Question: I need help with this question Rantzow-Lear Company buys and sells debt securities expecting to earn profits on short-term differences in price, and holds these

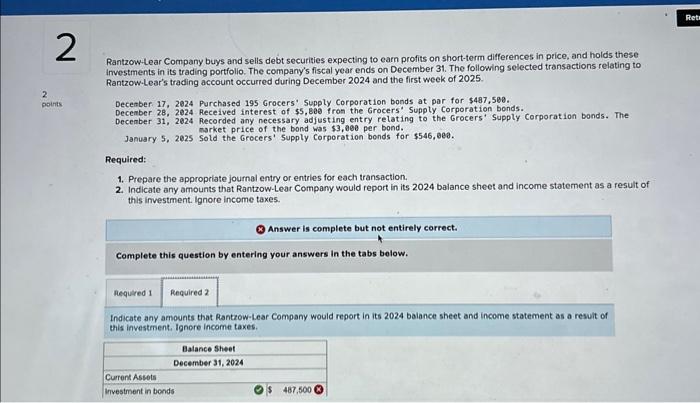

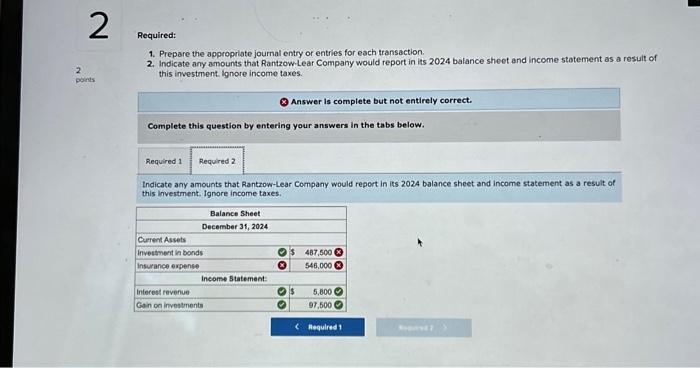

Rantzow-Lear Company buys and sells debt securities expecting to earn profits on short-term differences in price, and holds these Imvestments in its trading portfolio. The company's fiscal year ends on December 31 . The following selected transactions relating to Rantzow-Lear's trading account occurred during December 2024 and the first week of 2025 Decenber 17, 2024 Purchased 195 Grocers' Supply Corporation bonds at por for $487,500. December 28, 2024. Heceived interest of $5,800 fron the Grocers' suppty Corporation bonds. Decenber 31, 2024 Recorded any necessary adjusting entry relating to the Grocers' Supply Corporation bonds. The market price of the bond was $3, aee per bond. January 5, 2025 sold the Grocers' Supply Corporation bonds for $546, 0e0. Required: 1. Prepare the appropriate journal entry or entries for each transaction. 2. Indicate any amounts that Rantzow-Lear Company would report in its 2024 balance sheet and income statement as a result of this investment. Ignore income taxes. * Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Indicate any amounts that Rantrow-Lear Company would report in its 2024 balance sheet and income statement as a result of this investment. Ignore income taxes. 1. Prepare the appropriate joumal entry or entries for each transaction. 2. Indicate any amounts that Rantzow-Lear Company would report in its 2024 balance sheet and income stotement as a result of this investment ignore income taxes. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Indicate any amounts that Rantzow-Lear Company would report in its 2024 balance sheet and income statement as a result of this investment. Ignore income taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts