 Not yet answered Use these data for the following 2 questions (Total Mark: 2) Company X a

I need help with this question

I need help with this question

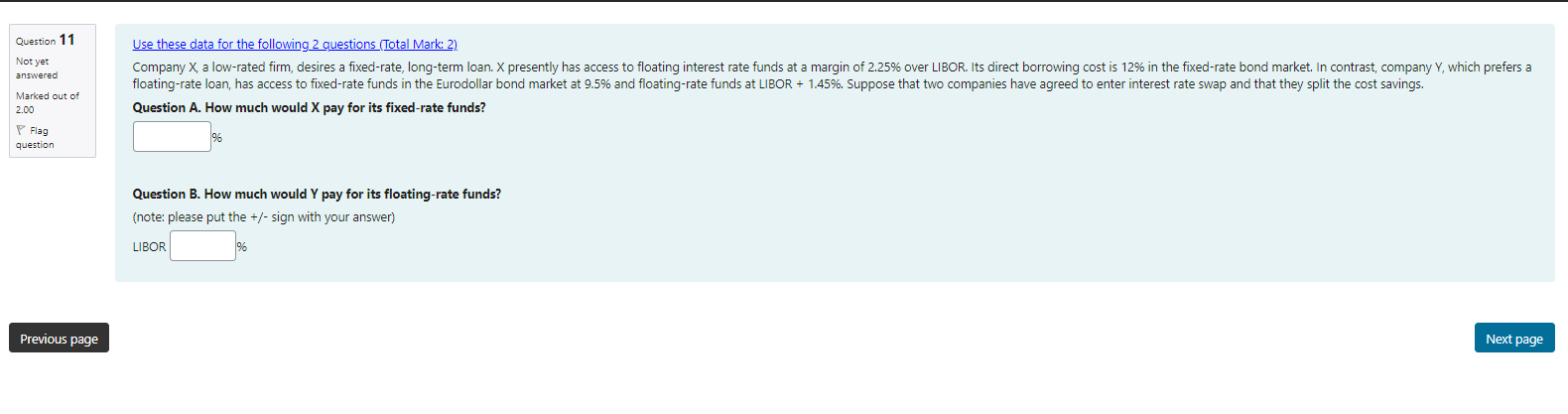

Question 11 Not yet answered Use these data for the following 2 questions (Total Mark: 2) Company X a low-rated firm, desires a fixed-rate, long-term loan. X presently has access to floating interest rate funds at a margin of 2.25% over LIBOR. Its direct borrowing cost is 12% in the fixed-rate bond market. In contrast, company Y, which prefers a floating-rate loan, has access to fixed-rate funds in the Eurodollar bond market at 9.5% and floating-rate funds at LIBOR + 1.45%. Suppose that two companies have agreed to enter interest rate swap and that they split the cost savings. Question A. How much would X pay for its fixed-rate funds? Marked out of 2.00 P Flag question Question B. How much would Y pay for its floating-rate funds? (note: please put the +/- sign with your answer) LIBOR Previous page Next page

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts