Question: I need help with this question Question 2 Not yet answered One-Punch man needs 45 million in 2 months for a 8-month period to finance

I need help with this question

I need help with this question

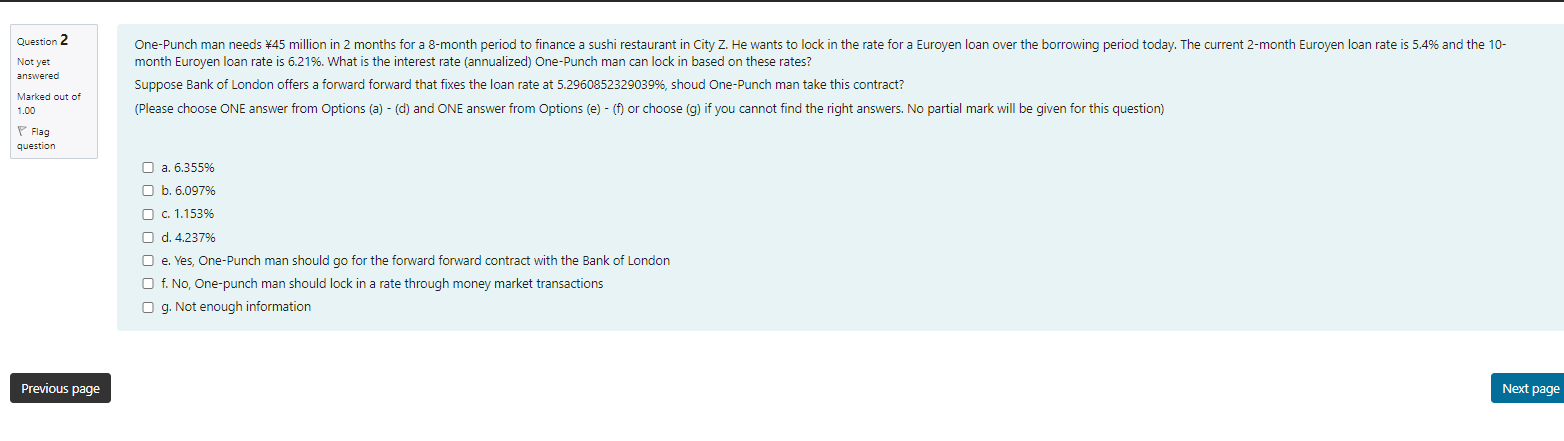

Question 2 Not yet answered One-Punch man needs 45 million in 2 months for a 8-month period to finance a sushi restaurant in City Z. He wants to lock in the rate for a Euroyen loan over the borrowing period today. The current 2-month Euroyen loan rate is 5.4% and the 10- month Euroyen loan rate is 6.21%. What is the interest rate (annualized) One-Punch man can lock in based on these rates? Suppose Bank of London offers a forward forward that fixes the loan rate at 5.2960852329039%, shoud One-Punch man take this contract? (Please choose ONE answer from Options (a) - (d) and ONE answer from Options (e) - (f) or choose (g) if you cannot find the right answers. No partial mark will be given for this question) Marked out of 1.00 P Flag question O a. 6.355% O b. 6.097% O c. 1.153% O d. 4.237% O e. Yes, One-Punch man should go for the forward forward contract with the Bank of London f. No, One-punch man should lock in a rate through money market transactions O g. Not enough information Previous page Next page

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts